According to IDC, the traditional PC market in India, including desktops, notebooks, and workstations, reached 4.5 million units in 3Q23, marking a 14% YoY increase, following a decline of 15.3% YoY in Q2 2023. The notebook category grew by 13.1%, while desktops saw a 19.3% growth.

The commercial segment remained steady, while the consumer segment experienced a 26.3% YoY growth. The education sector, supported by the Gujarat education project, notably contributed to a 117.5% YoY growth in the education segment. E-tailers bounced back with a 26.4% YoY growth after four consecutive declines, gearing up for festival sales.

In the consumer segment, there was a notable uptick in 3Q23, following a challenging past year. In August, the Government of India announced a mandatory import licence requirement for PCs starting October 30th, later put on hold.

Vendors proactively shipped channel inventory to avoid potential supply shortages or price hikes, ensuring sufficient stock for festival season sales, according to Bharath Shenoy, Senior Research Analyst, IDC India.

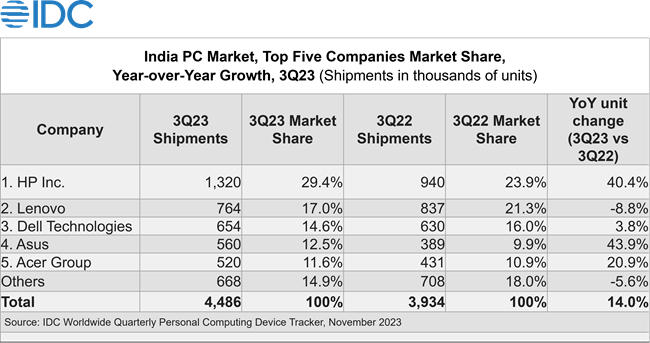

Top 5 Company Highlights Q3 2023 in India

HP: Led the market with a 29.4% share, dominating both commercial (34.3%) and consumer (25.9%) segments. Growth in education and government sectors contributed to a 33.5% YoY increase in the commercial segment.

Lenovo: Secured the second position with a 17% share, experiencing an 8.8% YoY decline in shipments. It outpaced Dell in the commercial segment (21%) but trailed behind Asus in the consumer segment. Lenovo performed well in the desktop category with a 32.5% YoY growth.

Dell Technologies: Claimed the third spot with a 14.6% share, witnessing a 3.8% YoY growth. It closely followed Lenovo in the commercial segment (20.8%) and achieved a significant 68.5% YoY growth in the consumer segment.

ASUS: Surpassed Acer to secure the fourth position with a 12.5% share. ASUS had its best-ever consumer quarter, shipping over 500k units. The consumer segment grew by 42.9% YoY, and the commercial segment saw a substantial 69.9% YoY growth.

Acer Group: Dropped to fifth place with an 11.6% share, despite a strong YoY growth of 20.9%. The commercial segment declined by 6.7% YoY, but the consumer segment showed remarkable growth of 75.7% YoY, driven by increased stock on online channels.

Commenting on the outlook, Navkendar Singh, Associate Vice President, Devices Research, IDC India, South Asia & ANZ said:

In recent months, there has been a significant channel push in the consumer segment and, to some extent, in the SME segment within the PC market. Vendors are currently emphasizing the augmentation of their local assembly mix, anticipating a preference for locally assembled devices in government and education projects. While this shift may further stimulate growth in the government and education segments, the lack of enterprise orders is worrisome, given expectations of a decline exceeding 20% YoY in the enterprise segment for 2023.