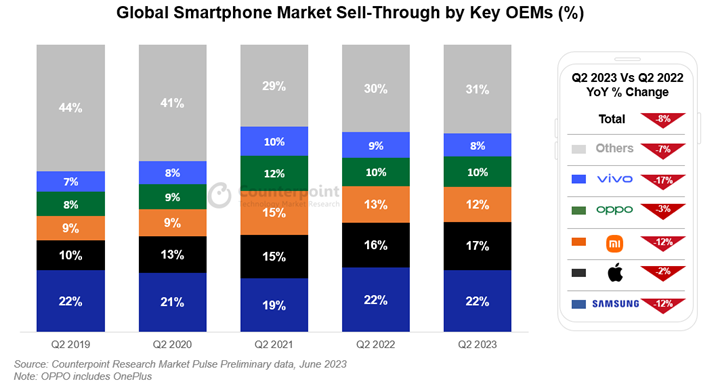

According to the latest research from Counterpoint’s Market Pulse service, the global smartphone market experienced an 8% year-over-year (YoY) and 5% quarter-over-quarter (QoQ) decline in sell-through during Q2 2023.

This follows a report from IDC stating that global smartphone shipments decreased by 14.6% YoY in Q1 2023, marking the eighth consecutive quarter of YoY decline.

Market Leaders and Challenges

- Samsung held the largest market share at 22%, benefiting from the strong performance of its Galaxy A-series worldwide.

- Apple secured the second position and achieved its highest-ever Q2 market share.

- Xiaomi, the third-largest brand, faced challenges in its key markets of China and India but sought growth in other markets and through portfolio refreshes.

- OPPO performed well in China and India but experienced losses in Western Europe.

- vivo witnessed declining growth in China and faced tough competition from Samsung and OPPO in India and Southeast Asia.

Changing Dynamics of the Global Smartphone Market

The global smartphone market is transitioning from its rapid growth phase, with longer consumer replacement cycles, innovation convergence, and a growing refurbished market impacting demand, particularly in the low-to-mid-tier price segment.

Growth in the Premium Segment

The premium segment (wholesale price $600+) continued to grow despite broader market constraints. Consumers seeking a superior experience, supported by accessible finance options, contributed to the segment’s growth.

- The premium segment achieved its highest-ever Q2 contribution to the overall market, with more than 20% of smartphones sold falling into this category.

- Apple capitalized on this trend and gained market shares in non-traditional markets, such as India, with a 50% YoY growth in Q2, 2023.

Decline in Sales Across Regions

All regions experienced a decline in smartphone sales, with the most significant drops observed in developed markets like the US, Western Europe, and Japan, where double-digit annual declines were recorded.

Comparatively, China, India, and the Middle East & Africa witnessed relatively smaller declines. To clear excess inventory, OEMs and channels employed promotions and “big sale” festivals. However, weak demand persisted, influenced by higher interest rates impacting disposable income.

Positive Outlook for the Industry

Counterpoint’s Smartphone Inventory Tracker indicates healthy global smartphone inventory levels over the past few months. This provides OEMs with an opportunity to launch and promote newer models in the second half of the year, stimulating consumer upgrades and accelerating the replacement cycle. As a result, Counterpoint expects a gradual market recovery in the upcoming quarters.