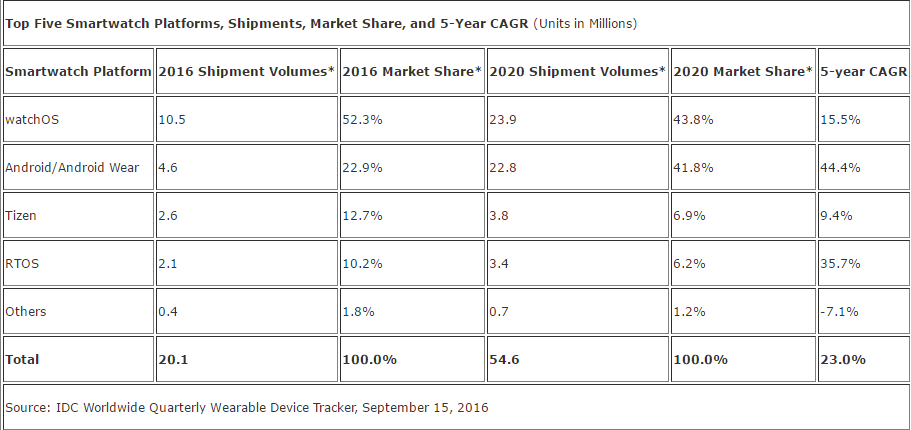

According to a new forecast from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker, total smartwatch shipments will reach 20.1 million units in 2016, an increase of 3.9% from the 19.4 million units shipped in 2015.

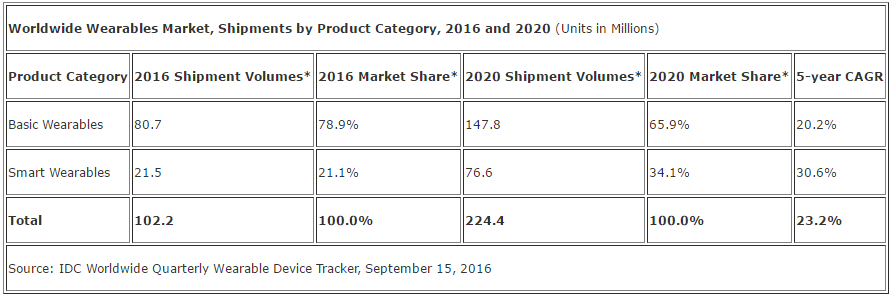

New smartwatch shipments are expected to see only modest growth for the rest of 2016 due to late-in-the-year and iterative product releases. IDC expects total smart wearable volumes to reach 21.5 million units shipped in 2016. By volume, smartwatches account for the largest part of the category, and are expected to reach a total value of $17.8 billion dollars in 2020.

Meanwhile, IDC categorizes a wearables that do not run third party applications as a basic wearable devices. Basic wearables can take on multiple form factors – wristbands, clothing, and watches – but underpining all of them is that none of them run third party apps. By the end of 2016, total shipments of basic wearables will reach 80.7 million units.

IDC says Android and Android Wear will see the fastest growth of any platform on the list, and by 2020 will challenge watchOS for the top position in the worldwide smartwatch market. The research firm said watchOS will rule the smartwatch platform list throughout the forecast. The Series 2 Watch addresses some of the shortcomings of its Series 1 predecessor, but the lower price on the Series 1 may end up driving more volume in the upcoming holiday season.

Ramon Llamas, research manager for IDC’s Wearables team said,

First, smartwatches will look and feel like traditional watches, appealing to those who put a premium and design and style. Second, once the smartwatches get cellular connectivity, they’ll disconnect from the smartphone, making them more useful. Third, smartwatch applications will build on this cellular connection, and connect with other devices within the home and at work. Finally, smartwatch prices will come down, making them more affordable to a broader market.

Ryan Reith program vice president for IDC’s Mobile Device Trackers said,

It is increasingly becoming more obvious that consumers are not willing to deal with technical pain points that have to date been associated with many wearable devices. Complaints about battery life, smartphone dependancy, and minimal use cases have been well versed across most publications and research findings. The aformentioned improvements that are rapidly being deployed by most vendors should improve this aspect, but at the same time the increase in devices that have more fashion appeal over technological appeal should also be a catalyst to growth in both smartwatches and basic watches with minimal functionality beyond normal analog.