The Indian smartphone market shipped 34 million smartphones, marking an 11.5% YoY growth, according to the International Data Corporation (IDC)’s Worldwide Quarterly Mobile Phone Tracker.

This growth trend has persisted for three consecutive quarters. In Q4 2023, shipments saw a 25% YoY increase.

New Launches and Promotional Activities

Numerous launches across various price ranges occurred in the quarter, alongside increased promotions, especially for premium offerings. Brands focused on microfinancing schemes to enhance affordability.

eTailers organized sales events, offering discounts on models nearing end-of-life, driving demand and reducing inventory, according to Upasana Joshi, Senior Research Manager, IDC India.

Key Highlights for 1Q24

Smartphone Average Selling Prices (ASPs) remained unchanged year-over-year and quarter-over-quarter at US$263, ending a trend of consistent ASP growth over several quarters.

Segment-wise Analysis

Entry-Level Segment (Sub-US$100)

- Declined by 14% year-over-year, capturing a 15% market share, down from 20% a year ago.

- Xiaomi led this segment, followed by POCO and itel.

Mass Budget Segment (US$100<US$200)

- Witnessed a 22% year-over-year growth, reaching a 48% market share, up from 44% a year ago.

- The top three brands were vivo, Xiaomi, and Samsung, collectively holding 53% of this segment.

Entry-Premium Segment (US$200<US$400)

- Expanded to a 23% market share, growing by 25% year-over-year.

- OPPO and realme gained significant shares, accounting for nearly 30% of this segment.

Mid-Premium Segment (US$400<US$600)

- Experienced a 46% decline in unit terms, representing a 3% market share, down from 6% a year ago.

- OnePlus led this segment with a 38% share, followed by vivo and OPPO.

Premium Segment (US$600<US$800)

- Held a 2% market share and witnessed a 21% decline in unit terms.

- Key models included the iPhone 13, Galaxy S23FE/S23, iPhone 12, and OnePlus12.

- Apple’s share declined year-over-year to 45%, while Samsung increased its share to 44%, up from 16% a year ago.

Super-Premium Segment (US$800+)

- Recorded the highest growth at 44%, increasing its share from 7% to 9%.

- The iPhone14/15/14 Plus/15 Plus dominated this segment with a 64% share, followed by the Galaxy S24/S24 Ultra/S23/S24+ with a 25% share.

- Apple led the segment with a 69% share, followed by Samsung at 31%.

5G Smartphone Trends

Out of the total shipments, 23 million were 5G smartphones, constituting 69% of the market. This reflects a significant rise from 46% in 1Q23.

- The average selling price (ASP) of 5G smartphones decreased by 21% YoY to US$337 in 1Q24.

- Within the 5G category, the mass budget segment (US$100<US$200) observed a threefold growth, capturing a 46% market share.

- Top shipped 5G models included Xiaomi’s Redmi 13C, vivo’s T2x, Samsung’s Galaxy A15, vivo’s Y28, and Apple’s iPhone 14.

Online Channel Growth

- Shipments through online channels grew by 16% YoY, constituting 51% of total shipments in 1Q24.

- POCO, vivo, and Motorola experienced significant YoY growth, surpassing 65% in the online channel.

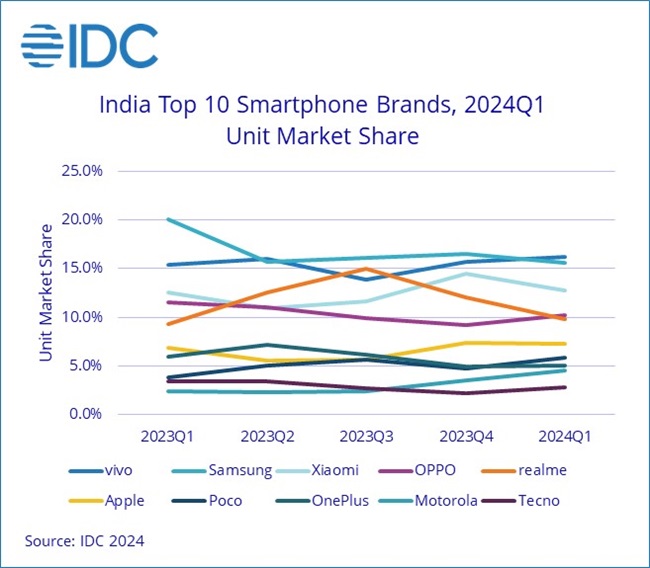

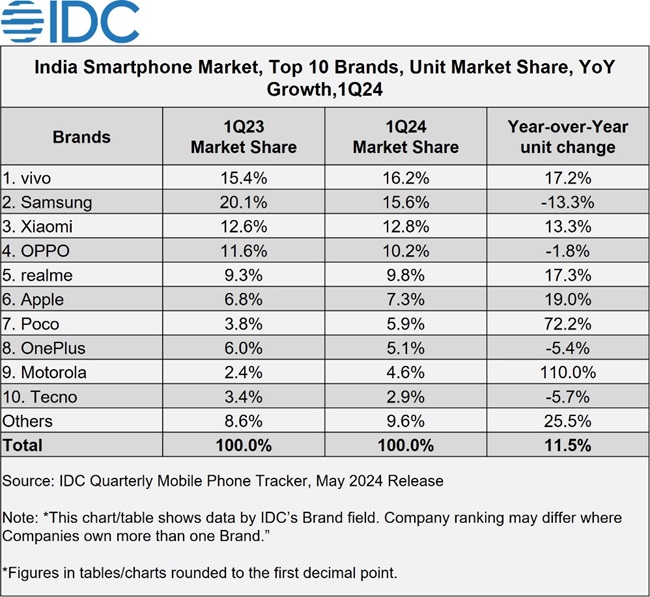

Brand Performance

- POCO exhibited remarkable YoY growth of 72.2% in Q1 2024, securing a 5.9% market share and surpassing OnePlus in shipments.

- vivo emerged as the leading brand, overtaking Samsung, with a diverse product portfolio across price segments and distribution channels.

- Motorola registered the highest growth among the top 10 brands, primarily driven by affordable launches.

- Apple witnessed a 19% YoY growth in shipments, with iPhone 14/15 constituting 56% of total shipments.

Outlook and Challenges

The smartphone market in India has gained momentum in the first few months of the year. However, the second half will be crucial.

- IDC predicts a modest annual growth in the mid-single digits for 2024.

- Challenges persist in attracting first-time smartphone users and mitigating the impact of the second-hand market.

The market’s concentration among top brands is weakening, with smaller brands and sub-brands gaining volume, as stated by Navkendar Singh, Associate Vice President, Devices Research, IDC.

Commenting on the brand’s performance growth in Q1 2024, Himanshu Tandon, Country Head of POCO India, said,

POCO’s significant advancement underscores our steadfast commitment to innovation and our thorough comprehension of our consumers’ requirements. Moving ahead, our resolve to sustain this momentum and establish fresh standards in the industry is stronger than ever. This achievement is indebted to the immense support and affection from our POCO community. We are optimistic about the potential that 2024 holds for us.