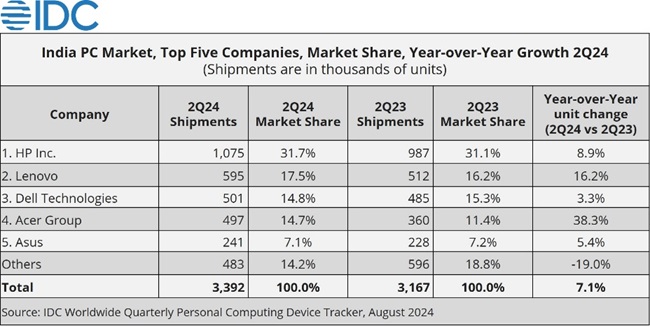

India’s traditional PC market, which includes desktops, notebooks, and workstations, shipped 3.39 million units in the second quarter of 2024, showing a 7.1% year-over-year (YoY) increase, according to the IDC.

Growth was seen across all three categories: desktops grew by 5.9% YoY, notebooks by 7.4% YoY, and workstations by 12.4% YoY.

Segment Performance

- Consumer Segment: The consumer segment experienced an 11.2% YoY increase, with strong demand across both online and offline channels. Notably, the e-tail channel grew by 22.4% YoY.

- Commercial Segment: The commercial segment rose by 3.5% YoY, driven by a 12.4% YoY increase in the Small and Medium Business (SMB) segment and a significant 33.1% YoY growth in the Large Business (LB) segment.

Bharath Shenoy, Research Manager at IDC India & South Asia, noted that this is the fourth consecutive quarter of YoY growth for the consumer segment.

He pointed out that vendors launched back-to-school campaigns and prepared for Independence Day sales, which led to strong demand and higher consumer PC shipments, particularly in the e-tail channel during online sales.

Top 5 Companies in Q2 2024

HP: HP led the market in both the commercial and consumer segments, holding market shares of 33.5% and 29.7%, respectively. The company also dominated the notebook category with a 34.4% share, driven by high consumer demand and key enterprise orders.

Lenovo: Lenovo ranked second, with a 32.7% YoY increase in consumer segment shipments and a 6.3% YoY growth in the commercial segment. The company’s strong performance in the SMB segment, which grew by 16.5% YoY, was supported by strong demand in the e-tail channel and a diverse range of AMD-powered devices.

Dell Technologies: Dell came in third, despite a 15.9% YoY decline in the commercial desktop category due to pricing pressures in government and enterprise orders. However, Dell saw a 6.4% YoY growth in the consumer segment, helped by successful back-to-school campaigns and strong offline channel performance.

Acer Group: Acer recorded a 38.3% YoY growth, securing the fourth position overall. It led the desktop category with a 27.6% market share, thanks to key government and BFSI (Banking, Financial Services, and Insurance) orders. Acer’s aggressive strategy during e-tail sales also strengthened its position in the consumer segment.

ASUS: ASUS placed fifth, with a 5.4% YoY growth. Despite a lower base, Asus saw a significant 131.7% YoY increase in the commercial segment, driven by a stronger focus on this area and continued expansion of its offline presence.

Market Outlook

Navkendar Singh, Associate Vice President of Devices Research at IDC India, South Asia & ANZ, highlighted the positive impact of recent AI PC launches on market sentiment.

He noted that while AI PCs may not immediately boost consumer demand, they could attract gamers and content creators in the medium term and are expected to drive commercial refresh orders starting in the third quarter of 2024.