Google Pay has rolled out UPI LITE support that enables users to make fast and one-click UPI transactions without needing to enter the UPI PIN. Introduced by the Reserve bank of India in September 2022, UPI LITE feature eases UPI transaction process and is enabled by National Payments Corporation of India (NPCI).

The LITE account is linked to the user’s bank account, but does not rely realtime on the issuing bank’s core banking system. This promises higher success rates even during peak transaction hours.

You can add up to INR 2000 twice a day for a total of INR 4000 per 24 hours, and transact up to INR 200 at a time. Using UPI Lite, also results in a less cluttered bank passbook with fewer transaction details.

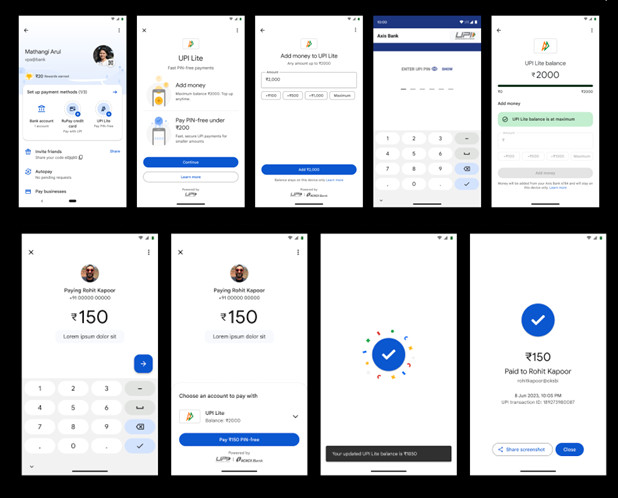

How to activate UPI Lite on Google Pay?

- Google Pay app users can go to their profile page and tap on activate UPI LITE

- On completion of the linking process, users will be able to add funds up to INR 2000 to their UPI LITE account, with the maximum per day limit being INR 4000.

- Subject to UPI Lite balance and for transaction values less than equal to INR 200, the UPI LITE account will be selected by default.

- To complete the transaction, users need to tap on “Pay PIN-Free”

As of now, 15 banks support UPI LITE with more banks to follow in upcoming months, said Google. According to the help page from Google AU Small Finance Bank, Axis, Bank of India, ICICI, Indian, Kotak, SBI, South Indian Bank and Union are listed as supported banks.

UPI Lite is now like on Google Pay app for Android and iPhone.

Speaking about the roll-out, Ambarish Kenghe, VP Product Management from Google, said:

At Google Pay, we feel privileged to partner with the Indian government along with NPCI and RBI, in growing the reach and usefulness of UPI. Unique offerings and use cases are core to driving further adoption of digital payments in the country and with the introduction of UPI LITE on the platform, we aim to simplify small-value transactions by helping users access a convenient, compact and superfast payments experience.