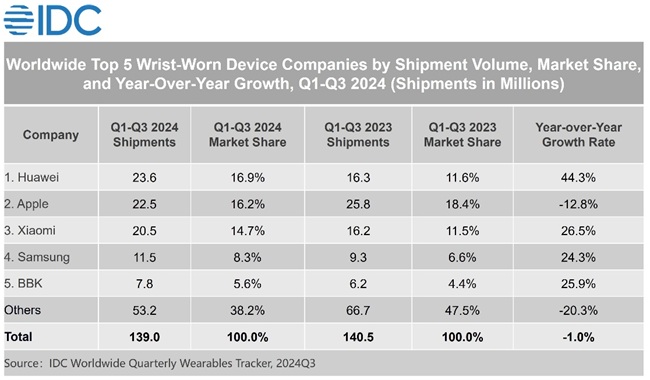

International Data Corporation (IDC) has released its latest Worldwide Wearables Quarterly Tracker, reporting that global wrist-worn device shipments totaled 139.0 million units in the first three quarters of 2024, reflecting a 1.0% year-over-year decline.

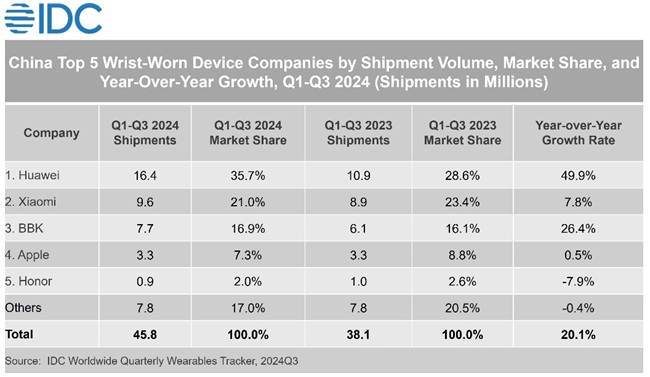

The decline is attributed to market saturation and intensified competition, particularly in India and the United States. Conversely, China’s wrist-worn market saw significant growth, shipping 45.8 million units—a 20.1% year-over-year increase—positioning China as the largest contributor to global shipments.

Market Breakdown

The wrist-worn device segment includes smartwatches and wristbands:

- Smartwatches: Global shipments reached 112.2 million units, down 3.8% year-over-year. In China, smartwatch shipments increased by 23.3% to 32.9 million units.

- Wristbands: Global shipments hit 26.8 million units, a 12.7% year-over-year increase. China shipped 12.9 million units, reflecting 12.6% growth.

Brand Performance Highlights

HUAWEI

HUAWEI led the global wrist-worn market in cumulative shipments during the first three quarters of 2024. Its Q3 launches, including the GT5, GT5 Pro, and the WATCH D2 with the TruSense System, enhanced its health monitoring features, boosting shipment growth. The company saw steady expansion across Asia-Pacific, Latin America, the Middle East, and Africa through localized strategies.

Apple

Apple reclaimed the top spot in the wrist-worn market in Q3 2024 with the launch of the Series 10 smartwatch. However, growing competition across various price segments challenges its market dominance. Although Apple remains the global smartwatch leader, continuous innovation will be critical to maintaining its position.

Xiaomi

Xiaomi gained momentum with the launch of the Band 9, offering upgrades in screen brightness, battery life, and health tracking. The Xiaomi Watch S series strengthened its mid-to-high-end lineup. Strong performance in its smartphone and vehicle segments also boosted its wrist-worn device visibility.

Samsung

Samsung’s 7th-generation devices helped expand its market presence in Q3. The Ultra smartwatch filled its high-end product gap, while the FE version strengthened its entry-level lineup. The Fit3 wristband, launched earlier in 2024, enabled Samsung to cover a broader consumer base.

BBK

BBK maintained its leadership in China’s kids’ watch market while expanding into emerging overseas markets through its IMOO brand. The company strengthened its global distribution network through strategic partnerships.

Market Trends and Projections for 2025

IDC highlighted growing consumer demand for sports and health-related features as a key driver of wrist-worn market growth.

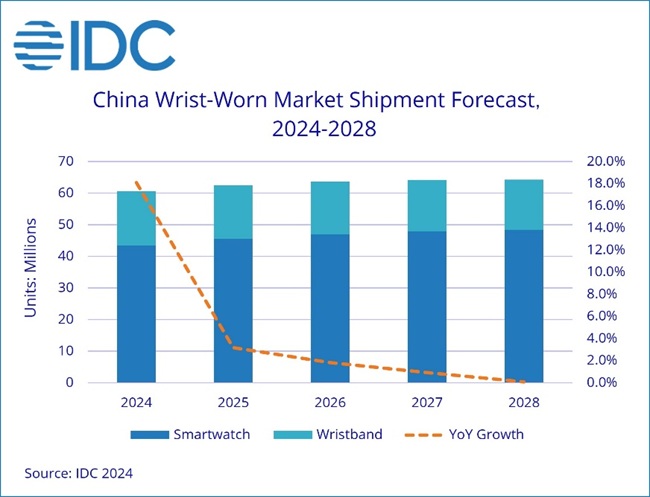

By 2025, China’s wrist-worn device shipments are projected to reach 62.5 million units, reflecting a 3.2% year-over-year increase. Key trends expected to shape the market include:

- Enhanced Health Monitoring: Advancements in AI and sensing technologies will improve health monitoring capabilities, especially for blood pressure tracking.

- Channel Structure Evolution: Diversification in online sales will create challenges and opportunities, while offline sales will remain concentrated in key retail stores.

- Personalization Focus: Wrist-worn devices will emphasize personalized designs, appealing to sports enthusiasts, fashion-conscious users, and business professionals.

Sophie Pan, Research Director at IDC China, noted that product launches by top manufacturers have driven a rebound in the mid- and high-end market segments. She emphasized that technological innovations and product diversification will further enhance the wrist-worn market’s appeal, particularly in AI-driven multimodal interaction capabilities.