According to Counterpoint’s PC tracker service, global PC shipments experienced a 15% year-over-year (YoY) decline in Q2 2023 but showed an 8% quarter-over-quarter (QoQ) increase. Despite inventory levels normalizing, another double-digit YoY decline was recorded following the 28% YoY decline in Q1.

Early Signs of Stabilization in PC Market

IDC reported a 13.4% YoY decline in global PC shipments for Q2 2023, indicating a relatively stable downturn compared to Q1 2022. Moreover, Q2 saw the first QoQ growth since Q1 2022, suggesting an early sign of stabilization in the PC market. Counterpoint’s report also mentioned a mild recovery expected in H2 2023, as solid growth drivers are absent.

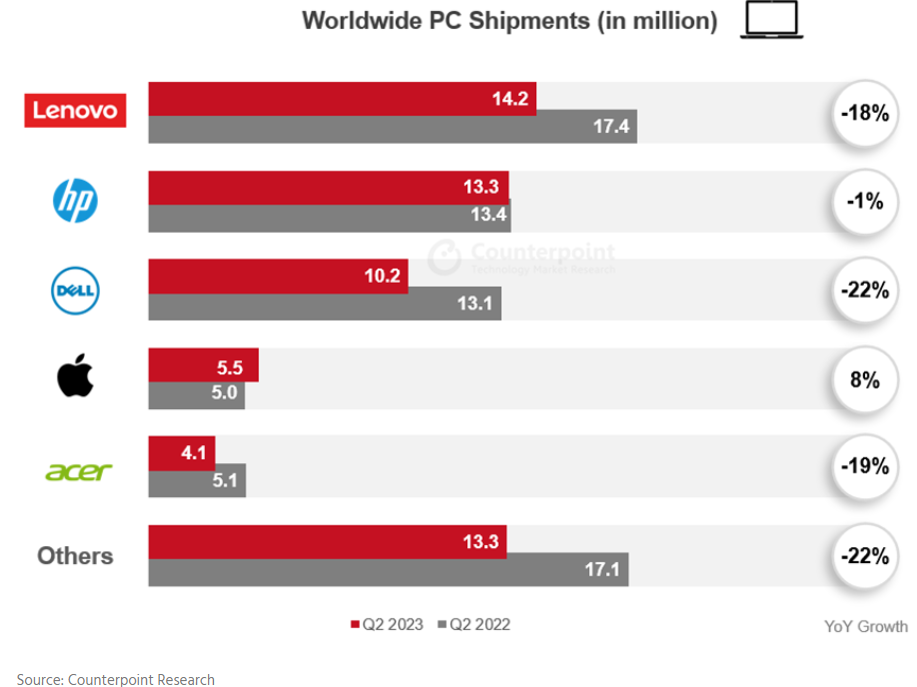

Shipment Performance of Major Vendors

1) Lenovo maintained its leading position in shipments during Q2, although the company experienced an 18% YoY decline due to soft demand in certain markets. The double-digit sequential growth indicates a normalization of demand and healthier inventory levels.

2) HP achieved a 22% market share, the highest since Q2 2021. Its resilient shipment numbers resulted from early inventory correction and increased Chromebook orders.

3) Dell reported sequential shipment growth but faced a double-digit YoY decline due to overall weak demand.

4) Apple witnessed high single-digit shipment growth compared to the previous year, primarily due to relatively low Q2 2022 figures and new product launches.

Positive Outlook for H2 2023

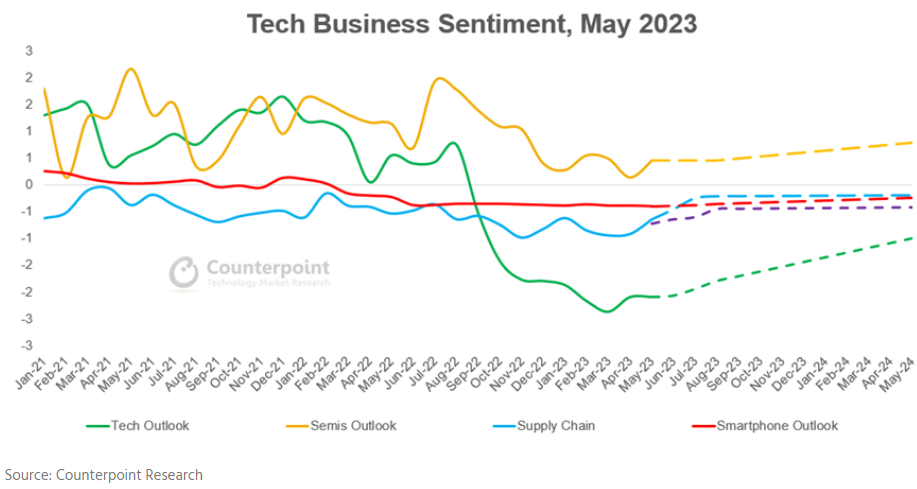

Although the global PC market experienced a QoQ rise in Q2 after a prolonged decline, Counterpoint’s Macro Index Tracker suggests potential turbulence in the second half of the year.

However, the end demand appears stronger than OEM shipments, indicating accelerating re-order demand. Anticipated back-to-school momentum, coupled with potential AI-enabled and Arm laptop launches, is expected to strengthen sales numbers. Overall, the market is gradually transitioning to a new post-COVID-19 normal.

Projected Return to Pre-COVID-19 Levels in H2 2023

Counterpoint predicts a sustained sequential rebound in global PC shipments throughout the year, with a return to pre-COVID-19 levels anticipated in H2, 2023.

However, caution is advised regarding YoY shipment performance in upcoming quarters, as further declines are expected before the PC industry regains its growth momentum.

Counterpoint also highlights the importance of healthy inventory levels by 2024, with potential growth drivers including replacement demand, AI-enabled models, Chromebook renewals, and enterprise expenditure plans.