One 97 Communications Limited (OCL), the parent company of Paytm, has announced the sale of its entertainment ticketing business to Zomato Limited for Rs. 2,048 crores on a cash-free, debt-free basis.

This move highlights Paytm’s strategic shift towards its core payments and financial services operations.

Paytm’s Transaction Details

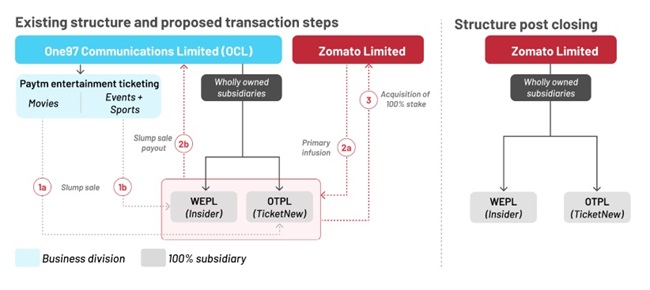

Business Transfer: OCL will move its ticketing business to its subsidiaries, Orbgen Technologies Pvt Ltd (OTPL) and Wasteland Entertainment Pvt Ltd (WEPL).

Sale of Stake: Zomato will acquire a 100% stake in OTPL and WEPL, which operate the TicketNew and Insider platforms. The deal also includes approximately 280 employees from the ticketing business.

Adjustments: The final transaction value will be adjusted based on cash and net working capital at closing. The deal is subject to meeting specific conditions.

Impact and Transition

Focus on Core Areas: With the sale, Paytm will concentrate on its core areas of payments and financial services. The company is expanding its services in insurance, equity broking, and wealth management.

Ticket Availability: During the transition period of up to 12 months, tickets for movies and events will remain available on the Paytm app, as well as on TicketNew and Insider platforms.

Historical Investment: Paytm acquired TicketNew and Insider for Rs. 268 crores between 2017 and 2018 and invested further to expand the business. In FY24, the ticketing business reported Rs. 297 crores in revenue and Rs. 29 crores in adjusted EBITDA.

Zomato’s Acquisition Details

Business Scope, Financials and Deal Structure

As mentioned above, Zomato’s acquisition of Paytm’s ticketing operations, including TicketNew and Insider, involves FY24 revenues of Rs. 297 crores and a GOV of Rs. 2,000+ crores with a 1.5% EBITDA margin.

The ticketing business will be transferred to OTPL and WEPL, which Zomato will fully own after funding the purchase.

Executive Insights

Akshant Goyal, CFO of Zomato: The acquisition is valued at approximately a 1.0x trailing Enterprise Value/FY24 GOV multiple. KPMG confirmed the fair valuation, and Kotak Mahindra Capital Co. Ltd. provided a fairness opinion. The business’s asset-light profile aligns with Zomato’s balance sheet.

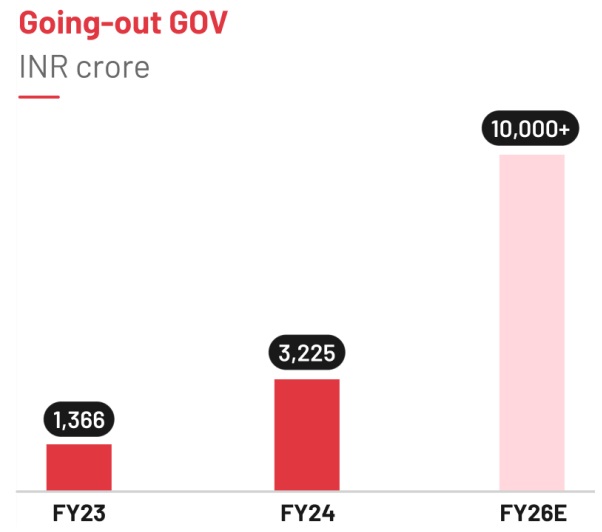

Deepinder Goyal, Founder, MD & CEO of Zomato: He highlighted that the acquisition aligns with Zomato’s strategy to strengthen its “going-out” segment, encompassing dining and event ticketing, which achieved a Gross Order Value (GOV) of Rs. 3,225 crores in FY24.

Additionally, the deal will facilitate the introduction of a new app called “District,” designed to integrate and streamline entertainment services.

Future Plans

District App: Zomato plans to launch the District app soon, integrating various entertainment services into a single platform. Over the next 12 months, customers will transition from existing apps to District.

Growth Projections: Zomato expects the GOV of its going-out business to exceed Rs. 10,000 crores by FY26, with potential for a 4-5% adjusted EBITDA margin in the long term. The company aims to balance profitability across different categories within the new app.

This sale reflects Paytm’s strategy to focus on its core financial services, while Zomato aims to enhance its entertainment offerings and customer experience.

Announcing the acquisition, a Paytm spokesperson said,

We developed the entertainment ticketing business to meet market demands. As it transitions to Zomato’s ownership, we express our gratitude to every team member who played a role in its success. It has been an honor to grow this business with such a remarkable team. This transition allows us to concentrate on long-term growth in our core areas and continue creating value for all stakeholders.