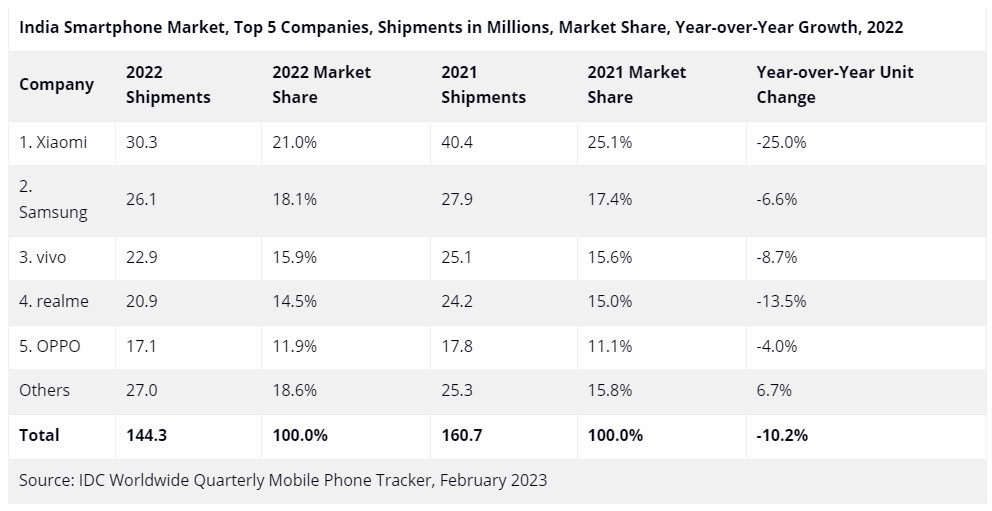

According to the International Data Corporation’s (IDC) quarterly and annual report, India smartphone market saw 144.3 million smartphones in 2022, down by 10.2% YoY (year-over-year), despite multiple price discounts and channel schemes, high inventory levels after Diwali.

Totally, 201 million mobile phones were shipped in 2022, down 12% YoY. Only 57 million feature phones were shipped in the year, down 18% YoY. Samsung, Xiaomi and Transsion were top companies based on mobile phone shipments.

Key Highlights for 2022:

- Online market saw a record-high share of 53%, but dropped by 6% YoY. The offline channel declined by 15% YoY.

- 50 million 5G smartphone shipments with an ASP of US$395 in 2022, down from US$431 in 2021. 60% of 5G shipments expected in 2023.

- MediaTek and Qualcomm-based smartphone shares dropped while UNISOC’s share doubled to 14%, thanks to entry-level 4G phones from realme and Samsung

- Smartphones from US$300-500 and US$500+ grew 20% and 55%, respectively, while the sub-US$300 segment declined by 15% with Apple maintaining its lead with a 60% share (iPhone 13 being the 3rd most shipped device in 2022), followed by Samsung with a 21% share.

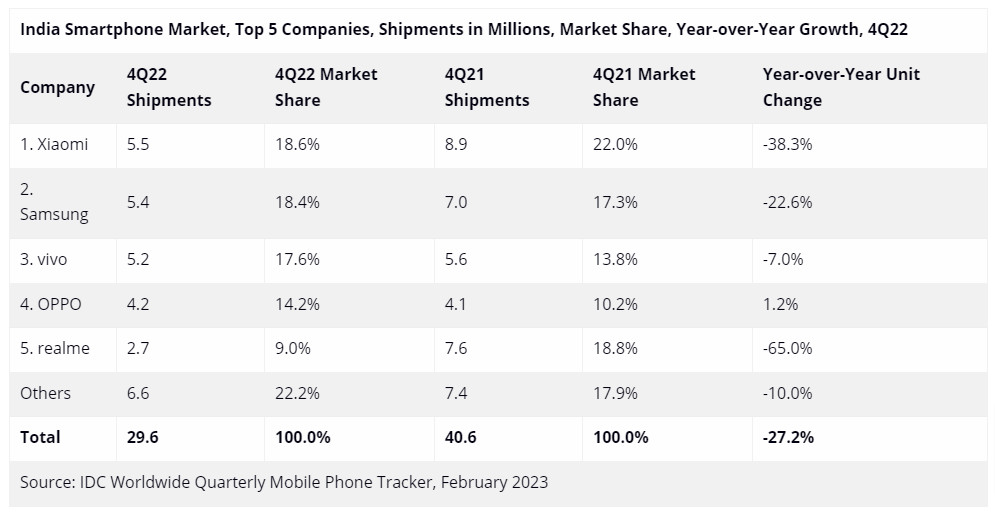

Xiaomi maintained the lead in 2022, but it declined 25% YoY, and in Q4 2022 it was down 38.3%.

Samsung also maintained the second spot, and declined just 6.6% in 2022, thanks to sales of Galaxy A series in the offline channel, the M and F series online, and also the Galaxy S series and the foldables in the premium segment.

vivo in the next position declined 8.7% YoY, and did well in the online channel with aggressive shipments in the T series and iQOO brand through 2022.

OPPO climbed to the fourth slot in fourth quarter of 2022, maintained the fifth spot in 2022. The ‘A series’ lead the sales, followed by F and Reno series.

realme slipped to the fifth slot in the fourth quarter, mainly due to high inventory from the previous quarter. C series and affordable 5G models sold well towards the end of the year.