India’s smartphone market expanded by 4% year-over-year (YoY) in 2024, with shipments reaching 151 million units, according to the IDC Worldwide Quarterly Mobile Phone Tracker. Strong growth of 7% in the first half balanced a slower 2% growth in the second half. However, the market saw a slight dip in Q4 2024, with shipments declining by 3% to 36 million units.

Apple Gains Ground, Enters India’s Top 5

India became Apple’s fourth-largest market after the U.S., China, and Japan, with record shipments of 12 million units, marking a 35% YoY growth.

In Q4 2024, Apple secured a spot among India’s top five smartphone brands for the first time, capturing a 10% market share. The iPhone 15 and iPhone 13 were the most shipped models, contributing 6% of overall quarterly shipments.

Price Cuts, Discounts, and Financing Drive Sales

Following the festive season, vendors and retailers continued offering price cuts, discounts, and extended warranties. Financing options, especially ‘No Cost EMIs’ for up to 24 months, played a crucial role in boosting sales of mid-range and premium devices, according to Upasana Joshi, Senior Research Manager at IDC Asia Pacific.

Market Trends and Key Segments

- Average Selling Price (ASP): Reached $259 in 2024, with 2% YoY growth, significantly lower than previous years’ double-digit increases.

- Entry-Premium Segment ($200-$400): Registered the highest growth at 35.3% YoY, increasing its market share to 28% from 21%.

- Premium Segment ($600-$800): Grew by 34.9%, rising to a 4% market share, led by models like the iPhone 15, iPhone 13/14, and Samsung Galaxy S23/S24.

5G Expansion and Leading Models

- 5G Shipments: 120 million units shipped, accounting for 79% of total smartphone shipments, up from 55% in 2023.

- 5G ASPs: Dropped by 19% YoY to $303.

- Budget 5G Segment ($100-$200): Nearly doubled its share to 47%.

- Most Shipped 5G Models: Xiaomi Redmi 13C, Apple iPhone 15, vivo Y28, Apple iPhone 13, and vivo T3X.

Online vs. Offline Sales and Brand Performance

- Sales Channels: Both offline and online shipments grew by 4% YoY, with offline channels holding a slight edge at 51% market share.

- Online Sales: Samsung led, while Apple moved up to fourth place, with the iPhone 15 as the top-selling online smartphone.

- Offline Market: vivo remained dominant, followed by OPPO and Xiaomi.

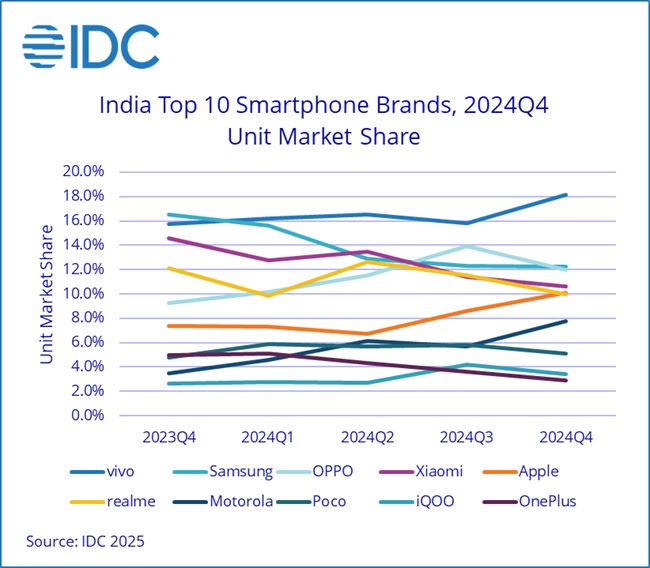

vivo overtook Samsung as the top smartphone brand in India, thanks to its strong presence across all price segments and retail channels. Nothing recorded the highest growth rate, followed by Motorola and iQOO. The combined market share of the top five brands declined from 76% in 2022 to 65% in 2024, as smaller brands gained traction.

Feature Phone Market and Total Mobile Shipments

- Feature Phone Shipments: Declined by 11% YoY to 54 million units.

- Top Feature Phone Brands: Transsion led with a 30% share, followed by Nokia and Lava.

- Total Mobile Shipments: 205 million units, marking a 1% annual decline.

What’s Next for 2025?

Growth in 2025 will depend on stronger sales in the mass segment ($100-$200) and new options in the entry-premium segment ($200-$400) for upgraders, says Navkendar Singh, Associate Vice President, IDC India.

Generative AI features will become a key differentiator beyond flagship models, expanding to more price categories. Meanwhile, online-focused brands will expand offline to maintain growth. However, a weakening rupee could push ASPs higher, limiting overall market growth to under 5% in 2025, Singh added.