India shipped a total of 52.6 million handsets in Q1 CY 2016, against 55.4 million in 1Q CY 2015, registering a decline of 4% YoY, according to CMR’s India Mobile Handset Report. The QoQ decline was 12.8%.

Indian smartphone brands contributed at an all-time high of 45%, up 7% compared to 4Q’15. However, the highlight of this quarter was that smartphones made in India contributed 67% of total sales. The contribution of Chinese and Global brands has though declined QoQ by few percentage points. The report further identified that average selling prices for smartphones were going up as it was Rs 12,285 in 4Q’15 against Rs 10,364 in the first quarter of 2015.

Faisal Kawoosa, Lead Analyst CMR’s Telecom Practice said,

We saw for the first time, price band of Rs 10,000 – 15,000 contributing the maximum (22%) towards the Smartphone shipments. Usually, the prime contributor used to be the price bracket of Rs 6,000 – 8,000. This increase has been primarily due to introduction of shipments by LeEco and launch of new handsets / significant increase in shipments from Lenovo, Oppo, LG, Panasonic, Micromax, Intex, LYF (RJio) and Vivo in Rs 10,000 – 15,000 price bands. Some of the Smartphones that have done exceptionally well in this price band include Lenovo’s K4 Note, LeEco’s Le 1S, Micromax’s Canvas Mega 4G, Huawei’s Honor 5X and Intex’s Aqua Freedom.

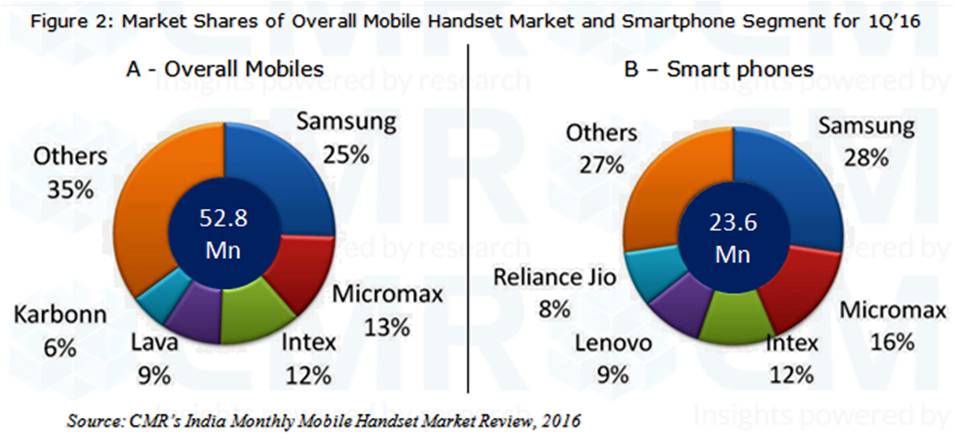

Faisal further stated that among the handsets produced out of India, 66 per cent of the smartphones and 60 per cent of the 4G smartphones were manufactured in India itself. Samsung, Micromax and Intex were the top three smartphone vendors with 28%, 16% and 12% market share respectively.