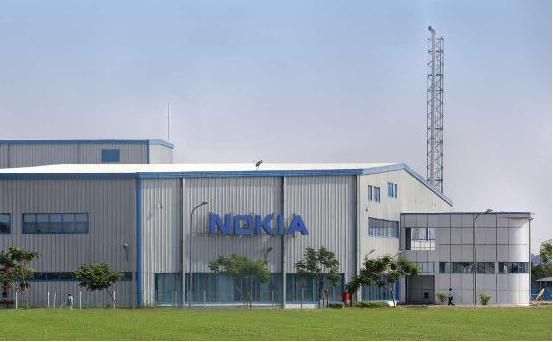

Nokia and the Indian government have been at odds for quite a while regarding a purported Tax evasion by the Finnish company. A lot of multi-national companies like Vodafone and Shell too have been facing the heat regarding similar tax evasion cases. Nokia in particular had its Chennai Sri Perumbudur plant raided by the Income tax department. Finally, the Indian government decided to slap a tax demand of around Rs. 2000 crore for tax evasion, and a case was filed in the Delhi high court regarding the same. As of now, the case has been stayed and Finland has now come in aid of Nokia, with them proposing a mutual agreement procedure with the Indian Government based on a Tax treaty between the two countries.

According to Wikipedia, the MAP, as it is called, is briefly described as – “APAs are generally bi- or multilateral—i.e., they also include agreements between the taxpayer and one or more foreign tax administrations under the authority of the mutual agreement procedure (MAP) specified in income tax treaties.” This bi-lateral agreement between India and Finland is being put forward to bring a mutual settlement between the two countries.

And according to the Economic Times – “They have filed an application. We are examining it and will take a decision in accordance with the provisions of our tax treaty with Finland,” a finance ministry official said. A Nokia spokeperson too has confirmed this – “We can confirm that the mutual agreement procedure under the India-Finland tax treaty has indeed been invoked, but given the fact that the tax case remains open, I’m afraid we cannot comment on any details at this stage,”

The source article from Times of India suggests that the government will not give in to such efforts. Rewinding back to the main issue, the Income tax department slapped a Rs 2,000-crore tax demand on Nokia on March 21 for not withholding tax on the payment made to its parent as royalty for the software used in its mobile phones since 2006. We will be bringing you more updates as the case progresses.

Source Times of India