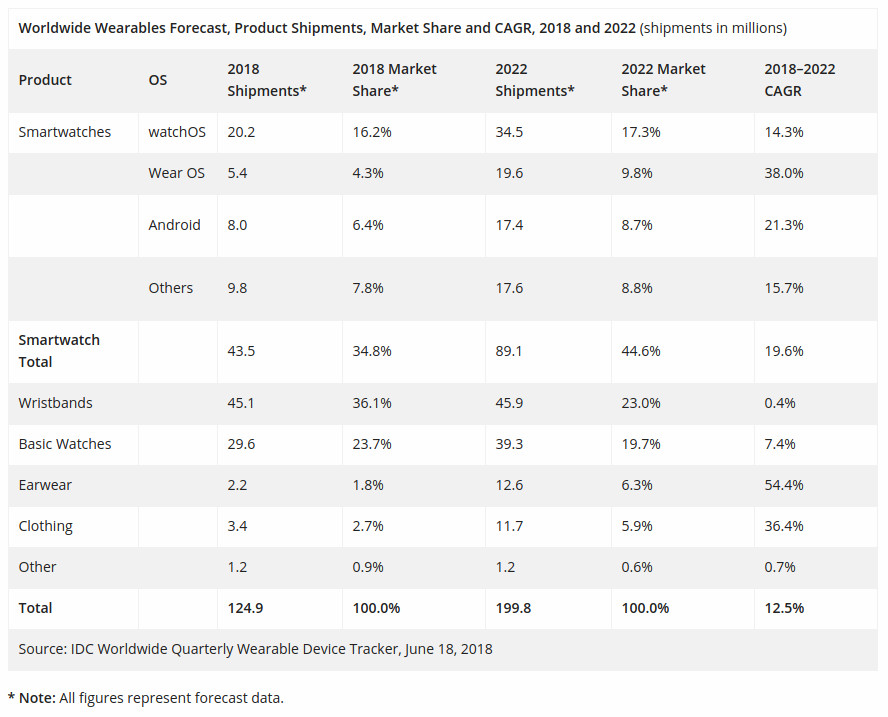

The worldwide wearables market forecasts an estimate of 124.9 million units by the end of 2018, which is an 8.2% increase from the same time last year. Though the growth is slightly lower than the 10.3% growth experienced in 2017, the market is expected to return to double-digit growth from 2019 until 2022 as smartwatches and other form factors grow according to International Data Corporation (IDC).

According to IDC, beyond the typical wrist-worn devices, earwear is also expected to gain momentum as various brands start to capitalize on the growing interest in smart assistants. Qualcomm’s dedicated chipsets for this category is likely to also help bolster supply. Furthermore, products with built-in sensors is also expected to grow and double its share by 2022.

As expected, Apple’s WatchOS continued to lead with 20.2 million shipments, 16.2% market share in 2018. However, the market share is expected to go up to 34.5 million units by 2022. On the other hand, Wear OS stands second with 5.4 million shipments with 4.3% market share. The combined smartwatch shipments hit 43.5 million units in 2018 with 34.8% market share. But it is expected to double by 2022.

On the other hand, wristband segment is expected to decline 6.6% in 2018 as demand for these simple devices has cooled off and incumbents like Fitbit and Garmin continue to pursue smartwatch growth instead. Beyond 2018, the category is expected remain largely flat with growth below 1% in the upcoming years.

Jitesh Ubrani senior research analyst for IDC Mobile Device Trackers said:

The shift in consumer preferences towards smartwatches has been in full swing these past few quarters and we expect that to continue in the coming years,” said “While Apple will undoubtedly lead in this category, what bears watching is how Google and its partners move forward. WearOS (formerly Android Wear) has been somewhat of a laggard recently and despite expected changes to the OS and the release of new silicon, we anticipate Android-based watches to be WearOS’ closest competitor due to the high amount of customization available to vendors and the lack of Google services in China.