In the third quarter of 2023, worldwide smartphone shipments experienced a marginal 0.1% decline, totaling 302.8 million units, as per preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

Despite ongoing economic uncertainties, soft demand, inflation, and geopolitical tensions, some vendors are cautiously increasing their shipments, following a significant 7.8% YoY decline in global smartphone shipments in the previous quarter.

Apple’s Regional Performance in Q3 2023

Apple is experiencing growth in all regions except China, where it faces competition from Huawei and economic uncertainties that lead consumers to be more discerning in their purchasing decisions.

China’s Continued Decline

China saw a 6.3% YoY decline in smartphone shipments in 3Q23, marking the tenth consecutive quarter of decline. Factors such as youth unemployment, the real estate crisis, and deflation have significantly impacted consumer spending and the macroeconomic environment in China.

Regional Variation

Shipments in Europe, Japan, and the U.S. declined by 8.6%, 5.3%, and 1.1%, respectively. However, emerging markets like the Middle East and Africa, Latin America, and Asia/Pacific (excluding Japan and China) experienced shipment growth of 18.1%, 8.2%, and 1.3%, respectively.

Emerging Markets Show Promise

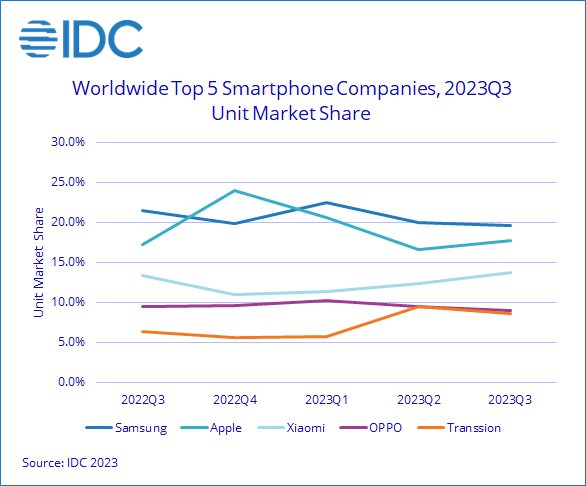

Nabila Popal, a research director at IDC’s Mobility and Consumer Device Trackers, noted a positive trend in emerging markets, with vendors like Xiaomi and Transsion ramping up their smartphone shipments.

While this indicates potential recovery, vendors must be mindful of managing inventory due to weak demand in several regions.

Commenting on the report, Anthony Scarsella, Research Director, Mobile Phones at IDC, said:

In the face of global economic challenges, the sustained growth in the high-end market may appear counterintuitive. However, this trend endures thanks to the availability of generous trade-in and financing options in many developed markets.

As consumers opt for premium models, the refresh cycle inevitably lengthens. Attributes such as superior build quality, expanded storage, premium features, and extended support cycles propel buyers towards the high-end segment, as these devices outlast most affordable alternatives.