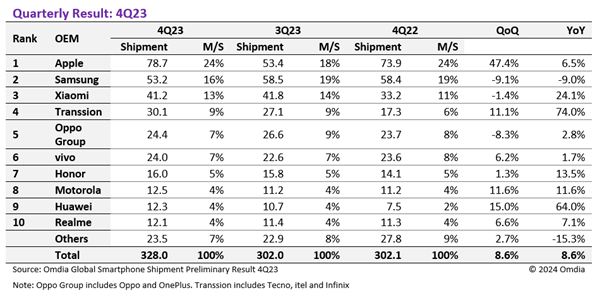

Global smartphone shipments in the fourth quarter of 2023 reached 328 million units, marking an 8.6% increase from 4Q22, reports research firm Omdia.

This growth, the first significant upturn since 2Q21, concludes nine consecutive quarters of year-on-year declines in overall smartphone shipments.

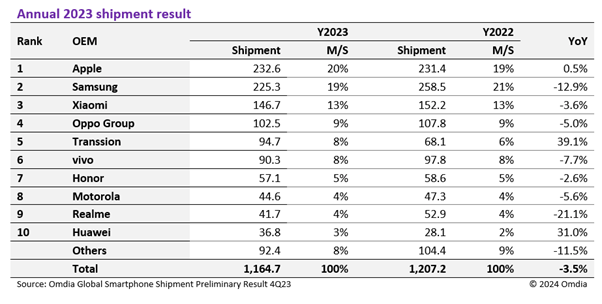

After grappling with challenges like supply chain disruptions in 2022, the smartphone industry appears to be stabilizing. Despite the positive growth, overall shipments for 2023 fell by 3.5% compared to 2022, signaling a cautious recovery.

Key Players of 2023

Apple: In Q4 2023, Apple dominated with a record-high shipment of 78.7 million units, a 6.5% increase from the previous year, driven by the iPhone 15 series.

Samsung: Contrary to the industry trend, Samsung faced a 9% fall in shipments in Q4 2023. Global economic challenges, particularly affecting mid and low-end phones, may have contributed to this decline.

Xiaomi: Xiaomi maintained its position as the third-largest OEM globally, showing signs of recovery with 41.2 million unit shipments in Q4 2023, a 24.1% increase from Q4 2022.

Transsion brand: Transsion Holding emerged as the fourth-largest OEM in Q4 2023, surpassing both vivo and OPPO, with a remarkable 74% increase in shipments from Q4 2022.

OEM’s Shuffling Positions and Growth Challenges

OPPO and vivo: OPPO, despite an 8.3% fall in Q4 2023 with 24.4 million shipments, is gradually recovering from a decline in 2022. Vivo recorded a 6.2% increase with 24.0 million units, signaling a slow recovery in its shipment figures.

HONOR: HONOR demonstrated a steady performance with a marginal increase of 1.3% in Q4 2023, maintaining its cumulative shipments better than other major OEMs for the year, recorded 16.0 million unit shipments.

Motorola: Motorola rose from 9th to 8th, recording 12.5 million units, an 11.6% increase both quarter-on-quarter and year-on-year.

HUAWEI: HUAWEI climbed from 10th to 9th, with a 15% increase from Q3 2023 and a massive 64% increase from Q4 2022.

realme: realme fell from 8th to 10th, recording 12.1 million units in Q4 2023, witnessing the worst decline throughout 2023.

Predictions for 2024

The smartphone market is expected to return to growth in 2024; however, Omdia predicts potential challenges leading to negative growth in the second half of the year.

Economic recovery delays, geopolitical instability, and the growing used phone market are factors contributing to this uncertainty.

Commenting on the report, Zaker Li, Omdia Principal Analyst, said:

The notable success of Transsion Holding in 2023 can be attributed to several key factors: first, effectively resolving inventory challenges ahead of the industry; second, addressing consumer downgrading resulting from global inflation, with Transsion Holding’s products aligning seamlessly with current market demands; and third, the implementation of a proactive market expansion strategy throughout 2023, creating favorable shipping conditions.

Speaking about market dynamics, Jusy Hong, Senior Research Manager, Omdia, said:

The dynamics of the smartphone industry in 2023 were shaped by the specific product focuses and regional markets of each brand. Apple, with its emphasis on the premium market, demonstrated resilient performance amid an overall decline in market demand.

Conversely, major Chinese OEMs, heavily concentrated in the Chinese and Indian markets, experienced a notable decrease in performance compared to the previous year due to the downturn in smartphone demand in these regions.

Samsung, known for its substantial share in low- to mid-priced smartphones, faced a significant dip in shipments. The economic recession across regions impacted its sales of mid- to low-priced smartphones, ultimately leading to conceding the top position to Apple.