According to the recent data from the International Data Corporation (IDC) India Monthly Wearable Device Tracker, India’s wearable device market experienced remarkable growth in the first half of 2023, recording a robust 53.3% year-over-year increase. This growth followed an 80.9% YoY surge in the first quarter of the year.

The market witnessed a surge in smartwatch models featuring diverse designs and features, leading to an impressive 128.6% YoY growth, notably raising the smartwatch share from 26.8% to 40.0%; earwear also grew by 27.3% in the first half of the year.

Second Quarter 2023 Insights and Earwear Trends

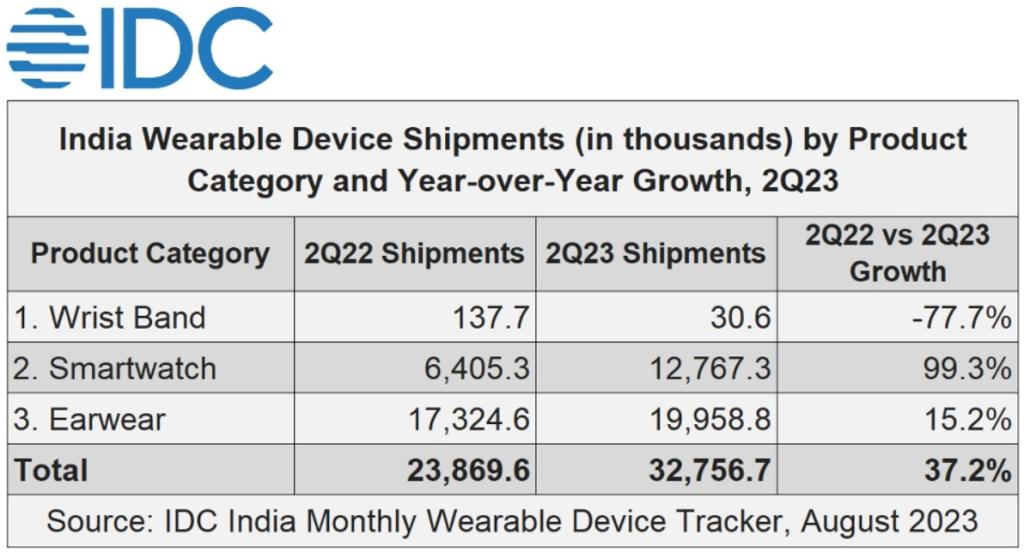

In Q2 2023, the wearable device market maintained its momentum, shipping 32.8 million units for a 37.2% YoY growth and a 30.6% QoQ increase. Notably, smartwatch shipments almost doubled, reaching 12.8 million units, while earwear shipments saw a 15.2% YoY growth. During this period, smartwatch ASP dropped by 44.9% to $25.6 from $46.6, leading to an overall wearable ASP decline from $26.7 to $21.0 YoY.

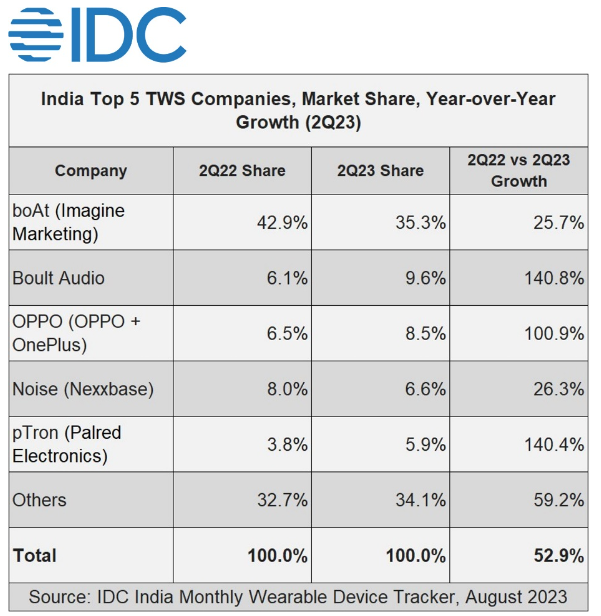

In the earwear category, True Wireless Stereo (TWS) earbuds captured a significant 65.5% share, growing remarkably by 52.9% YoY. Conversely, neckband earphones declined by -22.5% in Q2. The ASP for neckbands and TWS earbuds were $15.0 and $18.7, respectively, with declines of 6.4% and 15.3%.

Diverse Distribution Channels

Online channels, particularly e-tailers, remained a key driver of sales, accounting for 73.9% of the market share in the second quarter of 2023. However, prominent brands are now exploring offline avenues to expand their reach and presence, especially in Tier 3, 4, and 5 towns.

Affordable Models with Premium Features

Vikas Sharma, Senior Market Analyst at IDC India, notes that advanced features once limited to high-end products are now becoming accessible in affordable models.

These advancements encompass elements like advanced active noise cancellation (ANC), multiple microphones, minimal delay or low latency, simultaneous dual device connection, and advanced sound chipsets.

Top 5 Wearable Companies in Q2 2023

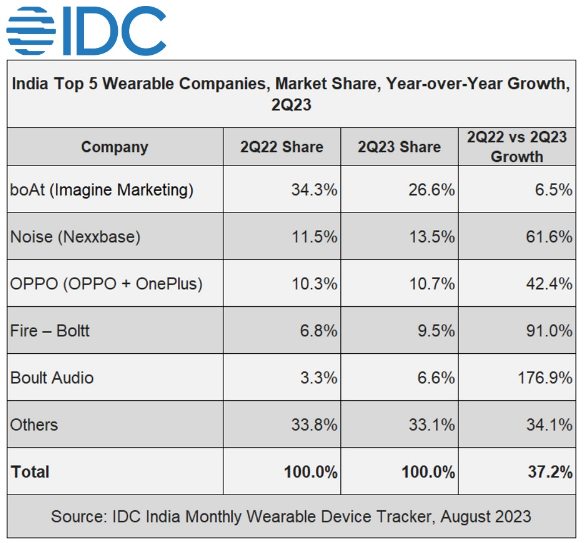

- boAt (Imagine Marketing): Retaining the lead with a 26.6% market share, boAt experienced a 6.5% YoY growth. Earwear constituted 77.7% of its Q2 shipments, while it also dominated the TWS sector with a 35.3% share.

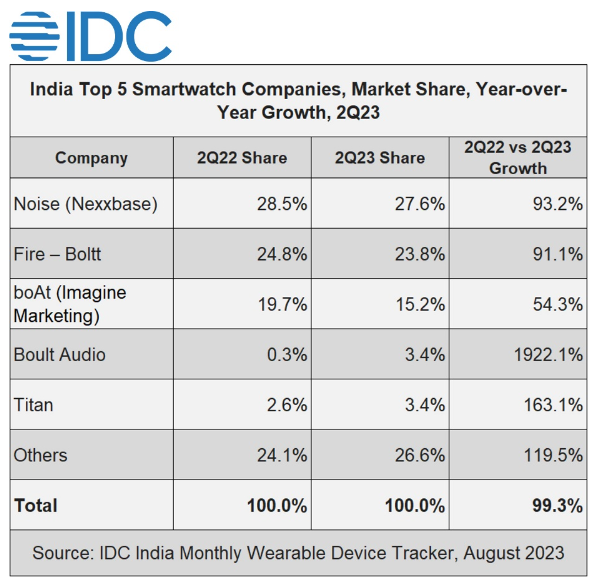

- Noise (Nexxbase): Securing the second position, Noise achieved a YoY growth of 61.6%, capturing 13.5% of the market share. It regained its top spot in the smartwatch segment with a 27.6% share.

- OPPO (OPPO + OnePlus): Holding the third position with a 10.7% share, OPPO witnessed a growth of 42.4% YoY. It also ranked third in the TWS segment and showcased a significant 100.9% YoY growth.

- Fire – Boltt: Claiming the fourth spot, Fire – Boltt achieved a YoY growth of 91.0%, commanding a 9.5% market share. It diversified its portfolio and attained the second position in the smartwatch category.

- Boult Audio: In fifth place, Boult Audio showcased impressive growth of 176.9% YoY, capturing a 6.6% market share. It retained the second position in the TWS category and secured fourth place in smartwatches.

Other Notable Players

- pTron (Palred Electronics) and Mivi (Seminole) held the fifth and sixth positions in the TWS category, with shares of 5.9% and 4.5%, respectively.

- Pebble (SRK Powertech) achieved the sixth position in smartwatches, with a 2.4% share and an impressive 247.5% YoY growth.

- Ambrane and Beat XP secured the seventh and eighth positions in the smartwatch category, respectively.

Commenting on the report, Upasana Joshi, Research Manager at IDC India, said:

In the first half of 2023, the smartwatch market saw a surge of new models with premium finishes, sporty designs, and a variety of strap options. The second half of the year will bring aggressive holiday promotions and discounts, while brands remain cautious about supplies. Additionally, we can expect more affordable smart ring launches.