![]()

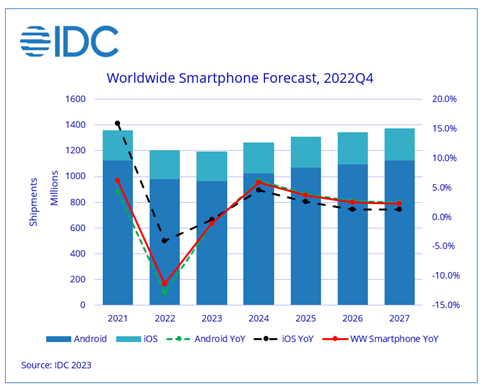

As weak demand continues, global smartphone shipments are expected to decrease by 1.1% in 2023, pushing recovery into 2024, as reported by the IDC tracker. Earlier, IDC reported Indian smartphone shipments decreased 10% YoY in 2022.

IDC Revises Smartphone Forecast

International Data Corporation (IDC) has adjusted its smartphone forecast due to a slower market recovery than initially expected. The Worldwide Quarterly Mobile Phone Tracker predicts that shipments of smartphones will1% in 2023 to 1.19 billion units.

The market continues to struggle with low demand and macroeconomic issues, and real recovery isn’t expected until 2024, with a 5.9% year-over-year growth and a five-year CAGR of 2.6%.

Growth of 5G and Foldable Phones

5G is growing, projected to account for 62% of smartphones shipped worldwide by 2023, and 83% by 2027. Foldable phones are a rising segment, estimated to reach 22 million units in 2021, a 50% increase despite market contraction.

As costs reduce and more OEMs launch this form factor, this segment is expected to continue growing. Average selling price (ASP) of smartphones saw rapid growth from $334 in 2019 to $415 in 2022 but will start to decline in 2023 and is projected to hit $376 by the end of the forecast period, according to IDC.

Speaking on the report, Nabila Popal Research Director with IDC’s Mobility and Consumer Device Trackers, said,

With increasing costs and ongoing challenges in consumer demand, OEMs are quite cautious about 2023. While there is finally some good news coming out of China with the recent reopening, there is still a lot of uncertainty and lack of trust, which results in a cautious outlook.

However, we remain convinced the global market will return to growth in 2024 once we are past these short-term challenges as there is a significant pent up refresh cycle in developed markets as well as room for smartphone penetration in emerging markets to fuel stable long-term growth.

Commenting on the IDC report, Anthony Scarsella, Research Director with IDC’s Mobility and Consumer Device Trackers, said,

2023 is set to be a year of two halves with the first half piggybacking off the downhill slide from the fourth quarter of 2022. Most regions will face double-digit declines in the first half of the year, make a turn into positive territory in the third quarter, and then boost into double-digit growth in the last quarter of the year. We expect the influx of premium flagships that typically launch in the third and fourth quarters will keep the full year decline from being worse.