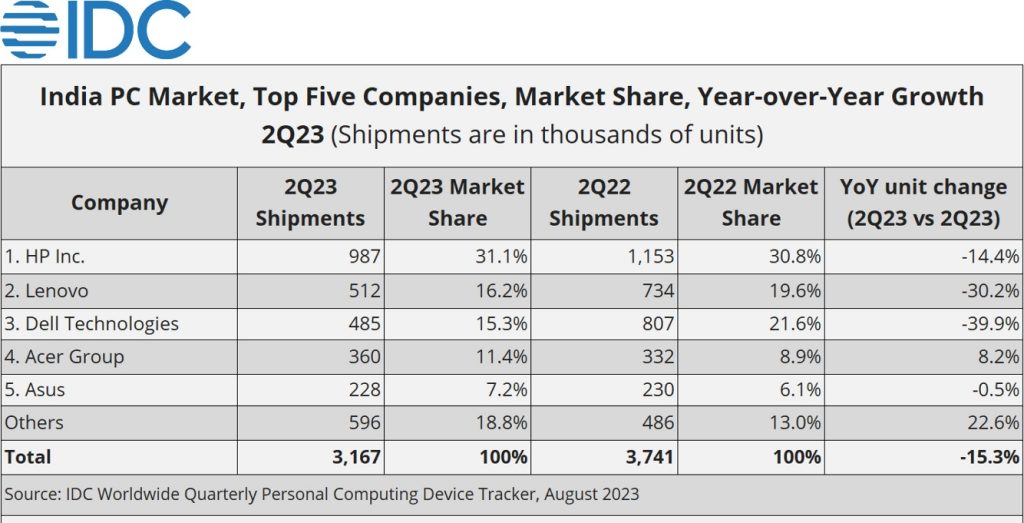

The traditional PC market in India, which includes desktops, notebooks, and workstations, dropped by 15.3% YoY in Q2 2023 to 3.2 million units, as per the latest IDC report.

The consumer category fell 17% year-on-year, while the commercial segment fell 13.8% year-on-year. HP, Lenovo, Dell, Acer, and ASUS were the top five manufacturers in the second quarter.

Most categories saw annual declines, led by notebooks falling 18.5%. Meanwhile, desktop shipments dipped 7% despite prior growth. Both consumer and commercial segments fell year-over-year as the enterprise sector continued struggling.

Despite overall declines, certain segments in the Indian PC market showed positive growth. Education segment rose over 40% aided by government initiatives in states like Madhya Pradesh and Gujarat. Government buying grew 8% following court orders as well.

HP has a 31.1% market share in both the consumer and commercial markets. Lenovo came in second place with a market share of 16.2%, despite a 30.2% YoY loss in Q2 2023. Dell Technologies stood third in the overall market with a 15.3% share. It held a stronger 19.1% share of the commercial segment but only 11% in the consumer space.

Acer secured fourth place with 11.4% market share, excelling in desktops, where it ranked second after HP. Leading commercial desktop sales with 29.8% share driven by government demand, Acer also witnessed strong consumer interest, achieving 8.2% YoY growth. ASUS held fifth position with 7.2% share, expanding offline channels successfully and performing well among consumers.

The future of the PC market holds uncertainty due to macroeconomic pressures. Government, education, enterprise, and consumer sentiment will shape the upcoming quarters. India’s PC industry faces challenges but shows potential in certain segments, offering glimpses of hope amid the uncertainty.

Regarding the shipments, Bharath Shenoy, Senior Market Analyst, IDC India said,

The India consumer PC segment has started showing signs of recovery as market sentiment is improving. Despite a YoY double-digit decline, it clocked a strong double-digit QoQ growth. PC vendors successfully ran college campaigns and got good traction. The improved performance of their e-tail channels has also provided much needed respite to the consumer segment.