Global smartphone sales dropped by 8% compared to the same time last year in Q3 2023. This marks the ninth straight quarter of decline, but there was a 2% growth compared to the previous quarter, according to research from Counterpoint’s Market Pulse service.

The drop in sales compared to last year was mainly due to slower consumer demand recovery. However, the growth in sales during the quarter, especially in September, despite having a week less for new iPhone sales, suggests better times ahead.

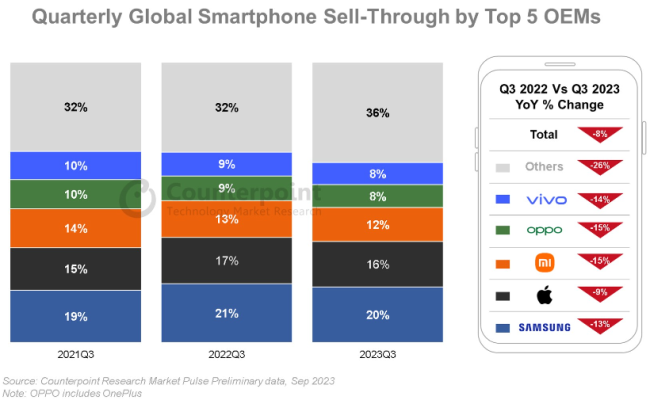

Global smartphone shipments Q3 2023: Top 5 OEMs

1. Samsung led the global market with a fifth of Q3 sales. The new foldable phones had mixed responses, with Flip 5 outselling its counterpart by nearly twice. Samsung’s A-series models dominated mid-price segments.

2. Apple took second place with a 16% market share, despite limited iPhone 15 availability, which was well-received.

3. Xiaomi, OPPO, and vivo rounded out the top five but saw year-over-year declines. They focused on strengthening their positions in China and India while scaling back expansion overseas.

4. HONOR, Huawei, and Transsion Group gained market share and experienced year-over-year growth in Q3. Huawei’s growth was driven by the Mate 60 series in China, and HONOR’s growth came from strong overseas performance.

5. Transsion brands expanded, benefiting from the MEA market recovery.

YoY Growth in MEA Region

MEA was the only region with year-over-year growth in Q3, thanks to improved macroeconomic indicators. Developed markets like North America, Western Europe, and South Korea experienced significant declines but are expected to rebound in Q4, largely due to the delayed iPhone launch.

Market Expectations for Q4 2023

Counterpoint anticipates continued momentum through year-end, driven by the iPhone 15 series’ full impact, the festive season in India, the 11.11 sales event in China, and end-of-year promotions. They foresee a halt in year-over-year declines in Q4 2023.

However, Counterpoint also predicts an overall market decline for the full year of 2023, reaching its lowest point in a decade. This shift is attributed to changing device replacement patterns, particularly in developed markets.

Counterpoint highlights the recovery of emerging markets and the growth of brands outside the top five as indicators of shifting dynamics and opportunities in the global smartphone market.