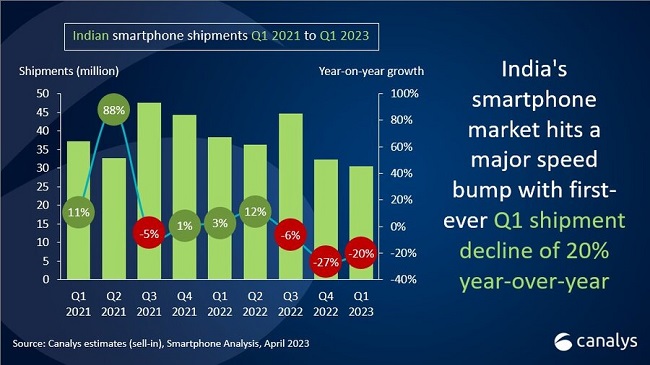

India’s smartphone market saw an unprecedented decline of 20% in Q1 2023, according to a new report by Canalys. This follows a 6% drop in smartphone shipments in Q4 2022, as reported by Canalys earlier.

Indian Smartphone Market Faces First-Ever Q1 Shipment Decline in 2023

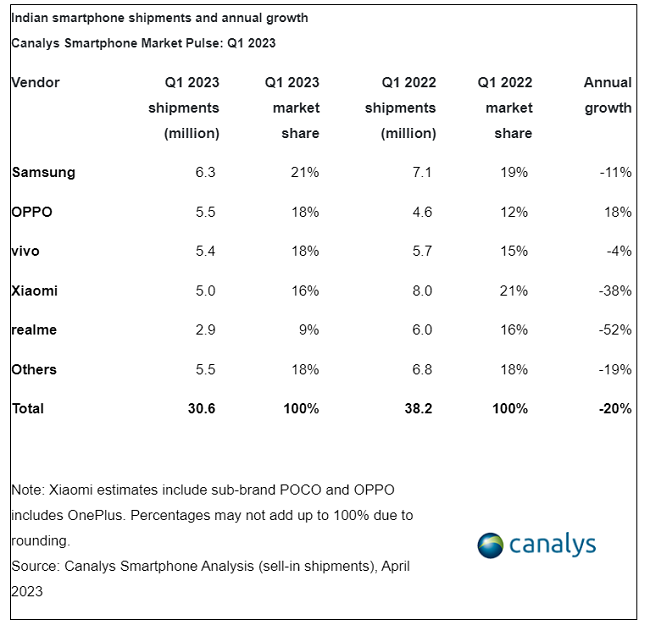

According to Canalys research, the Indian smartphone market experienced a challenging start to 2023, with a 20% year-on-year decline in Q1 shipments. The market still struggles with uneven demand, and stock build-up remains a vulnerability for channels. Samsung maintained its position as market leader, with a 21% market share and 6.3 million shipments.

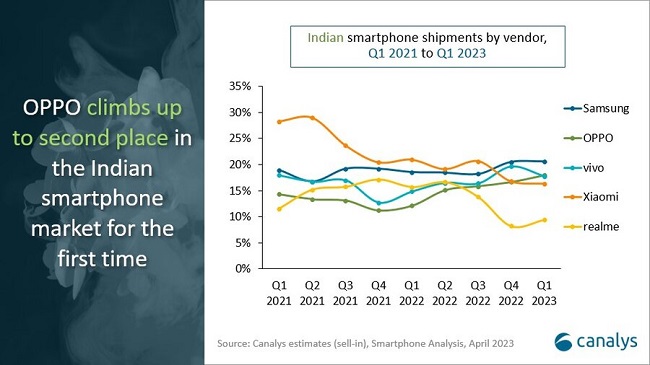

OPPO overtook vivo and Xiaomi to reach second place with 5.5 million shipments, and vivo came in third with 5.4 million shipments. Xiaomi slipped to fourth place with 5 million units, while realme held fifth place with 2.9 million shipments.

Importance of Channel Management

Canalys analyst Sanyam Chaurasia highlighted the importance of brands balancing their channel contributions to maintain business operations and market share.

Vendors who manage channels well are more stable in uncertain markets. After the pandemic, vendors who boosted mainline retail channels have shown steadiness. More high-end models have motivated vendors to improve their offline channels.

Samsung has been effective with its fast-moving model placement in the offline space, while Apple’s new offline stores staffed by expert employees will enhance its brand experience and position.

Challenges and Opportunities in the Market

Chaurasia mentioned that the mass-market segment is still moving slowly, making 2023 a challenging year. However, the premium segment is poised for growth, boosting the ASP growth of the overall market.

Consumers are gradually willing to spend more on premium devices, and to succeed in this segment, brands must prioritize availability, affordability, and aspirational value. Brands should also focus on export strategies to align with the government’s initiatives, as Apple and Samsung are currently driving India’s smartphone export growth.

Canalys expects modest growth this year, driven by organic growth drivers, but to stimulate the upgrade cycle, 5G devices and other market drivers must offer compelling utility for consumers.

Commenting on the report, Sanyam Chaurasia, Analyst at Canalys, said:

India’s market struggles but vendors remain optimistic. They invest in retail, manufacturing, local sourcing, and R&D to align with the government and consumers. They aim for long-term market success.

Commenting on the milestone of being the only brand to register year-on-year growth, Damyant Singh Khanoria, Chief Marketing Officer, OPPO India, said:

OPPO remains dedicated to providing its customers with premium technological experiences and fulfilling its brand promise of ‘Innovation Ahead’. Our consistent year-on-year growth is a testament to our commitment to pushing boundaries and introducing groundbreaking technology that delights consumers. We will continue to strive for excellence and innovate for the future.