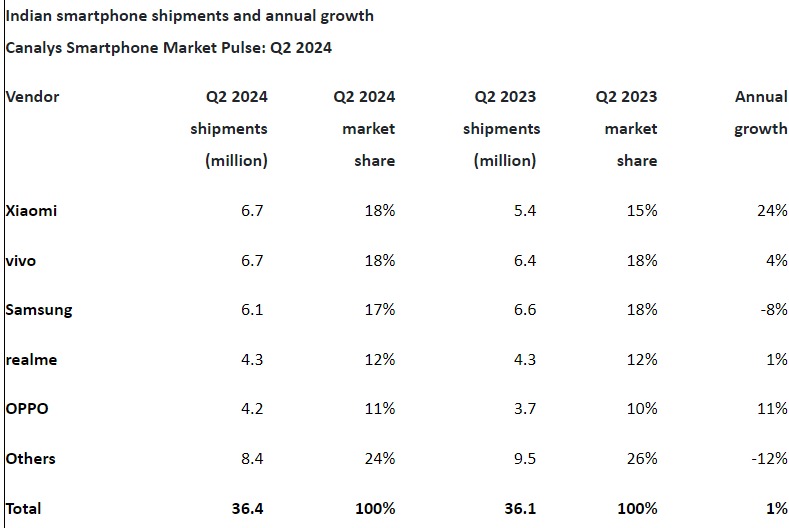

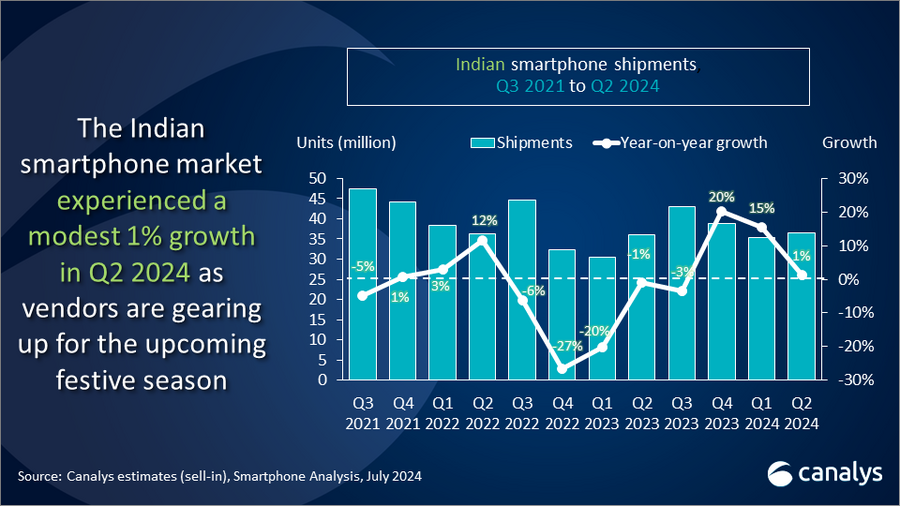

The Indian smartphone market shipped 36.4 million smartphones, marking just 1% growth in Q2 2024, according to a Canalys research report. Interestingly, Xiaomi reclaimed its position as the top Indian smartphone brand after 6 quarters, capturing an 18% market share with 6.7 million units shipped.

According to research, most brands focused on improving the mid-to-high-end portfolios of their products, while others concentrated on reducing existing stocks to optimize inventory ahead of the festival season.

Indian Smartphone Market Q2 2024

vivo secured the second position in the market, shipping around 6.7 million units, closely following Xiaomi. This success is attributed to V-series devices and the Y200 Pro. Samsung stood third with 6.1 million units shipped, followed by realme and Oppo (excluding OnePlus), with 4.3 million and 4.2 million units shipped, respectively.

The research further highlights the market’s challenging situation such as fluctuating demand in the mass-market segment, slow migration from feature phones to smartphones, and increasing adoption of second-hand smartphones.

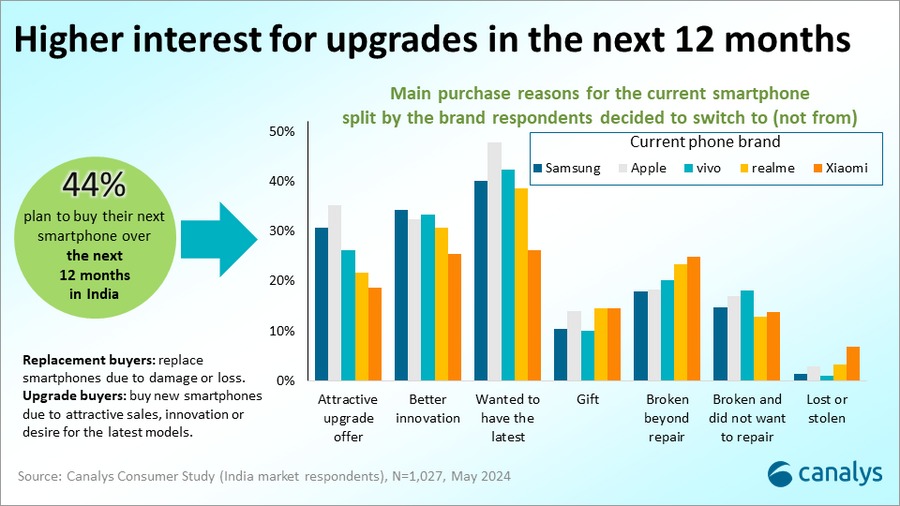

The firm also conducted a consumer study revealing that 44% of consumers expect to purchase a device within the next 12 months, with a significant majority being ‘upgrade buyers’ focused on the latest innovations, including 5G advancements.

So it’s high time brands start to focus on innovation in their product line-ups, introducing technologies such as GenAI, and building ecosystems to strengthen growth further.

Regarding the matter, Sanyam Chaurasia, Senior Analyst at Canalys said,

In Q2 2024, top mass-market brands expanded their mid-high-end portfolios and shall use early monsoon sales to clear inventory, making space for new models ahead of the festive season. Brands such as Xiaomi boosted their mid-to-high-end product lineup, driving volumes for the quarter with the Redmi Note 13 Pro series featuring refreshed color offerings and the newly launched Xiaomi 14 Civi with its camera quality and distinctive leather design. Meanwhile, vivo’s success in the mid-range market was driven by the V-series and Y200 Pro, focusing on refined design and camera features, along with increased push through LFR retail stores. realme has also expanded its mid-premium portfolio with the GT 6T and Number series models and plans to clear elevated inventory during the monsoon e-commerce sales.

Regarding a recent Canalys consumer study, Chaurasia added:

While 5G device upgrades continue to fuel growth in 2024, vendors will increasingly emphasize ‘brand experience’ across products and channels for long-term gains. A recent Canalys consumer study revealed that 44% of the consumers expect to purchase a device within the next 12 months, with a significant majority being ‘upgrade buyers’ focused on the latest innovations, including 5G advancements. Canalys anticipates mid-single-digit growth in both the upcoming festive season and overall shipments this year. In the study, young Indian consumers showcased very high openness toward new brands and innovation drivers such as GenAI. In the long term, brands should prioritize enhancing device experiences through GenAI features, ecosystem integration and innovative form factors to capture these consumers’ interests. Notably, delivering such brand experience through retail stores will be crucial for building brand competitiveness.