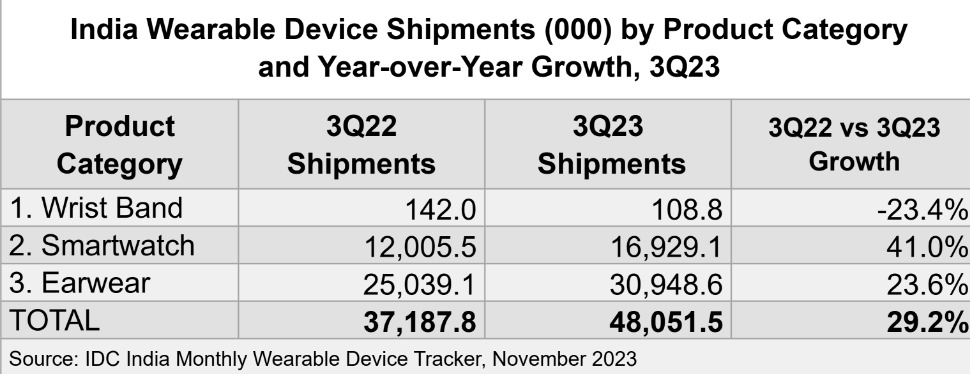

According to recent data from the International Data Corporation (IDC), India’s wearable market shipped a record 48.1 million units in Q3 2023, experiencing robust 29.2% year-over-year (YoY) growth. The market has shipped 105.9 million units in the first three quarters of 2023, surpassing the 100.1 million units shipped in 2022.

New model launches across price points and product categories fueled this momentum, with continuous innovation seen in smartwatches, earwear, and the emerging smart ring category. The overall average selling price (ASP) declined by 20.4% from USD 27.2 (Rs. 2,260 approx.) to USD 21.7 (Rs. 1,803 approx.).

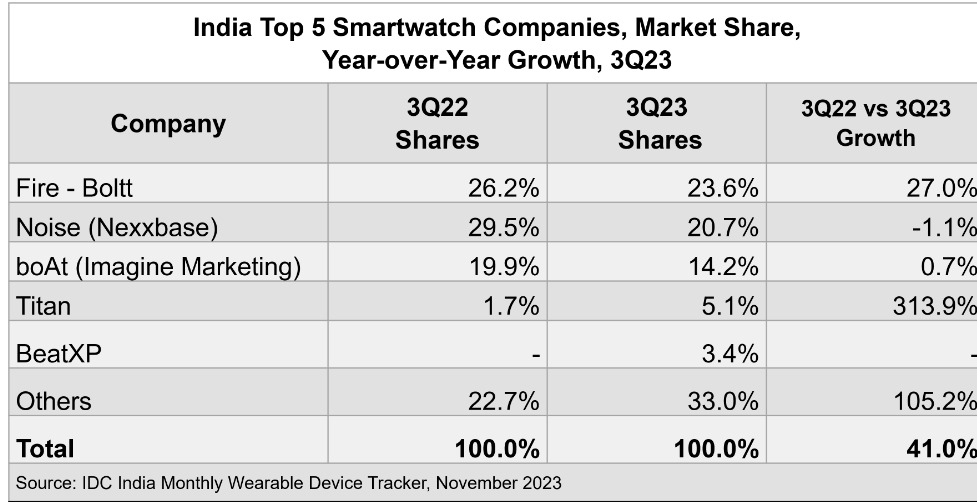

Smartwatches emerged as the fastest-growing category, reaching 16.9 million units with a 41.0% YoY growth. Heavy discounting and offers led to a 35.3% YoY drop in smartwatch ASPs to US$26.7 (Rs. 2,218 approx.) in Q3 2023. The ASPs grew QoQ by 4.3%, primarily due to an increased share of advanced smartwatches and the introduction of premium options.

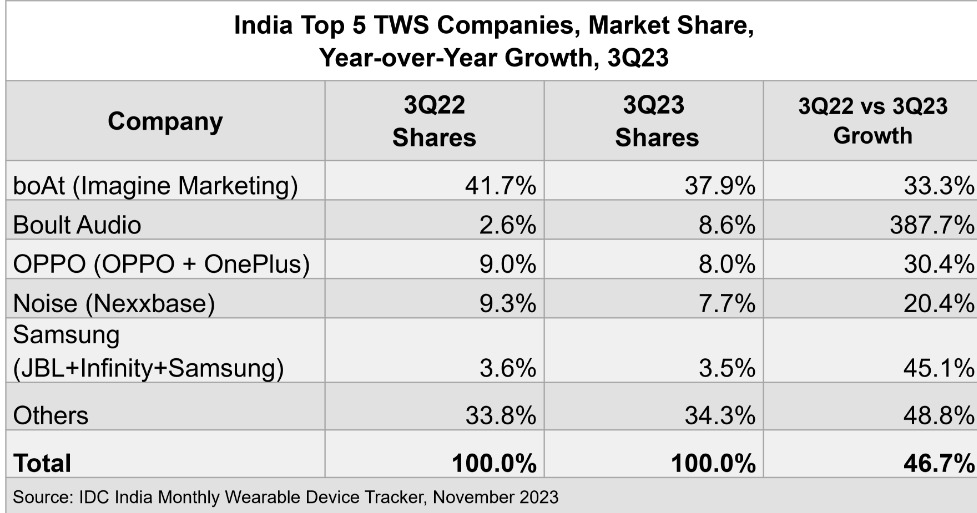

Earwear, although dropping in market share to 64.4%, saw a 23.6% YoY growth, shipping 30.9 million units. The Truly Wireless Stereo (TWS) segment dominated with a 68.4% share, growing by 46.7% YoY, while neckbands declined by 6.9% YoY. TWS and neckband ASPs stood at US$19.5 and US$14.2, with declines of 17.1% and 4.6% YoY, respectively.

Offline channels reached a record 31.5% share, growing by 58.3% YoY, underlining the importance of an omnichannel presence, especially in Tier 3/4 cities.

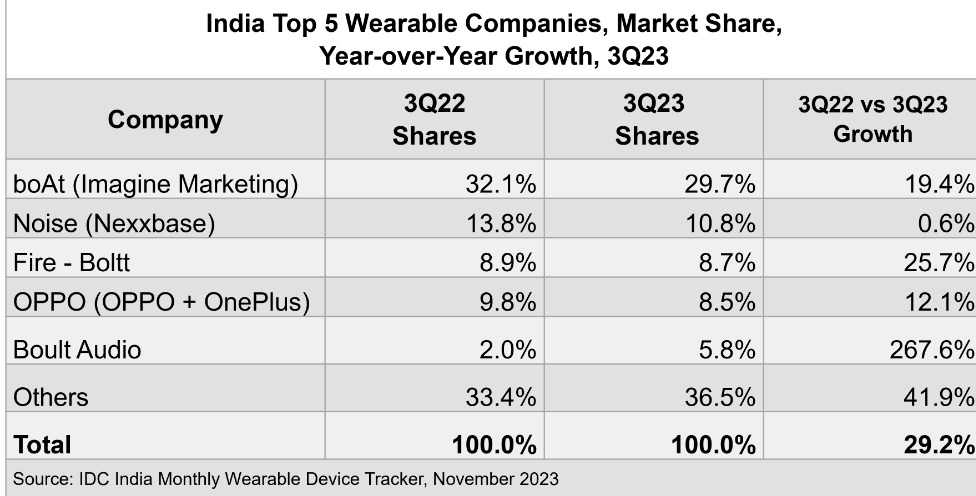

Top 5 Wearable Companies in Q3 2023:

- boAt (Imagine Marketing): Leading with a 29.7% share, boAt experienced a 19.4% growth in the overall wearable market. In TWS, it maintained leadership with a 37.9% share and a 33.3% YoY growth. It stood third in the smartwatch category with a 14.2% market share.

- Noise (Nexxbase): Securing the second position with a 10.8% share, Noise had a flat 0.6% YoY shipment growth. It dropped to the second position in the smartwatch category with a 20.7% market share and maintained its fourth position in the TWS segment at 7.7% share, growing by 20.4% YoY.

- Fire-Boltt: Claiming the third spot with an 8.7% share and a 25.7% YoY growth, Fire-Boltt reclaimed leadership in the smartwatch category with a 23.6% share, growing by 27.0% YoY.

- OPPO (OPPO + OnePlus): Holding the fourth position with an 8.5% share and a growth of 12.1% YoY, OPPO stood third in TWS with an 8.0% share, growing by 30.4% YoY.

- Boult Audio: Securing the fifth position with a 5.8% share and a remarkable 267.6% YoY growth, Boult Audio retained second place in the TWS category with an 8.6% share and 387.7% YoY growth.

Other notable players include Titan and BeatXP in the smartwatch category and Samsung and Mivi (Seminole) in the TWS category. Further, it is said that the smart ring category is gaining consumer interest due to its unique form factor and recent launches.

Commenting on the report, Vikas Sharma, Senior Market Analyst, Wearable Devices, IDC India said,

Brands have upped the game with high-end specifications at entry-level pricing. This combined with high-decibel marketing campaigns and promotions will drive 4Q23 shipments, resulting in strong double digit annual growth in 2023. In 2024, we will see an enhanced focus on localization of UI/UX, in-house app integration, SIM-based or standalone calling and Wi-Fi connectivity on basic smartwatches.