According to the latest market research from Counterpoint, India’s overall mobile phone shipments grew 48% YoY in Q1 2018. The feature phone segment almost doubled in Q1 2018 due to strong shipments of Reliance JioPhone, while the smartphone market remained flat compared to same time last year.

The major force behind the impressive growth in the feature phone is the JioPhone whose market share raced from 0% last year to 36% in Q1 2018. The company’s aggressive promotion and low-cost tariff plan help to boost the sales. On the flip side, the Chinese smartphone makers remained strong in India. They accounted for a 57% of the total smartphone market in Q1 2018, up from 53% during Q1 2017. This is the highest ever contribution by Chinese players in the Indian smartphone market.

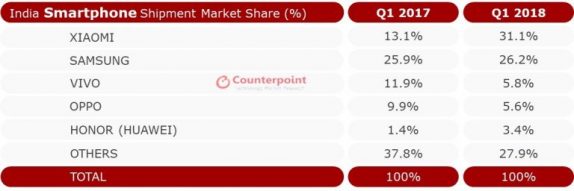

Xiaomi continued to lead the pack even in Q1 2018 with a record 31% market share followed by Samsung (26%), vivo (6%), OPPO (6%), and Honor (3%). Thanks to the Honor 7X and 9 Lite, Honor brand moved to 5th place replacing the Lenovo/Moto series. Honor, Xiaomi, OnePlus are among the fastest growing smartphone brands in Q1 2018.

As for the feature phone market, the Reliance Jio is at the top, followed by Samsung, Itel, Nokia, and others. Itel is the third largest player in the feature phone segment with 17% growth YoY in Q1 2018. The premium segment; Rs. 30,000 and above remained flat YoY during Q1 2018, Samsung captured the flagship segment thanks to its latest S-series flagships. While OnePlus retained in the second position.

Canalys report says that Xiaomi has shipped over 9 million units, in the quarter grabbing market share of just over 31%, the highest ever for a vendor since Q1 2014. Samsung shipped just under 7.5 million smartphones, growing by 24% on last year. OPPO took third place with 2.8 million shipments, and Vivo fourth with 2.1 million shipments. Overall, the smartphone market in India grew at 8% to 29.5 million units for the quarter. The top four vendors accounted for about 75% of all smartphone shipments to India, with Xiaomi and Samsung accounting for 56%.

Xiaomi Redmi 5A reached record sales of 3.5 million in the quarter. In comparison, Samsung’s best-selling device, the J7 Nxt, shipped just 1.5 million units.

Commenting on the competitive landscape, Anshika Jain, Research Analyst said,

This is the first time that the top five smartphone brands accounted for more than 70% market share in a single quarter, which could accelerate exits and possibly consolidation. Xiaomi and Samsung alone captured 58% of the total smartphone market. Xiaomi’s performance is driven by rising product-pull in the offline market, building upon its strong presence in the online channel where it captured a record 57% share. Xiaomi’s Redmi Note 5 and 5 Pro were the most popular models for the Chinese brand, whereas Samsung Galaxy J7 NXT and J2 (2017) drove volumes for the Korean vendor.

Canalys Research Analyst Ishan Dutt, said:

Xiaomi is becoming a force to be reckoned with in India. Apart from being some of the best value devices on the market, Xiaomi’s smartphones are now available in more places and in larger quantities. All in all, Xiaomi’s product and channel strategies are working.

The report also said that TRANSSION has emerged as the fifth largest player in the mobile phone industry by capturing 4% market share in Q1, 2018. The company said that itel, since its launch in April 2016 has retained its leadership position in the feature phone category.

Regarding the achievement, Marco Ma, Chief Managing Director – TRANSSION India, said:

We are deeply delighted to have achieved this success within 2 years of our operations in India and emerged as one of India’s leading mobile phone players. India is a key priority market for TRANSSION. We are consistently working towards providing world class experience, and, customized mobile solutions to the Indian consumers. Having said that, we are glad to gain recognition as well as a strong endorsement from a credible industry body, Counterpoint. This further fuels our commitment towards Indian consumers.