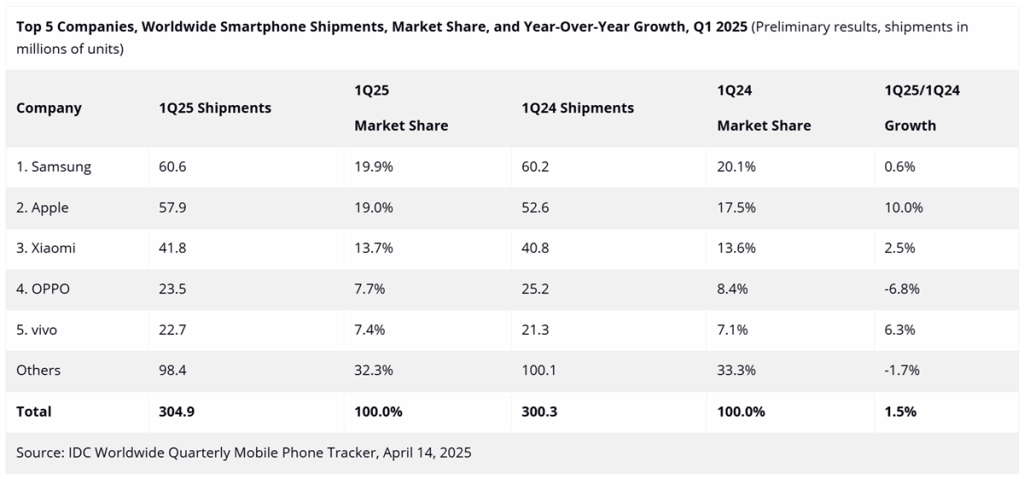

Global smartphone shipments grew 1.5% year-over-year (YoY) to 304.9 million units in the first quarter of 2025 (1Q25), according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker.

IDC noted that the smartphone market aligned with forecasts, as manufacturers increased production ahead of a widely anticipated announcement from the U.S. administration concerning tariffs on Chinese imports.

Shipment volumes surged due to tariff anticipation

Francisco Jeronimo, vice president of Client Devices at IDC, said that vendors accelerated production schedules in response to “heightened geopolitical uncertainty” and the threat of major U.S. tariff hikes on goods from China.

To avoid future cost increases and disruptions, many manufacturers “pulled forward” shipments into Q1, especially for the U.S. market. This move “effectively” pushed shipment numbers beyond what was expected from actual consumer demand trends, Jeronimo added.

U.S. tariff pause brings short-term relief

The U.S. government’s recent move to pause smartphone import tariffs from China has offered temporary relief to U.S. companies. However, dependency on China’s supply chain remains strong, creating volatility in future planning.

Ryan Reith, group vice president of Worldwide Device Trackers at IDC, stated that this situation “makes future planning challenging and leaves many companies with important decisions with high levels of uncertainty.”

Reith added, “Right now, the focus for U.S. smartphone brands should be taking advantage of the exemption by building and shipping as much as possible.” However, he warned that economic “uncertainty” may reduce consumer demand in the coming months.

U.S. smartphone market grew over 5%

The U.S. smartphone market grew more than 5% during Q1 2025, despite pressures from tariffs and broader trade challenges impacting consumer spending.

Anthony Scarsella, research director for Client Devices at IDC, said the growth was supported by increasing consumer interest in new models and a growing urgency to buy before possible price increases.

He noted that “the growth in 1Q25 was fueled by rising consumer interest in the latest models from top manufacturers, along with a sense of urgency to buy before potential price increases.”

Chinese subsidy program boosts local market

IDC observed that global growth among top smartphone vendors was particularly strong in China, helped by a government-backed subsidy program extended to smartphones in January 2025.

The program, which began in 2024, aims to drive consumption by covering products priced below CNY6,000 (approximately $820). This price range represents the bulk of sales by Chinese brands.

How major smartphone brands performed

- Samsung regained the top spot globally. The company was supported by the continued success of its Galaxy S25 premium model and its mid-range Galaxy A series—particularly the Galaxy A36 and A56—which offer AI features at lower price points.

- Apple recorded its best Q1 ever in terms of units shipped. The company increased its inventory to guard against potential U.S. tariffs and to prepare for possible supply disruptions globally. However, Apple saw a drop in its China performance, as its Pro models did not qualify for the government’s subsidy program.

- Xiaomi saw growth mainly from China, where the subsidy program boosted sales of its mid-range devices.

- OPPO moved back into fourth place, despite a decline in overall shipments. The brand’s performance weakened in international markets but was lifted by growth in China.

- vivo posted a 6.3% YoY increase in shipments, driven by both the Chinese subsidy program and international success, particularly in the low-end segment and its V series.

Looking ahead: Q2 2025 outlook

IDC expects the recently announced 90-day pause on U.S. smartphone tariffs to potentially lift Q2 sales, as consumers may move quickly to buy before the possible “reintroduction of tariffs” that could raise prices.