The National Payments Corporation of India (NPCI) has introduced a new payment feature called “UPI Circle” at the Global Fintech Fest.

What is UPI Circle?

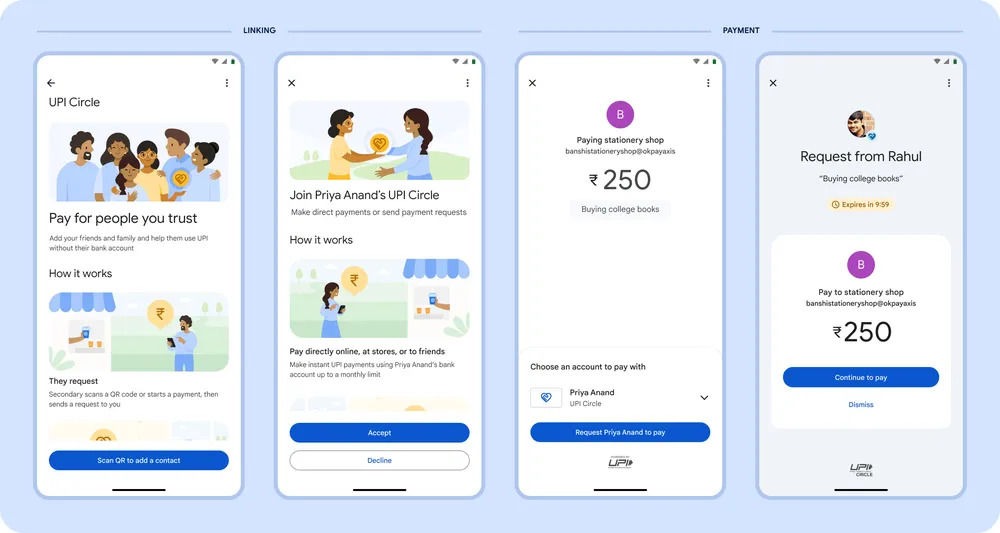

This feature allows UPI account holders (referred to as “Primary Users”) to delegate payment authorization to others (“Secondary Users”) under certain conditions.

This means a Primary User can let someone else, like a child or a trusted individual, make transactions from their UPI-linked account with minimal intervention.

How UPI Circle Works

UPI Circle, also known as Delegated Payments, lets Primary Users authorize Secondary Users to make payments from their account.

The Primary User can either approve each transaction individually or set a transaction limit of up to Rs. 15,000, within which payments can be made without further approval.

Use Cases for UPI Circle

1. Parents Supporting College Students: Parents can allow their college-going children to spend money on essentials like stationery or travel using UPI while maintaining control and oversight.

2. Assisting Senior Citizens: Elderly individuals who may not be comfortable with digital payments can let their children handle online transactions, making shopping easier and stress-free.

3. Managing Household Expenses: Busy professionals can delegate household shopping to domestic help, setting an authorization limit to manage expenses efficiently.

4. Business Owners Delegating Expenses: Small business owners can allow employees, like drivers, to pay for work-related expenses online, reducing the need for petty cash handling.

Reason for Introducing UPI Circle

NPCI designed UPI Circle to address the needs of users who are either hesitant about digital payments or do not have a UPI-linked bank account. The feature ensures that the Primary User retains control over their finances while allowing others to make payments on their behalf.

NPCI notes that about 6% of UPI users currently perform transactions for others, and this feature is aimed at making such delegated payments more convenient and secure.

Guidelines for Members

NPCI has provided a set of guidelines for implementing UPI Circle:

- Independent User Journey: UPI apps and Payment Service Providers (PSP) must offer separate user flows for Primary and Secondary Users, allowing them to choose their UPI app.

- Mandatory Security: Secondary Users must use app passcodes or biometrics (fingerprint/face recognition) for transactions.

- Linking Process: The Primary User can link a Secondary User by scanning a QR code or entering a UPI ID. Manual entry of mobile numbers is restricted.

- Delegation Limits: A Primary User can delegate payments to up to five Secondary Users, but a Secondary User can only accept delegation from one Primary User.

- Transaction Limits: The maximum monthly delegation limit is Rs. 15,000, with a per-transaction cap of Rs. 5,000. For the first 24 hours after linking, the daily limit is Rs. 5,000.

- Visibility and Control: Primary Users can monitor transactions made by Secondary Users through their UPI app and bank statements.

- Compliance: UPI Circle must adhere to RBI guidelines on turnaround time (TAT) and customer compensation for failed transactions, along with providing Online Dispute Resolution (ODR) functionality.

- Reconciliation Process: A new purpose code and line item in the Net settlement report will help identify UPI Circle transactions.

Availability

The UPI Circle feature will initially launch on the BHIM App. Google Pay has confirmed plans to introduce the feature soon, highlighting its aim to make digital payments more accessible and safe.

Other payment apps like Amazon Pay, PhonePe, and Paytm are expected to roll out UPI Circle by December 2024 or early 2025.