Jio recently announced the launch of Jio Bharat (JB) Phone, a new entry-level 4G feature phone. This move is aligned with India’s ‘2G-MUKT BHARAT’ vision and aims to cater to the low-end market segment that lacks access to the internet.

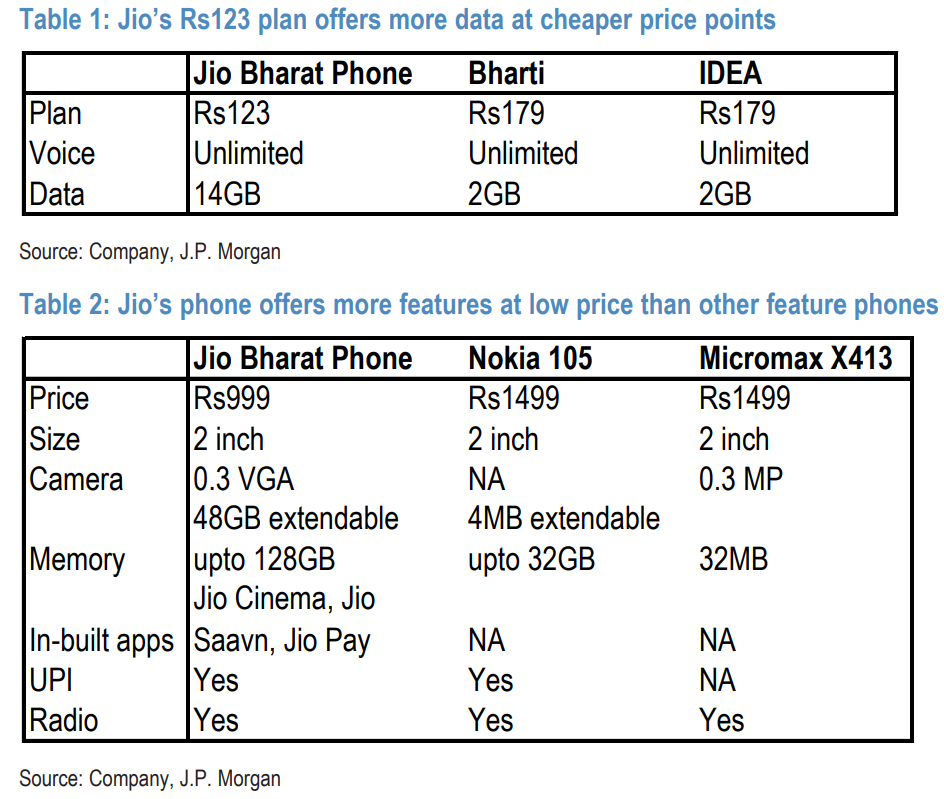

The Jio Bharat Phone features a 2-inch display, a 0.3 VGA camera, and comes with built-in apps such as JioSaavn and Jio Cinema. It also offers UPI functionality through Jio Pay. The phone has 48B of built-in storage, expandable up to 128GB with a microSD card.

JP Morgan Report: JioBharat’s Disruptive Potential in the Feature Phone Market

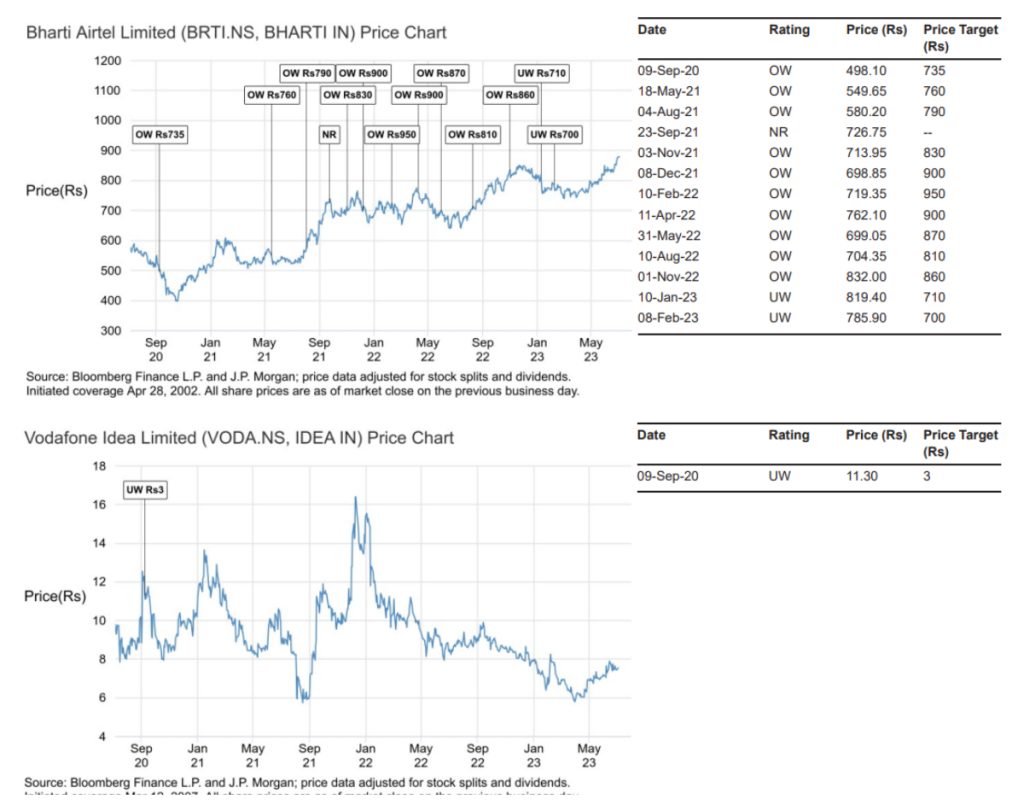

JP Morgan has prepared a comprehensive research report highlighting the strategic position of Jio Bharat in disrupting the feature phone market. The report emphasizes the potential of JioBharat to capture market share and disrupt the 2G segment, considering the competitive pricing and attractive plans offered by Jio.

Jio’s Market Share Potential and Impact on Competitors

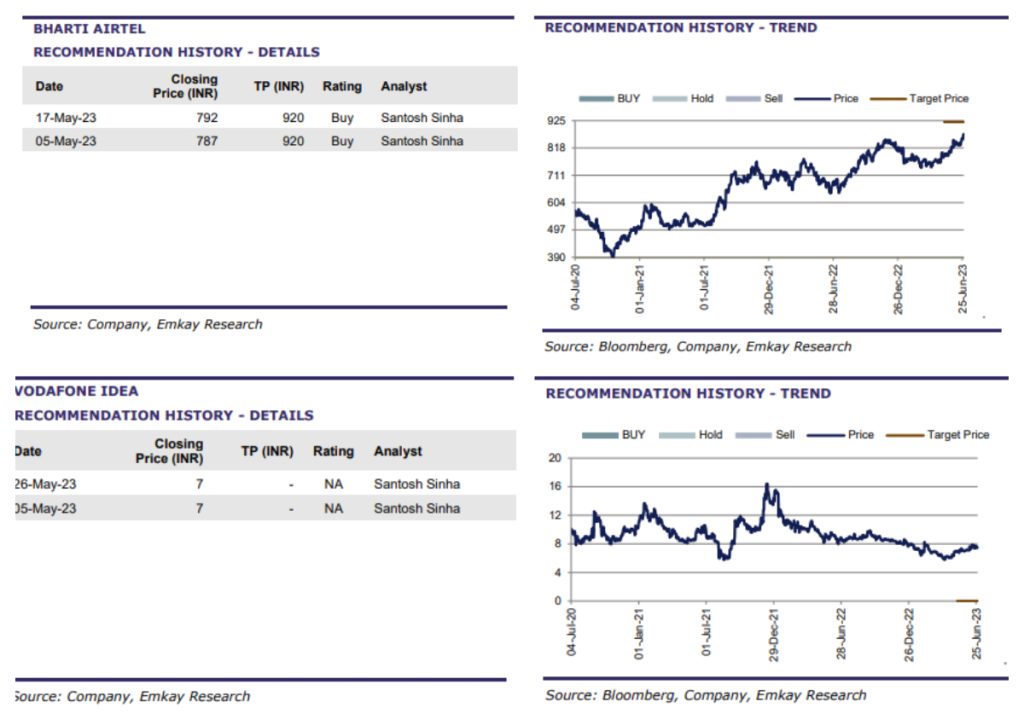

JP Morgan believes that Jio’s entry into the low-end market segment with Jio Bharat Phone poses a risk to competitors like Bharti, which recently increased 2G prices.

This significant action has the potential to stop gradual increases in 2G tariffs and assist Jio in acquiring a larger portion of the market. Jio’s aggressive strategies at both the premium and low-end segments indicate a lack of support for 4G tariff actions by Bharti Airtel and IDEA.

Emkay Report: JioBharat’s Advantages Over the Original JioPhone

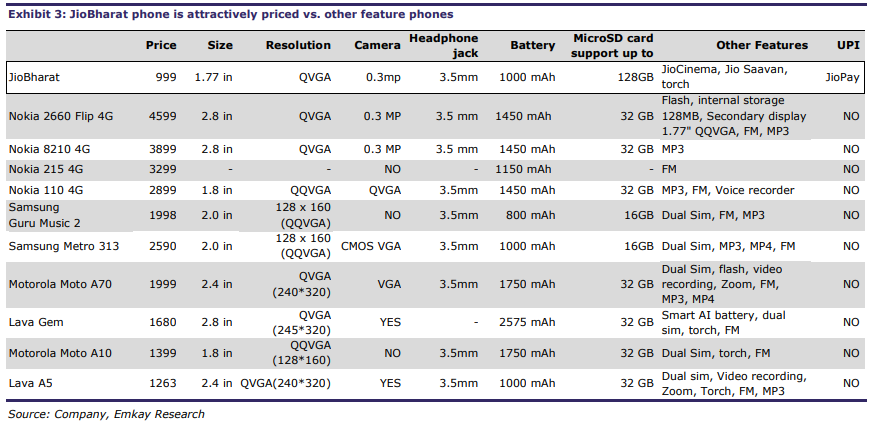

According to Emkay’s report, JioBharat is better positioned to disrupt the market compared to the original JioPhone launched in 2018. The report highlights the focused product offering, simpler value proposition, better distribution and production planning, and favorable timing of JioBharat’s launch, considering the recent increase in 2G tariffs by competitors.

JioBharat’s Potential to Expand Digital Networks and User Base

JioBharat phones offer an affordable option for users to access the internet and digital services. With the integration of Jio’s network and device capabilities, users can enjoy unlimited content through JioCinema and JioSaavn and make UPI-based digital payments with JioPay.

JioBharat’s availability at a price below Rs. 1,000 makes it appealing to a significant portion of the market, bridging the digital divide and expanding the adoption of digital networks.

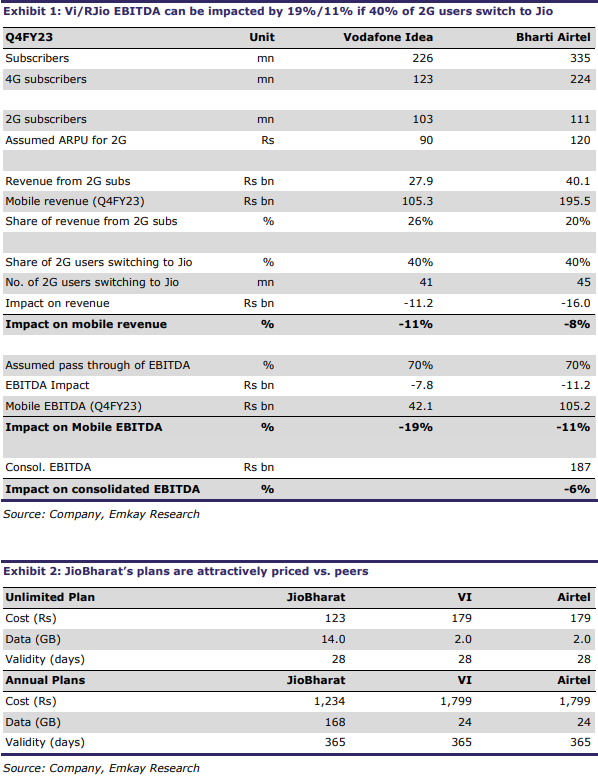

Anticipated Impact on Vi and Airtel’s Revenue and EBITDA

If 40% of 2G users switch to JioBharat, Vi and Airtel could experience a significant impact on their mobile revenue and EBITDA. Vi’s mobile revenue could be affected by 11%, while Airtel’s could be impacted by 8%. Additionally, Airtel’s consolidated EBITDA may see a decline of 6%.

This shift in user base highlights the potential disruption JioBharat can bring to the market and the need for incumbents to consider transitioning from 2G to 4G networks.

According to the report by J.P. Morgan and Emkay:

Jio Bharat Phone, accompanied by competitive pricing and attractive plans, aims to disrupt the feature phone market and accelerate India’s transition to a 2G-free nation.

With its strategic positioning, simpler value proposition, and better distribution, JioBharat has the potential to capture a significant market share and impact competitors like Bharti and IDEA. The expansion of digital networks and the transition of 2G users to 4G through JioBharat further solidify Jio’s position as a market leader.