The Indian tablet market saw a significant 25% year-on-year (YoY) growth in 2024, as per CyberMedia Research (CMR)’s Tablet PC India Market Report Review for CY2024.

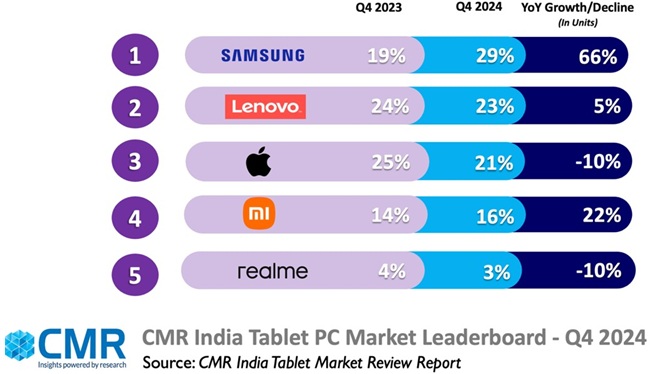

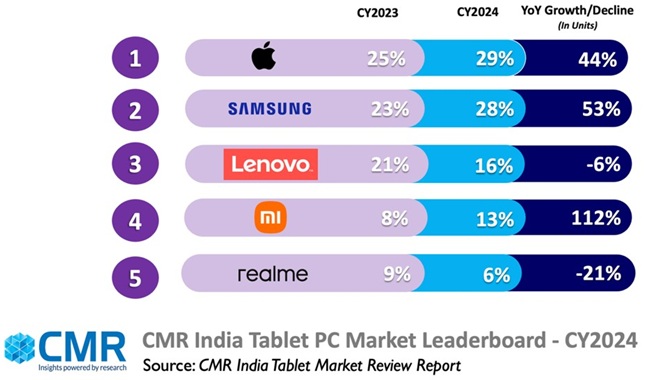

In Q4 2024, Samsung led the market with a 29% share, followed by Lenovo (23%) and Apple (21%). For the entire year, Apple emerged as the leader with a 29% market share, closely followed by Samsung (28%) and Lenovo (16%). A notable milestone was Apple’s iPad shipments crossing 1 million units in India for the first time in 2024.

Key Drivers of Growth

The growth was primarily driven by increased demand for 5G and premium tablets. Menka Kumari, Senior Analyst at CyberMedia Research, highlighted the market’s shift toward premiumization, with tablets priced above Rs. 20,000 experiencing strong demand.

She stated, “As hybrid work, digital learning, and on-the-go entertainment gain traction, premium tablets have become a key growth driver. Consumers are prioritizing high-performance devices with superior displays, advanced chipsets, and seamless 5G connectivity.”

Competitive Landscape in 2024

- Apple: Dominating the market with a 29% share and 44% YoY growth, Apple’s success was largely driven by the iPad 10 Series, which accounted for 55% of its shipments. The recently launched iPad mini (2024) is expected to further solidify its market position.

- Samsung: Securing a 28% market share and 53% YoY growth, Samsung’s Galaxy Tab A9 Plus 5G was its top performer, contributing 68% of its total shipments.

- Lenovo: With a 16% market share, Lenovo’s growth was fueled by the Tab M11 Series (36%) and M10 Gen 3 (16%). However, growth in the value-for-money segment remained subdued.

- Xiaomi: Achieving a 13% market share and an impressive 112% YoY growth, Xiaomi’s Pad 6 captured 33% of premium tablet sales in 2024.

Market Outlook for 2025

CMR forecasts a steady 10-15% growth for the Indian tablet market in 2025. Menka Kumari emphasized that this expansion will be driven by the growing 5G ecosystem, AI-powered productivity features, and government-backed digital initiatives.

She added, “The shift away from 4G tablets marks a key industry evolution, while Wi-Fi-only models continue to cater to the education and enterprise sectors.”