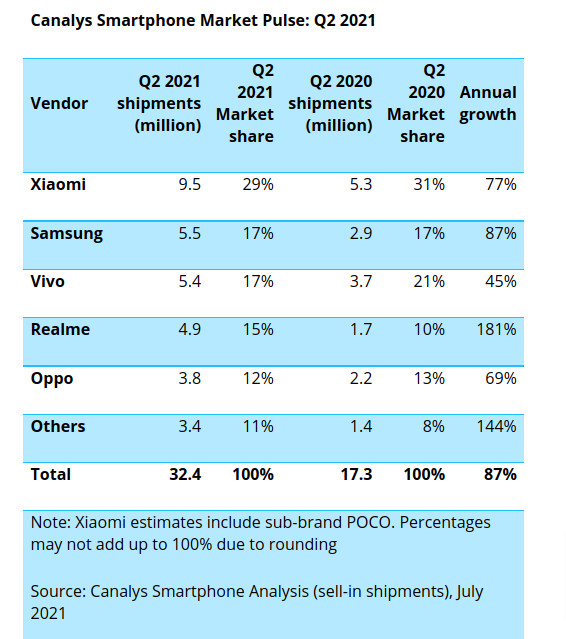

Indian smartphone market saw 32.4 million unit shipments in Q2 2021, up 87% compared to Q2 2020 due to Q2 2020’s two-month shutdown, but it fell 13% between Q1 and Q2 2021 due to the second wave of COVID-19, which stifled demand.

Xiaomi shipped 9.5 million units and had 29% share and posted 77% YoY growth due to strong sales of Redmi Note 10 series. Samsung stayed in second place, shipping 5.5 million units for a 17% share and posted 87% YoY growth. Vivo came in third with 5.4 million units shipped and 45% YoY growth. realme overtook OPPO for fourth place with 15% share, shipping 4.9 million units against OPPO’s 3.8 million. realme saw 181% YoY growth, due to strong narzo 30 series sales.

Canalys Analyst Sanyam Chaurasia expects that India will rebound in the second half of 2021, aided by accelerated vaccinations, as well as brands expanding promotional activities and new product releases. But the second half will not see a surge in pent-up demand like last year. The threat of a third wave still looms in India, but as citizen behavior and industrial operations continue to adapt to pandemic conditions, its impact should be minimal, he added.

Increasing costs will be challenging, amid limited component supply, rising shipping charges and a tough macroeconomic environment. In the short term, vendors will bear the impact of supply chain disruption, and will be conservative about raising prices. But the component shortage also brings another risk – regional deprioritization – as brands look to allocate their limited supplies of devices to more lucrative markets.