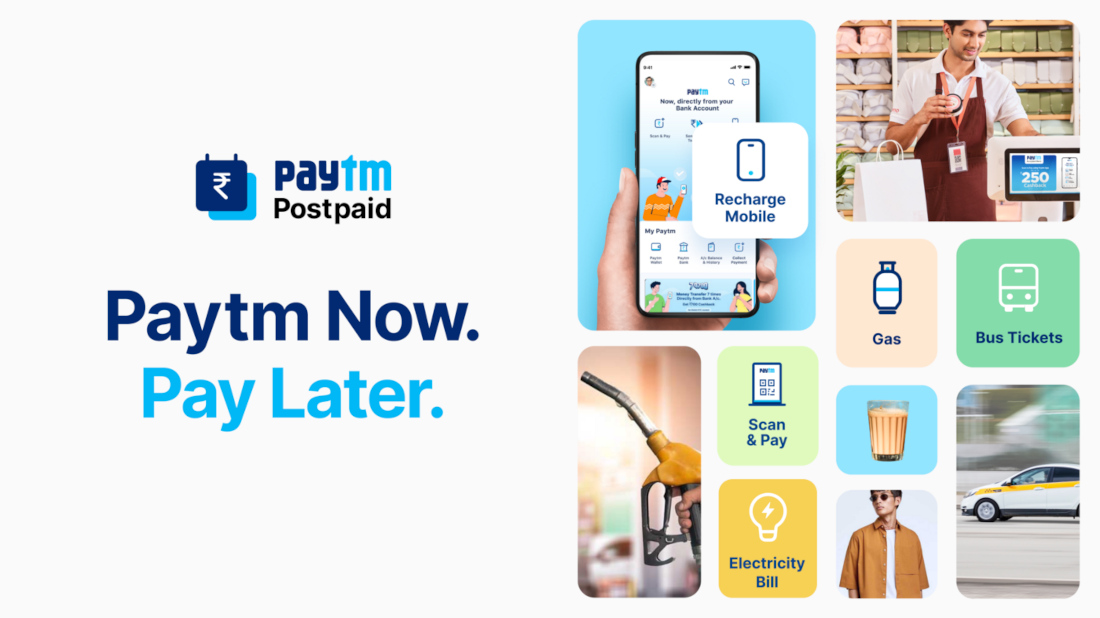

Paytm is expanding upon their Buy Now, Pay Later service, by introducing a new scheme called Paytm Postpaid Mini. It offers small ticket instant loans, ranging from Rs. 250 to Rs. 1000, and is designed to help people pay their mobile and DTH recharges, gas cylinder booking, electricity and water bills and more.

Postpaid Mini was launched in partnership with Aditya Birla Finance Ltd.

With it, users can avail these small ticket instant loans, and with a period of 30-days for repayment of the loans at 0% interest. Paytm promises that they will only charge a minimal convenience fee, and no annual fees or activation charges.

At the moment, Paytm Postpaid is available in over 550 cities in India, and it is accepted at petrol pumps, pharmacy shops, chains outlets such as Reliance Fresh, Apollo Pharmacy, etc., and in both online and offline retail stores across India.

Commenting on the launch of Postpaid Mini, Bhavesh Gupta, CEO of Paytm Lending said:

We want to help new-to-credit citizens start their credit journey and develop a financial discipline. Through Postpaid we are also making sincere attempts to help drive consumption in the economy. Our new Postpaid Mini service helps users manage their liquidity by clearing their bills or payments on time.