Google will not collect any transaction fees from credit card companies for Android Pay transactions, according to a latest Wall Street Journal report.

“There is one agreement with Visa and the banks can have confidence that there are no pass-through fees,” Visa President Ryan McInerney told the publication. In comparison, Apple Pay that was launched last year, receives 0.15 percent of the value of each credit card transaction and 0.5% for debit cards, said the report.

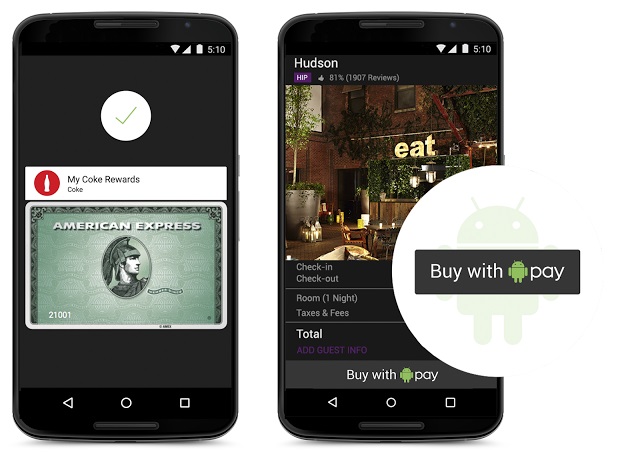

Google unveiled its pay-with-a-phone system for Android devices which will generate a one-time ‘token’ or virtual account number so the actual credit card data is not revealed in a transaction. Tokenization is the system that swaps credit card data like account numbers, expiry dates, and security codes with a unique string of numbers that can only be used once. It is much safer than traditional transactions, because the merchants never get the card data, and no directly sensitive information is transmitted.

Android Pay will come pre-installed on new devices from AT&T, Verizon, and T-Mobile. Android Pay will soon be accepted at over 700,000 store locations from your favorite brands across the US, and in over 1000 Android apps. Google has partnered with all the major payment networks in the US including American Express, Discover, MasterCard and Visa.