India’s PC market, including desktops, notebooks, and workstations, shipped 14.4 million units in 2024, up 3.8% from 2023, according to the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. Notebooks led with a 4.5% rise, desktops grew by 1.8%, and workstations surged 10.9% year-over-year.

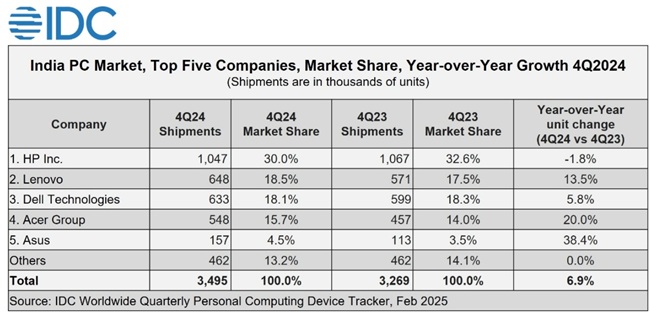

Fourth Quarter Surge

In Q4 2024, the market rose 6.9% compared to the same period last year. Notebooks drove this, climbing 9.6%. The report noted a 13.8% annual increase in premium notebooks priced over $1,000, signaling strong demand for high-end models.

Consumer Segment Growth

Consumer PC sales increased 2.6% in 2024 and 2.2% in Q4 2024. Online retail channels powered this growth, rising 21.7% yearly and 29% in the final quarter. Vendors stocked inventories in late December for year-end and Republic Day sales in January, lifting figures further.

Commercial Segment Gains

The commercial sector grew 5.1% in 2024 and 11.1% in Q4 2024. Enterprises and government purchases, including via the Government e-Marketplace (GeM), each jumped 10.6% annually. The report highlighted steady demand from global firms and public sector needs as key drivers.

Trends in Gaming and AI PCs

Bharath Shenoy, research manager at IDC India & South Asia, noted a boom in gaming and AI-powered PCs. Gaming notebooks achieved double-digit growth in 2024. Since mid-2024, AI-capable notebooks with Intel Core Ultra and AMD Ryzen AI processors have seen steady demand, Shenoy added.

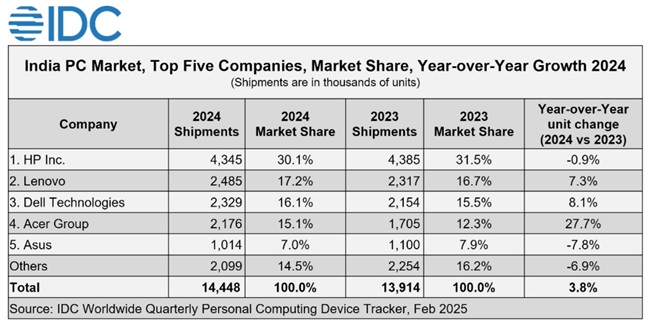

Top Five PC Brands in 2024

- HP Inc. topped the market with a 30.1% share. It led both consumer and commercial segments, though consumer sales fell 7.5% due to eTailer competition. Government and enterprise sales rose 14.7% and 14.3%, respectively.

- Lenovo ranked second with a 17.2% share, posting 7% growth in consumer sales and 7.4% in commercial. Enterprise demand and eTailer efforts fueled a 7.3% overall increase.

- Dell took third with a 16.1% share, holding second place in commercial sales at 21%, driven by small businesses and enterprises. It slipped to fifth in consumer sales, growing just 3.9%.

- Acer secured fourth with a 15.1% share, leading top-five growth with a 48.4% surge in consumer sales, thanks to aggressive pricing and eTailer discounts. Commercial sales rose 16.6%.

- Asus placed fifth with a 7% share, down 7.8% from 2023. It focused on stable inventory but grew 18.4% in commercial sales.

Market Outlook for 2025

Navkendar Singh, associate vice president at IDC India, South Asia & ANZ, said commercial PC demand is rising due to refresh cycles and public sector orders.

Devices from 2020-21 are nearing replacement age. However, a weakening rupee could raise costs, impacting price-sensitive buyers, he cautioned. Singh predicts low single-digit growth for India’s PC market in 2025.