The shipments of ‘Made in India’ smartphones recorded a 6% year-on-year (YoY) growth in 2024, largely driven by increasing exports from Apple and Samsung, according to Counterpoint’s ‘Make in India’ Service report.

The report noted that these two brands together contributed 94% of India’s smartphone exports. Their expanded manufacturing aligns with India’s efforts to reduce import dependency and establish a stronger position in global supply chains.

The Indian government’s Production-Linked Incentive (PLI) scheme has played a significant role by encouraging global manufacturers to set up or expand their production facilities in the country. This initiative has bolstered local manufacturing capabilities, the report added.

Performance of Key Manufacturers in 2024

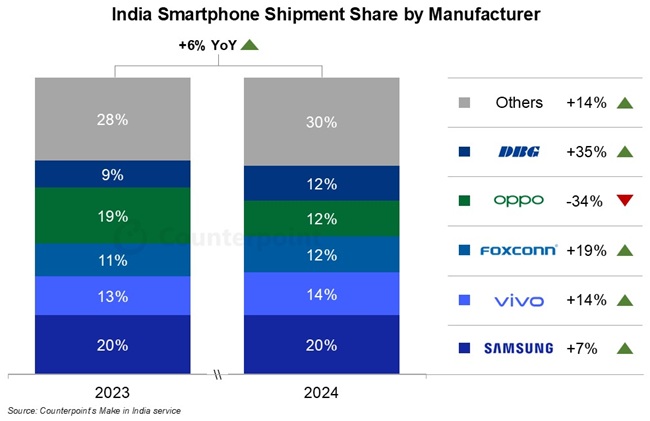

Samsung: The company remained a dominant player in India’s electronics manufacturing space, growing 7% YoY, primarily due to increased exports, as emphasized by Research Analyst Tanvi Sharma.

vivo: Noted for capturing 14% of the shipment share with a 14% YoY growth, vivo’s success stemmed from its expanded offline retail network and stronger distribution presence. According to Counterpoint’s shipment tracker, vivo emerged as the leader in India’s smartphone shipments in 2024.

Foxconn Hon Hai: Backed by Apple, Foxconn saw a 19% YoY rise in manufacturing volumes. The company aims to enhance local production by establishing a smartphone display module assembly.

OPPO: Slipped to the fourth spot among manufacturers, with shipments declining 34% YoY. The fall was attributed to intense competition and a growing share of contract manufacturing for OPPO and realme.

DBG: Achieved significant double-digit growth in 2024, supported by expanded partnerships with Xiaomi and realme.

Tata Electronics: Tata Electronics registered an exceptional 107% YoY growth, becoming the fastest-growing manufacturer of 2024. The iPhone 15 and iPhone 16 models were major contributors to its volume growth.

The company also expanded its assembly operations, ventured into semiconductor fabrication with a new plant in Dholera, Gujarat, and announced plans for an OSAT facility in Assam. These efforts position Tata Electronics as a key player in the global electronics supply chain.

In the overall mobile handset segment, which includes smartphones and feature phones, Dixon emerged as the top manufacturer. Its performance was driven by strong shipments from Transsion brands and Motorola.

In the smartphone segment, Dixon reported a 39% YoY growth, supported by partnerships with Transsion brands and realme. The report highlighted that Dixon’s strategic collaborations and joint ventures significantly contributed to its success in India’s handset manufacturing ecosystem.

Market Dynamics and Future Outlook

Commenting on the market trends, Senior Research Analyst Prachir Singh noted that major global smartphone manufacturers are increasingly diversifying their production to ensure a more resilient supply chain and reduce risks associated with over-reliance on a single country.

He highlighted India as a favorable manufacturing destination, citing its large local market, cost-effective labor, and supportive government policies. Singh added that smartphone production in India is expected to grow in double digits in 2025, with increased local value addition.