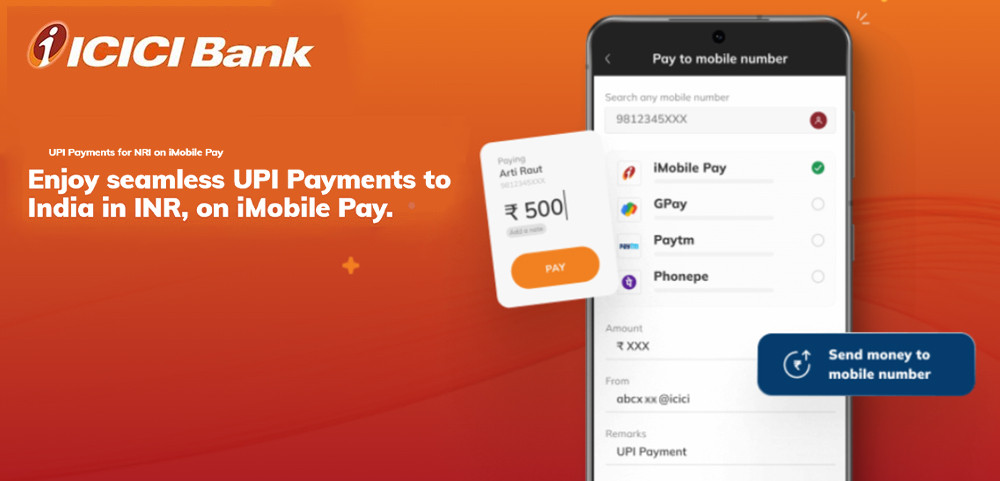

ICICI Bank has announced that now NRIs can use their international mobile numbers to instantly make UPI payments in India. This makes it much easier for them to handle everyday payments.

They can pay bills, go shopping, and more using their international mobile numbers linked to their NRE/NRO bank accounts with ICICI Bank. This service is provided through the iMobile Pay app. Before this, NRIs had to register an Indian mobile number to make UPI payments.

To make this happen, ICICI Bank used the international infrastructure set up by the National Payments Corporation of India (NPCI) for UPI across different countries.

The daily transaction limit for UPI is INR 1,00,000. For new UPI/VPA ID registrations, the limit is INR 5,000 for the first 24 hours and then resets to INR 1,00,000. UPI transactions are only available in Indian Rupees (INR).

Currently, there are no charges for NRIs using UPI, but this might change according to NPCI guidelines, as stated by ICICI Bank.

Steps to activate UPI on an international mobile number using iMobile Pay:

1. Log in to the iMobile Pay app.

2. Click on ‘UPI Payments’.

3. Verify your mobile number.

4. Click on ‘Manage’ → ‘My Profile’.

5. Create a new UPI ID (choose from the suggested options).

6. Select the Account Number and submit.

Availability

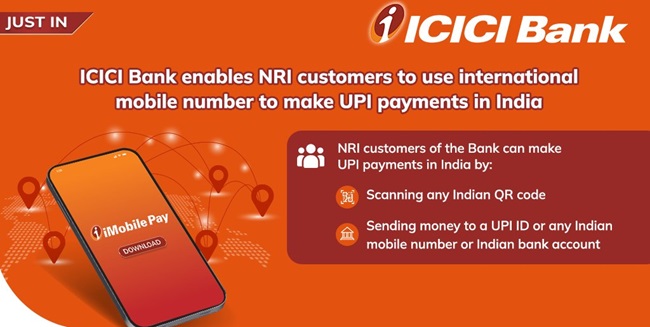

NRIs in 10 countries, including the USA, UK, UAE, Canada, Singapore, Australia, Hong Kong, Oman, Qatar, and Saudi Arabia, can make UPI payments by scanning QR codes or sending money to UPI IDs, Indian mobile numbers, or bank accounts.

Commenting on the initiative, Sidharatha Mishra, Head – Digital Channels and Partnerships, ICICI Bank, said,

We are thrilled to collaborate with NPCI in introducing the UPI feature on international mobile numbers via iMobile Pay. This advancement eliminates the necessity for our NRI customers residing in 10 countries to switch to an Indian mobile number for UPI payments.

This launch underscores our dedication to furnishing innovative solutions to our NRI customers, ensuring a secure, seamless payment experience. We have received encouraging feedback from our NRI customers who have adopted this feature. Through this initiative, we aim to harness NPCI’s UPI Infrastructure to fortify and revolutionize the digital payments landscape globally.