In the first half of 2023, India’s smartphone market saw a 10% YoY decrease, shipping 64 million units, according to IDC’s Worldwide Quarterly Mobile Phone Tracker. Furthermore, there was a 7.8% YoY decline in global smartphone shipments in Q2, 2023.

Market Growth and Strategies in 2Q23

The market experienced a 10% growth in the second quarter of 2023 compared to the previous quarter, but saw a 3% YoY decline, reaching 34 million units. To clear inventory before the festive season, vendors and channels offered discounts and special promotions.

Average Selling Price and Segment Shares in 2Q23

The average selling price (ASP) declined by 8% QoQ but grew by 13% YoY to reach USD 241 in 2Q23. The sub-USD 200 segment declined to 65% from 70% YoY, while the mid-to-high-end segment (USD 400 < USD 600) showed a 34% YoY growth, and the premium segment (USD 600+) saw the highest growth at 75% YoY.

Consumer Preference and Growth Expectations

Consumers are opting for premium offerings due to easy and affordable financing options. IDC expects this trend to continue in the upcoming months in 2023, driving further growth in the market.

In 2Q23, 17 million 5G smartphones were shipped, with an ASP of USD 366, showing a 3% YoY decline. Samsung, vivo, and OnePlus led the 5G segment with a combined share of 54%. The highest shipped 5G models were Apple’s iPhone 13 and OnePlus’ Nord CE3 Lite.

Offline and Online Channel Performance

Overall shipments to the online channel dropped by 15% YoY, while the offline channel grew by 11%, capturing a 54% share. The drop in online shipments was intensified by lower shipment figures for online-heavy players such as Xiaomi and realme.

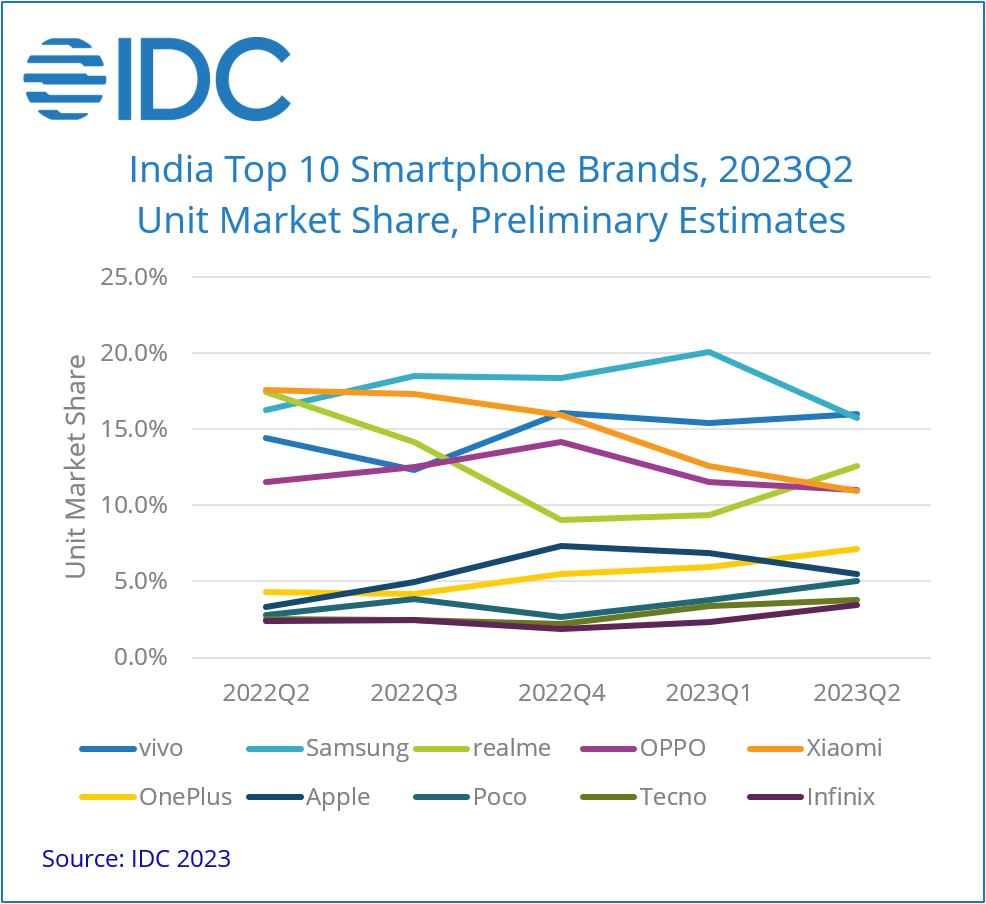

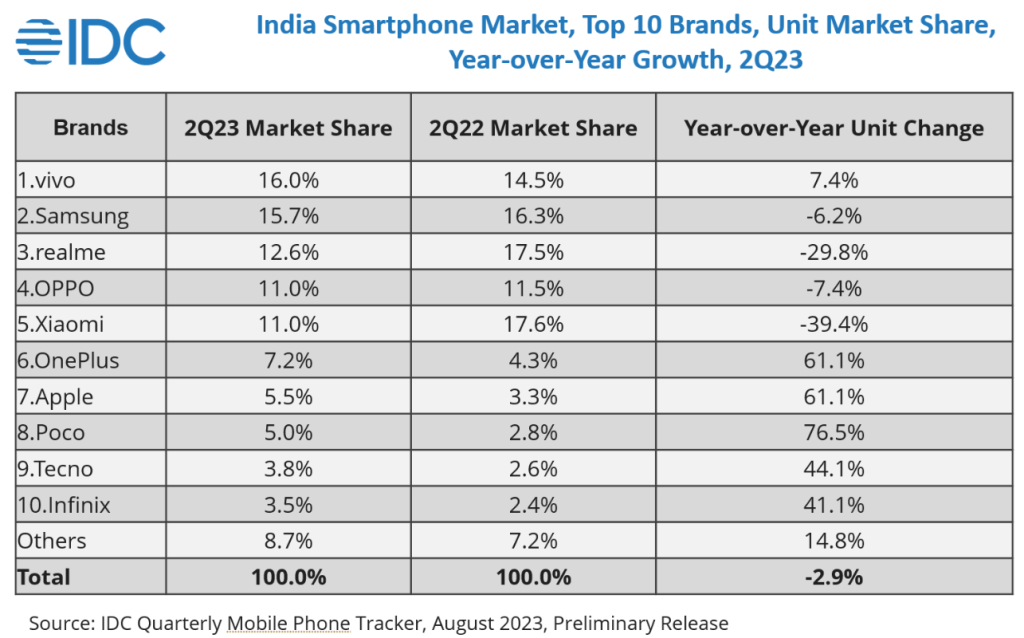

Brand Performance in 2Q23

Apple registered a massive 61% YoY growth with the highest ASP of USD 929. OnePlus also saw healthy growth of 61%, despite its ASP dropping by 14% YoY to USD 346.

POCO’s affordable C series models saw the highest growth among the top ten brands. vivo emerged as the market leader, driven by its V series models, closely followed by Samsung focusing on its higher-end portfolio.

Commenting on the report, Navkendar Singh, AVP – Devices Research, IDC, said:

During the festive season, brands will aim to boost consumer demand through affordable 5G releases, pre-order deals, and loyalty or upgrade programs combined with holiday discounts. Strong double-digit growth is needed in the coming months for the market to see annual growth in 2023, but this currently seems unlikely.