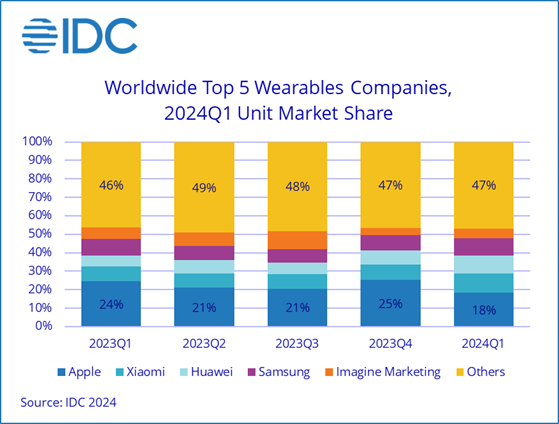

The wearables market started 2024 strong, with global shipments increasing by 8.8% year over year in the first quarter to reach 113.1 million units, according to the IDC Worldwide Quarterly Wearable Device Tracker.

Despite this growth, average selling prices (ASPs) have dropped for the fifth consecutive quarter, falling 11% in Q1 2024. This decline is due to the rising prominence of emerging markets and economic pressures reducing consumer spending.

Company Performance Q1 2024

Apple

Apple retained its leading position in the market but faced challenges due to poor macroeconomic conditions, a temporary ban on some watch models, and the absence of new AirPods.

Apple Watch shipments decreased by 19.1% year over year, and hearables, including AirPods and Beats, fell by 18.8% in the same period.

Xiaomi

Xiaomi ranked second, experiencing a 43.4% year-over-year growth. This growth was partly due to a low comparison base from a 16% decline in Q1 2023.

Xiaomi’s affordable products appealed to users, and its re-entry into Wear OS watches helped it become the third-largest vendor in the Google ecosystem, boosting its overall smartwatch ASPs.

HUAWEI

HUAWEI moved into the third spot, overtaking Samsung. The revival of its smartphone business positively impacted its wearables through bundling.

However, Huawei’s sales remain heavily concentrated in China, accounting for about 75% of its sales.

Samsung

Samsung dropped to fourth place. The launch of the Galaxy Fit 3 and success with lower-priced hearables contributed to its growth, despite a 5.1% decline in its core smartwatch volume during the quarter.

Imagine Marketing (boAt)

Imagine Marketing, known for its budget-friendly boAt products, completed the top five.

The Indian brand saw a 17.5% increase in hearables volume, but its smartwatch sales plummeted by 61.3% due to intense local competition.

Market Insights

According to Jitesh Ubrani, research manager at IDC, the lack of significant innovation in the premium segment has allowed tier-2 brands to close the gap.

Until new sensors or algorithms enable advanced health tracking features like blood pressure or glucose monitoring, consumers will likely prefer mid-range and value-priced options. This trend has driven brands to diversify their pricing strategies.

Ramon T. Llamas, research director at IDC, emphasized the importance of smaller, regional vendors. He noted that the demand for wearables in emerging markets remains high, but premium brand prices are often prohibitive.

This has created opportunities for local brands to offer affordable, feature-rich devices, helping companies like Xiaomi and Imagine Marketing secure top positions globally.