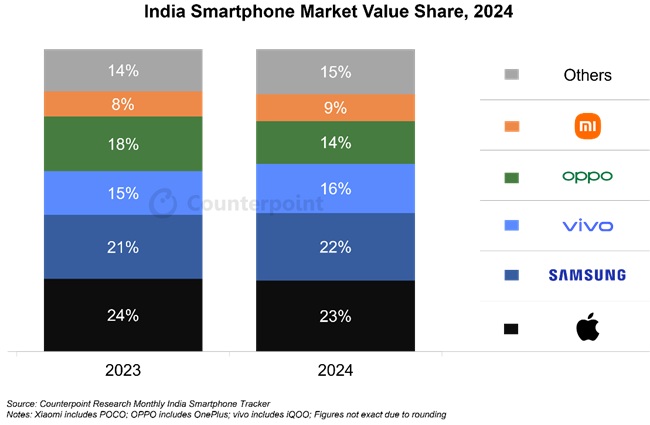

The Indian smartphone market witnessed a significant increase in wholesale revenue by 9% year-over-year (YoY) in 2024, reaching an all-time high, according to Counterpoint’s Monthly India Smartphone Tracker.

However, the growth in smartphone shipments was modest at just 1% YoY, with a total of 153 million units shipped. The year began with promising trends, including early growth and stable inventory levels, but later saw a slowdown due to diminished consumer demand and economic pressures, as detailed in the report.

Market Dynamics

Senior Research Analyst Shilpi Jain observed that the Indian smartphone market is showing signs of maturity, with stable volumes attributed to fewer new users entering the market. “Replacement cycles are lengthening as entry- and mid-range devices continue to enhance each year,” Jain stated.

There’s a marked shift towards higher-priced segments, with the premium category (>INR 30,000) experiencing double-digit growth, which has significantly contributed to the peak in wholesale value.

Consumer Trends

Jain further noted an accelerating preference for premium smartphones, driven by accessible trade-in programs and flexible financing options. Despite this trend, the entry-level segment (sub-INR 10,000) experienced a one-third decline due to inflationary pressures.

Competitive Landscape

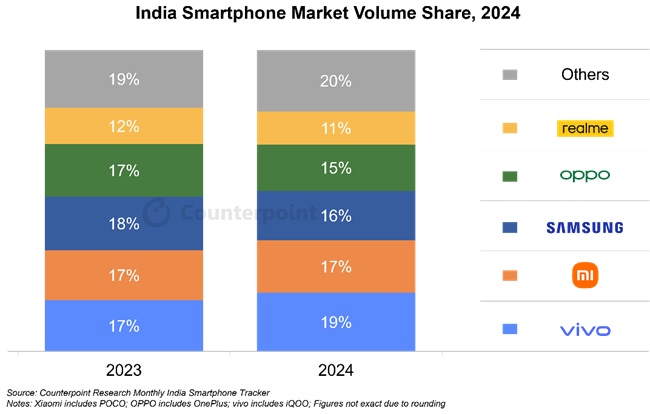

Research Analyst Shubham Singh highlighted notable changes in market leadership as follows:

- vivo emerged as the leader with a 16% YoY growth, bolstered by a robust offline presence and its sub-brand iQOO.

- Xiaomi regained growth momentum with a 6% YoY increase, while Samsung slipped to third place, impacted by its pricing strategies but maintaining strong performance in the premium segment with devices like the S series.

- OPPO saw a 10% YoY decline in the first half of 2023 but managed to recover through new product lines like the K and A series.

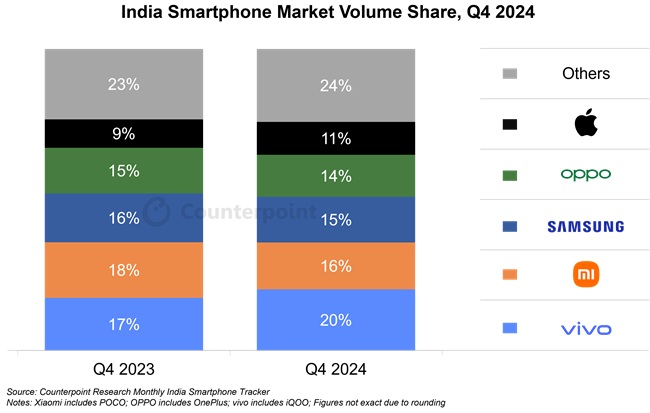

- Apple had a remarkable year, especially with the iPhone 15, leading to record shipments in Q4 2024 and achieving the highest market value share.

Nevertheless, the market experienced a 4% YoY drop in Q4 due to post-festive slumps, though the value increased by 5% thanks to demand for premium devices.

Other Insights

- Brand Growth: Nothing was the fastest-growing brand in 2024, with an extraordinary 577% YoY growth, driven by its 2a series and CMF sub-brand. Motorola also achieved significant growth at 82% YoY.

- Technology Adoption: 5G smartphones captured 78% of the market in 2024, facilitated by the availability of 5G chipsets even in entry-level phones. MediaTek dominated with a 52% chipset market share, followed by Qualcomm at 25%.

- Premium Segment: One in five smartphones shipped were from the premium category, underlining a trend towards high-end features. OEMs are increasingly leveraging GenAI for personalized experiences, improved user interfaces, and advanced audio-visual technologies.

- Channel Strategy: realme expanded its offline presence, with 52% of its shipments occurring through offline channels in 2024, up from 49% in 2023.

- Feature Phones: In the feature phone market, itel held the lead with a 32% market share, thanks to its strong distribution network in smaller cities.

Looking ahead, Jain anticipates that 2025 will see market volumes growing in single digits, with the value projected to reach another peak, predominantly due to ongoing premiumization.

Commenting on the achievement, Pranay Rao, Marketing Director India, Nothing said:

577% growth is a great achievement for a young startup like ours. This is a credit to our customers and our community who have been on this journey with us, helping us constantly evolve and make better products. We are very excited about our product portfolio for 2025 and hope customers continue to buy into our product and design philosophy and help us grow even faster.