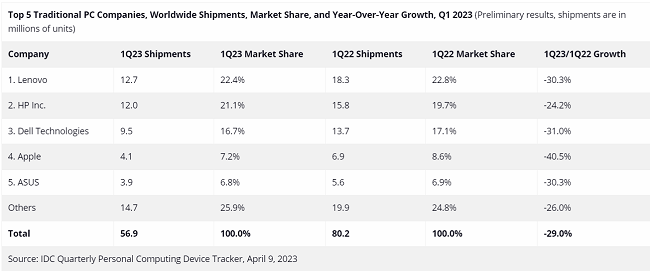

Traditional PC shipments plummeted in the first quarter of 2023 (1Q23) as a result of poor demand, excess inventory, and a deteriorating economic environment, according to IDC report.

The International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker reported that global shipments reached 56.9 million, a fall of 29.0% compared to the same quarter in 2022. This comes after IDC’s report last month that global smartphone shipments are projected to decline 1.1% in 2023.

Traditional PCs Shipments during the first quarter of 2023 (1Q23)

The preliminary results also signaled the conclusion of the COVID-driven demand period and a temporary return to pre-COVID patterns. Shipment volume in 1Q23 was considerably lower than the 59.2 million units shipped in 1Q19 and 60.6 million in 1Q18. The decline in growth and demand is also giving the supply chain some room to make changes as many factories begin to seek production options outside China.

Meanwhile, PC makers are also changing their plans for the rest of the year and have begun to order Chromebooks due to an expected rise in licensing costs later this year.

Nonetheless, PC shipments will likely struggle in the near term, with a resurgence in growth towards the end of the year with an expected improvement in the global economy and as the installed base starts to think about upgrading to Windows 11.

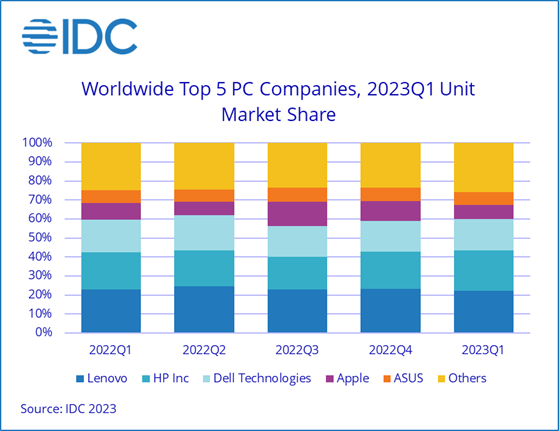

Top 5 Traditional PC Companies, Worldwide Shipments (Preliminary results, shipments are in millions of units)

- Lenovo led the PC market in 1Q23. It had a 22.4% share of the market.

- HP Inc. followed Lenovo closely. It had a 21.1% share of the market.

- Dell Technologies came in third. It had a 16.7% share of the market.

- Apple ranked fourth. It had a 7.2% share of the market.

- ASUS rounded out the top five. It had a 6.8% share of the market.