Recently, Counterpoint Research published a report on smartphone shipments in India during Q2 2019 and during Q2 2019, Xiaomi and Samsung continued to lead. Similarly, Counterpoint Research has published a report on smartphone shipments in India during Q3 2019 that reveals record-high smartphone shipments in India.

The report mentions that the India smartphone shipments reached 49 million units with 10% YoY in Q3 2019 despite the economic slowdown trends in other sectors and the growth was driven by new launches, discounts and various pre-Diwali sale online and offline by brands.

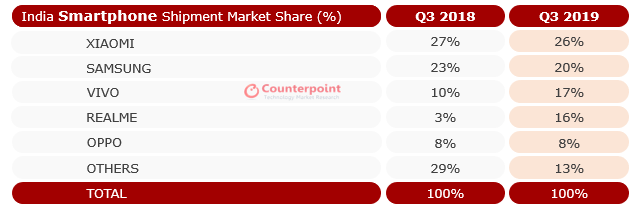

The India Smartphone Market Share Q3 2019 shows that Xiaomi has 26% shipment market share and is followed by Samsung with 20%, Vivo with 17%, Realme with 16%, OPPO with 8% and other brands with 13% shipment market share.

Xiaomi shipments grew 7% YoY, Samsung shipments declined by 4% YoY, Vivo reached its highest ever share in the India smartphone market, OPPO grew 12% YoY, itel grew 40% YoY, and Realme registered a 6X growth as compared to last year. Transsion group which includes itel, Infinix & Tecno together was ranked the number six OEM in the India smartphone market and OnePlus shipments are getting almost doubled as compared to last year. Also, Apple made an entry into the top ten smartphone brands due to price cuts on the iPhone XR model along with good channel demand for its newly launched iPhone 11.

| India Smartphone Shipments Market Share | 2018Q2 | 2018Q3 | 2018Q4 | 2019Q1 | 2019Q2 | 2019Q3 |

| Xiaomi | 28% | 27% | 27% | 29% | 28% | 26% |

| Samsung | 28% | 23% | 20% | 23% | 25% | 20% |

| vivo | 12% | 10% | 10% | 12% | 11% | 17% |

| Realme | 1% | 3% | 8% | 7% | 9% | 16% |

| OPPO | 9% | 8% | 7% | 7% | 8% | 8% |

| Others | 22% | 29% | 28% | 22% | 19% | 13% |

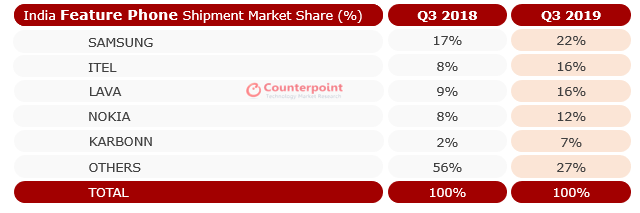

The feature phone market witnessed a steep decline of approx. 37% YoY due to the slowdown in the new shipments from Reliance Jio as the operator was focused on clearing the older JioPhone inventory ahead of Diwali season, according to the report. India Feature Phone Market Share Q3 2019 report shows that Samsung has 22% market share which is followed by itel with 16% market share, Lava with 16%, Nokia with 12%, Karbonn with 7%, and other brands with 27% Shipment Market Share.

Commenting on the market dynamics, Karn Chauhan, Research Analyst, said,

The India smartphone market grew double digits reaching a record 49 million units in Q3 2019 offsetting the ongoing economic slowdown in other sectors. Given maturity of smartphone users in terms of digital content consumption, commerce and communication, the smartphone has become central to people’s lives taking a priority in terms of their share of wallet. Further, the smartphone brands continue to expand their product portfolio with attractive advanced features from quad camera to full view display to fast-charging larger battery for the mainstream and the mass market. As a result, this holiday season, we estimate the demand for smartphones will supersede other categories despite uncertain economic climate.

Anshika Jain, Research Analyst at Counterpoint Research said:

The smartphone shipments reached a record-level, now accounting for two in three mobile phones sold. This was mainly driven by the spree of pre-festive season launches, aggressive marketing and incentivised channel strategy to maintain sufficient inventory to cash in on the festive season. Chinese brands Xiaomi, vivo, Realme and OPPO reached a record sell-in levels in Q3 2019. The growth and maturity of online channels from serving more zip codes than ever coupled with greater customer service, attractive promotions from discounts to cashback to EMI and exchange offers will be pivotal in driving smartphone sales during this festive season and also taking a large share from the offline channels.