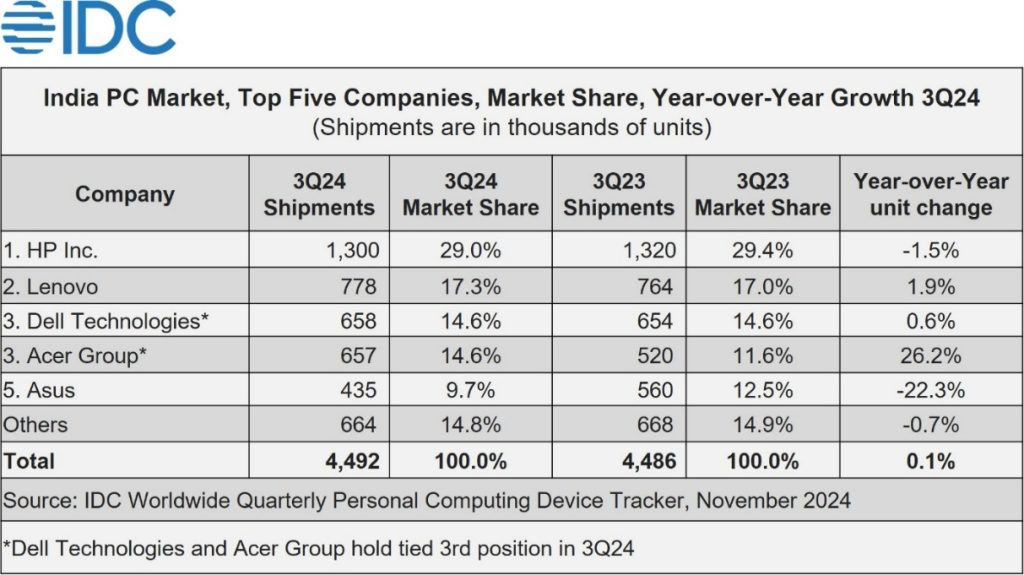

India’s traditional PC market, which includes desktops, notebooks, and workstations, recorded 4.49 million unit shipments in Q3 2024, reflecting a modest 0.1% year-over-year (YoY) growth, according to IDC’s Quarterly Personal Computing Device Tracker. This comes after a 7.1% YoY growth in Q2 2024.

While desktops declined by 8.1% YoY, notebooks and workstations showed slight gains of 2.8% and 2.4% YoY, respectively. Notably, premium notebook sales (priced above $1,000) surged by 7.6% YoY, driven by festive online promotions.

Consumer and Commercial Segments

The consumer segment experienced a 2.9% YoY decline, despite vendors offering aggressive discounts on online platforms. Unlike Q3 2023, demand remained organic, with vendors avoiding overstocking in Q3 2024, which helped limit losses.

In contrast, the commercial segment grew by 4.4% YoY, fueled by a 9.6% YoY rise in enterprise demand. According to Bharath Shenoy, Research Manager at IDC India & South Asia, early e-tail sales, starting in late September, boosted PC shipments.

Shenoy noted that brands capitalized on these sales by offering discounts, cashback offers, and bundled accessories, while matching prices across physical stores. This strategy resulted in one of the strongest consumer quarters on record.

Leading Brands in Q3 2024

- HP Inc. led the market with a 29% share, dominating both commercial and consumer segments with shares of 34.3% and 24.8%, respectively. HP’s success was driven by enterprise demand, which grew by 30.2% YoY, and robust consumer notebook sales during the festive season. The company shipped 1.05 million notebooks, marking its third-best quarter ever.

- Lenovo ranked second with a 17.3% market share. Key enterprise orders and momentum in the SMB sector helped it secure a 20.3% share in the commercial market. Lenovo’s consumer segment grew by 3% YoY, boosted by branded gaming notebooks and e-tail promotions.

- Dell Technologies held a 14.6% share, performing well in the SMB sector, where it grew by 14.9% YoY. It captured a 20.8% share in the commercial market but saw a 5.4% decline in the consumer segment due to limited participation in e-tail promotions.

- Acer tied with Dell, also holding a 14.6% share. Acer’s shipments increased by 26.2% YoY, driven by partial fulfillment of education projects and enterprise orders. It led the commercial desktop market with a 30.2% share and saw a 38% YoY rise in consumer shipments during festive sales.

- Asus ranked fifth with a 9.7% share. A leaner inventory resulted in a 22.3% YoY decline. However, Asus secured a 16.2% share in the consumer market, second only to HP, and grew by 5.5% YoY in the commercial segment.

Outlook for the Future

Navkendar Singh, Associate Vice President of Devices Research at IDC India, South Asia & ANZ, stated that the commercial PC market is recovering as enterprises gradually refresh their IT equipment. He noted that IT/ITES sector purchases are expected to gain momentum in 2025.

Singh also highlighted that increasing demand for PCs in gaming and content creation, alongside a growing focus on AI-driven features, will drive consumer demand in Q4 2024 and into 2025.