Owing to migration of a large user base from feature phones to smartphones, India has recorded 186% growth in smartphone shipment in Q1 of 2014, according to IDC. The smartphone penetration in India still hovers at 10% and it is expected to grow due to a variety of factors including greater availability of low-cost devices and additional sales emphasis by top-flight vendors on less populous parts of the country.

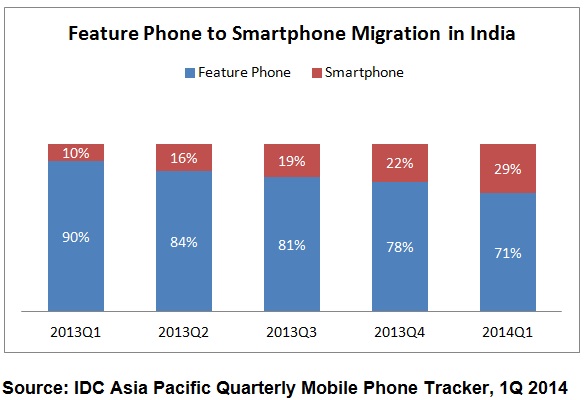

The share of feature phones in the overall market further slipped further to 71% in Q1 2014 which is a considerable decrease from 90% share in 1Q 2013. According to IDC Asia-Pacific Quarterly Mobile Phone Tracker (excluding Japan), vendors shipped a total of 17.59 million smartphones in 1Q 2014 compared to 6.14 million units in the same period of 2013. The research firm further stated that the sub-$200 (Rs. 11,800) smartphone category helped the overall market to grow significantly during the first quarter and contributed about 78% to the overall smartphone market in India.

This rapid pace of growth in smartphones is expected to continue in India. While we notice that much of the growth is coming from low-cost devices using the Android operating system, Windows is making adequate gains too based on the strength of the entry-level product mix in smartphones,

comments Kiran Kumar, Research Manager- Client Devices at IDC India .

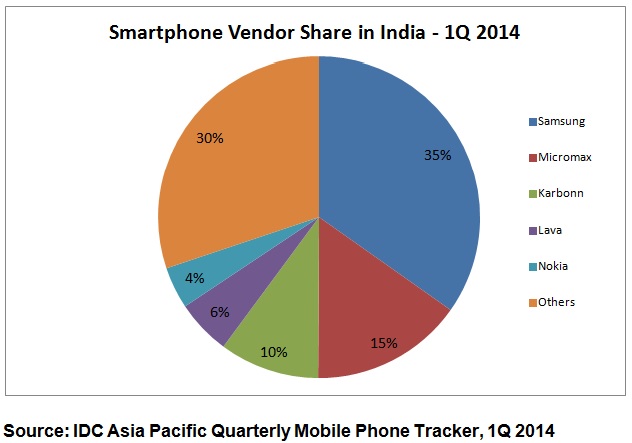

Giving insight on vendor share in Indian smartphone market, IDC revealed that Samsung maintained top spot with 35% of market share which was followed by Micromax with approximate 15% . Karbonn, Lava and Nokia had a market share of 10%, 6% and 4% respectively.

IDC estimated that India’s smartphone shipments will reach 80.57 million units in 2014 and the Indian smartphone market will grow at a CAGR of about 40 percent for the next 5 years.