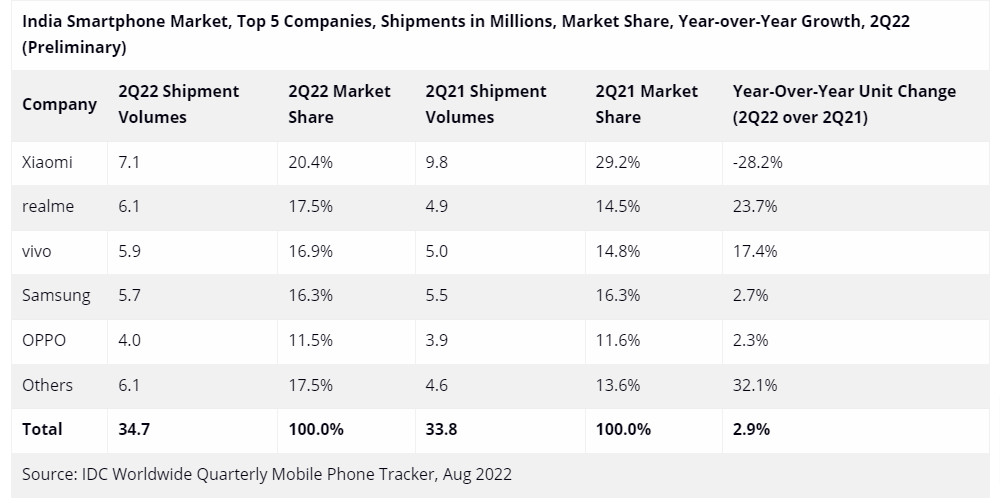

In 2Q22 (April through June), 35 million smartphones were shipped in India, a 3% year-over-year (YoY) increase, while the first half of 2022 saw just a 1%YoY decline to 71 million units, according to statistical data from the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker.

Due to seasonal factors, the second quarter of the year typically has higher demand than the first, but declining consumer demand resulted in a 5% quarter-over-quarter (QoQ) fall. Earlier, IDC reported that global smartphone shipments declined 8.7% YoY in Q2 2022.

The online outlet achieved 52% with 5% YoY growth; this is likely to stay strong in the 2H22 (Jul-Dec) festival season, with increased promotions by e-tailer platforms. Following three consecutive quarters of decline, offline grew by 1%. Furthermore, the ASP (average selling price) has increased QoQ since 4Q20, topping US$213 in 2Q22, up 15% YoY.

UNISOC’s share reached 17% in 2Q22, while MediaTek’s fell below 50%, a level not seen since 2020. Shipments and shares of Qualcomm and Samsung devices rose. 11 million 5G phones were shipped at an ASP of $377. From 2020 to 1H22, 51 million 5G smartphones were supplied, and they are predicted to reach a 50% market share by 2023, claims IDC.

The premium segment, $500 or above, of the market accounted for 6% of the market. Apple’s market share was 53%, followed by OnePlus (19%) and Samsung (15%). The $200-$300 mid-range sector accounted for 17% of the market, expanding by 21% YoY, and is a target area for manufacturers, with many model launches planned in the next few months. The sub-$100 segment fell to 17% of the market from 22% a year ago.

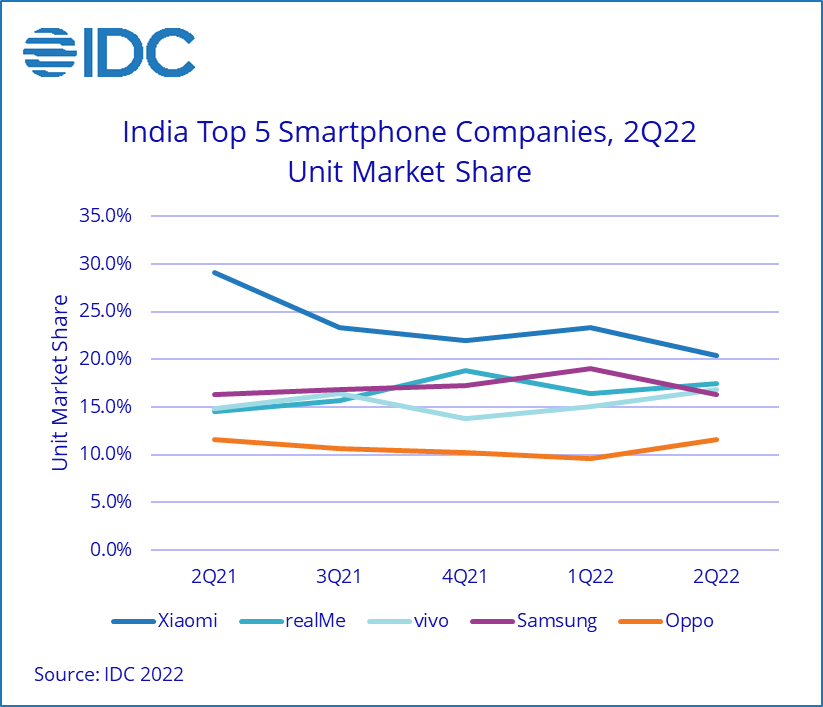

Top 5 Smartphone company highlights: 2Q22

- In 2Q22, Xiaomi was the only top ten vendor with falling shipments (-28%) YoY. 1H22 supply limitations, notably in the sub-$200 category. 2Q22 was the launch quarter for the Redmi 10 series, which coupled with the Redmi 9A Sport and Redmi Note 11 accounted for 35% of shipments. Xiaomi slid to third in 5G, which accounted for 25% of total shipments.

- realme ascended to second place for the second time in 2Q22, with a 24 percent YoY growth. With cheap and effective C-series models, it ranked second online with a 23% share. realme ensured entry-level supply with two-thirds of its range using UNISOC chipsets.

- vivo grew 17% YoY to place third. It had a 24% lead offline. Vivo was the second-largest 5G smartphone player in India, with 33% of 5G phones. Its internet share increased after the release of the T-series and iQOO.

- Samsung plummeted to fourth with a dismal 2Q22 and 3% YoY growth. Demand remained low despite a revamped portfolio, while ASPs rose to $250 (highest amongst the top five vendors). However, it led the way in 5G smartphones with 46% of shipments.

- OPPO, in fifth, grew by 2%. With the F21 Pro, it targeted the mid-premium category and extended online with the K-series.

Speaking on the 5G smartphone supplies, Navkendar Singh, Associate Vice President, Devices Research, IDC India, South Asia & ANZ, said,

5G smartphone supplies are much better than 4G, leading to higher ASPs but lower demand. The mass segment of below US$200 has seen fewer new launches. On top of this, inflationary stress is impacting consumer demand and is not expected to ease anytime in 2H22. These factors will certainly impair 2022 to be flat

Commenting on the supply constraints, Upasana Joshi, Research Manager, Client Devices, IDC India, said,

The primary challenge in 2021 was around supply constraints, which have eased considerably. However, the market is now facing demand contraction in 2022 due to rising inflation and higher input costs, leading to higher market prices. As a result, the inventory cycles are increasing across brands and channels