In the year 2023, the wearable market in India experienced significant growth, according to the International Data Corporation’s (IDC) India Monthly Wearable Device Tracker.

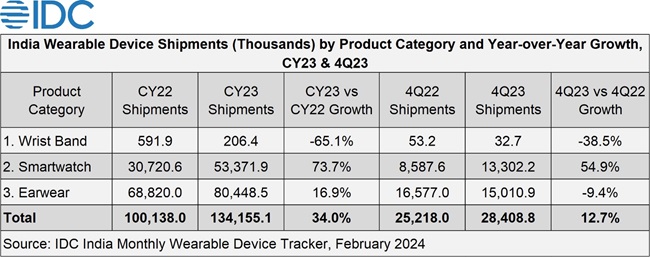

The market expanded by 34%, reaching a milestone of 134.2 million units. During the fourth quarter of 2023 (October-December), there were 28.4 million units shipped, marking a 12.7% increase compared to the previous year.

Shifts in Consumer Behavior

Despite numerous new product launches and promotional activities during festive seasons, there was an excess of inventory throughout the latter half of 2023.

This surplus led to a decline in the average selling price (ASP) of wearables by 15.4%, dropping from US$25.0 to US$21.2 in the fourth quarter.

Key Highlights of 2023: Indian Wearable Market

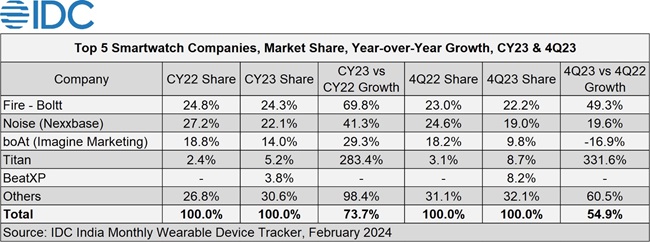

Smartwatch Growth: Smartwatch shipments surged by 73.7% year-over-year, totaling 53.4 million units.

Their market share rose from 30.7% in 2022 to 39.8% in 2023. However, despite heavy discounts during festive seasons, the average selling price dropped by 38.7%.

Earwear Category: The earwear category experienced a modest growth of 16.9% year-over-year, reaching 80.4 million units.

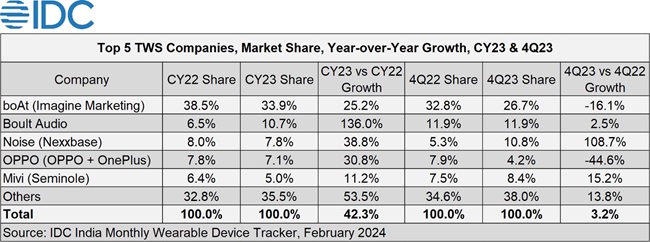

The Truly Wireless Stereo (TWS) segment saw a significant increase in market share, reaching 67.3%, while neckband shipments declined by 15.2%.

Top Vendors Indian Wearable Market

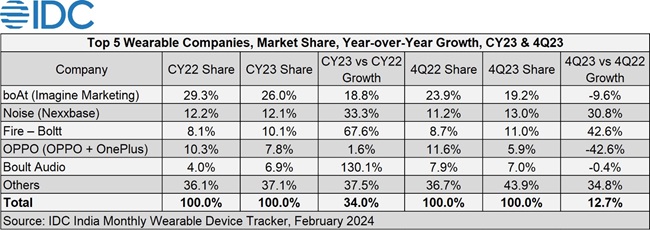

Leading vendors such as boAt, Noise, and Fire-Bolt maintained their positions in the market through diversified product ranges and continuous innovation.

Boult Audio witnessed the highest year-over-year growth among the top five vendors. A newcomer, BeatXP, made its mark in the smartwatch category with aggressive online marketing strategies.

Distribution Channels

Shipments through offline channels outpaced online channels, with a 55.6% year-over-year growth.

The share of offline channels increased to 31.0% in 2023 from 26.7% in 2022, registering a 55.6% year-over-year growth.

IDC Outlook for 2024

Looking ahead, IDC’s Vikas Sharma, Senior Market Analyst, Wearable Devices, predicts single-digit growth for wearables in 2024. Vendors are expected to focus on expanding their omnichannel strategies to tap into untapped markets, particularly in Tier 3 cities and beyond.

Additionally, advancements such as LTE SIM/eSIM connectivity and advanced health sensors are anticipated in smartwatches, while earwear is expected to offer premium features like Active Noise Cancellation (ANC) at more affordable prices.

Commenting on the market dynamics, Anand Priya Singh, Market Analyst, Wearable Devices, IDC India, said:

Affordability, low product penetration, and a plethora of options have fueled a significant rise in the demand for smartwatches. However, the increasing preference for non-branded watches is posing a challenge to established brands.

These non-branded alternatives offer inexpensive versions of popular models and often come bundled with multiple watch straps. This trend dilutes the initial user experience, underscoring the need for established vendors to explore alternative strategies to engage first-time users effectively.