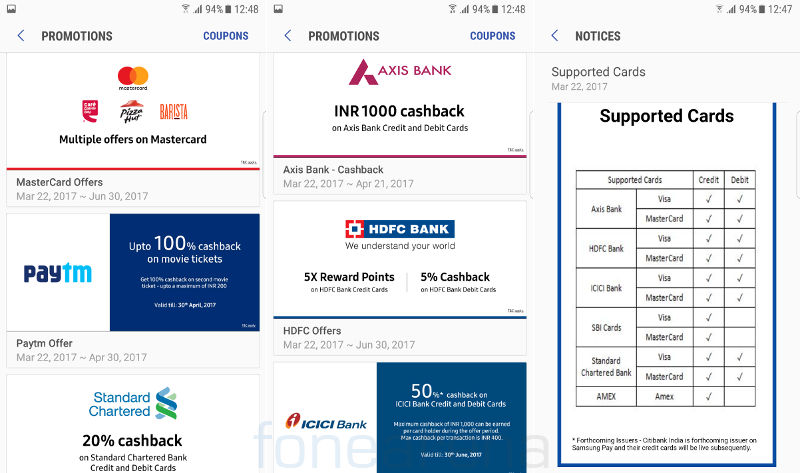

After taking registrations for early access a few weeks back, Samsung today officially launched Samsung Pay mobile payments service in India. It has partnered with Visa, MasterCard and American Express, who act as gateways. It currently supports Axis Bank, HDFC Bank, ICICI Bank, SBI Cards and Standard Chartered Bank cards, and will soon support Citibank India.

To pay using Samsung Pay, you just needs to:

- Swipe up on an eligible Samsung Galaxy smartphone (Galaxy S7 edge, Galaxy S7, Galaxy Note 5, Galaxy S6 edge+, Galaxy A5 (2016), Galaxy A7 (2016), Galaxy A5 (2017) and Galaxy A7 (2017) currently)

- Select the card

- Authenticate using a fingerprint or PIN

- Bring the phone near the Point of Sale terminal

Samsung Pay will also be available on the Samsung Gear S3 Smartwatch soon. Apart from offer simply tap and pay on the go using the registered cards, Samsung Pay has Paytm integration so that you can pay by scanning QR codes securely, generating one-time codes for merchant payments and also do peer to peer money transfers, as well as the government’s Unified Payments Interface in the app. We are yet to see UPI in the app, so it might get via an update soon.

Samsung Pay works with Samsung’s patented Magnetic Secure Transmission (MST) technology as well as with Near Field Communication (NFC). MST replicates a card swipe by wirelessly transmitting magnetic waves from the supported Samsung device to a standard card reader.

Through MST, Samsung pay will work seamlessly on a majority of Point of Sale terminals in India. It has three levels of security—fingerprint authentication, card tokenization and Samsung’s security platform Samsung KNOX.

Commenting on the launch, Asim Warsi, Senior Vice President, Mobile Business, Samsung India, said:

Our insights show that convenience, security and acceptance are seen by consumers as the most important influencers when choosing among different digital payment options.

With Samsung Pay, we give our consumers the smartest way to make digital transactions by far. Samsung Pay is highly secure through the signature KNOX Platform, fingerprint authentication and tokenization. We have partnered with major banks and card networks to give our consumers the widest range of choices, and are working on bringing more and more partners on board soon.