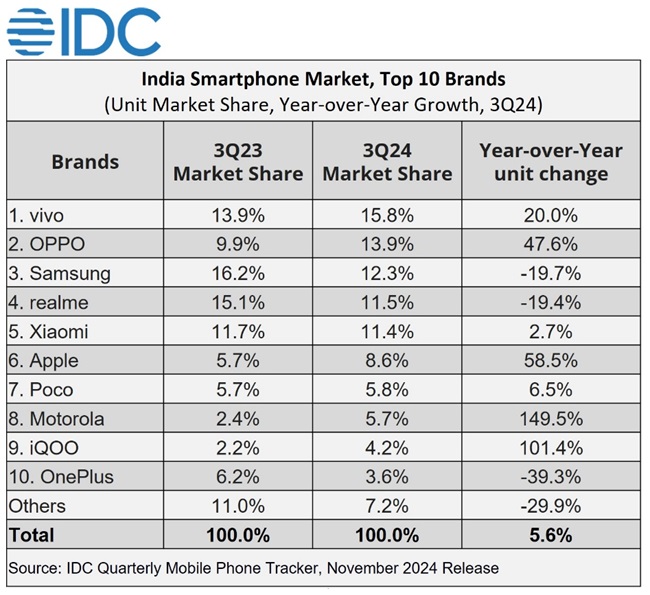

The Indian smartphone market has marked its fifth consecutive quarter of growth, reaching 46 million units shipped in Q3 2024, reflecting a 5.6% year-over-year increase. During this period, Apple achieved its highest-ever quarterly shipment in India, with 4 million units, as reported by IDC’s Worldwide Quarterly Mobile Phone Tracker.

Growth Driven by Discounts and Financing Options

This robust growth was driven by widespread discounts, flexible financing, extended warranties, and cashback offers available across both online and offline channels.

The surge in demand was further fueled by the launch of new 5G smartphones, with discounted flagship models from brands like Apple and Samsung proving popular during major online sales, noted Upasana Joshi, Senior Research Manager at IDC Asia Pacific.

Key Highlights for Q3 2024

Average Selling Price (ASP): Smartphone ASP rose by 0.9% year-over-year (YoY) and 3.8% quarter-over-quarter (QoQ), reaching $258.

Entry-Premium Segment: The $200-$400 price range saw a 42% YoY increase, now comprising 28% of the market, up from 21% a year ago. OPPO saw the most growth in this segment, while Samsung and vivo’s market share declined. Together, these three brands hold 53% of the segment.

Premium Segment: The $600-$800 price range saw the highest growth, rising 86% YoY to capture 4% of the market. Key models included the iPhone 15, 13, 14, Galaxy S23, and OnePlus 12. Apple’s market share increased to 71%, while Samsung’s share dropped to 19%, down from 30% last year.

5G Shipments: Approximately 38 million 5G smartphones were shipped in Q3, with 5G devices making up 83% of total smartphone shipments, up from 57% in Q3 2023. The ASP for 5G phones declined by 20% YoY to $292. The mass-budget 5G segment ($100-$200) reached 50% market share, with popular models like Xiaomi Redmi 13C, iPhone 15, OPPO K12x, and vivo T3x and Y28.

Online and Offline Sales: Shipments via online channels grew 8% YoY, making up 51% of total shipments, with Apple ranking as the second-largest player in this channel, driven by iPhone 15 and iPhone 13 sales. Offline shipments increased by 3% YoY, with brands extending similar offers across both channels.

Apple Breaks Record with 4 Million Units in India

Apple had a record-breaking quarter, shipping 4 million units, primarily driven by the iPhone 15 and iPhone 13 models. This growth increased the value share gap between Apple and Samsung, which stood at 28.7% and 15.2%, respectively.

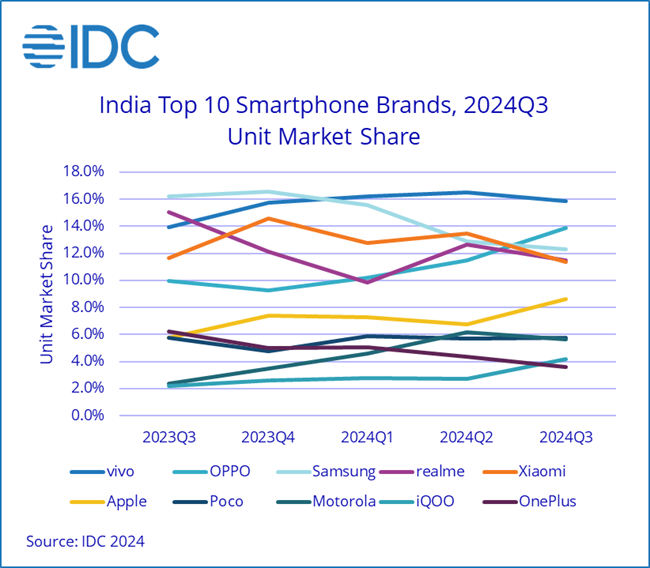

vivo Retains Lead; OPPO, Nothing Grow

vivo maintained its lead for the third consecutive quarter, supported by its Y series and newly launched T3 and V40 series. OPPO recorded the highest growth among the top five brands, driven by affordable models like the A3x/K12x and Reno 12 series. Nothing also showed the highest overall growth, followed closely by Motorola and iQOO.

Looking Ahead

Following strong shipments in Q3, India’s smartphone market may face a seasonal dip in demand after the festive season, with higher stock levels expected in Q4, 2024. Annual growth for 2024 is projected to remain in the low single digits.

According to Navkendar Singh, AVP of Devices Research at IDC, strong growth in 2025 will depend on momentum in the mass and entry-premium segments ($100-$400), with anticipated launches featuring more affordable options and a focus on Gen AI capabilities.