According to the IDC Worldwide Quarterly Mobile Phone Tracker, smartphone vendors shipped a total of 355.2 million units during the Q3 2018; this is a 6% decline year-over-year. This was the fourth consecutive quarter of year-over-year declines for the global smartphone market.

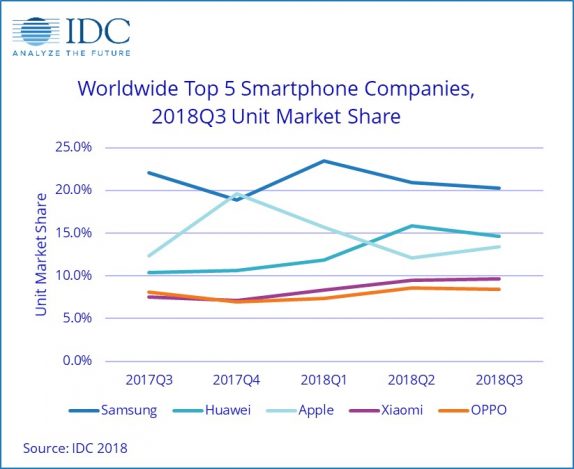

Samsung accounted for 20.3% of shipments in Q3 2018 with 72.2 million units shipped, which is a 13.4% decline year-over-year. China, which is the largest market for smartphones, accounted for roughly one-third of global shipments. Even the China market is down for the sixth consecutive quarter. Samsung seems to be facing the heat coming especially from Huawei who is inching closer to the top after its second consecutive quarter as the number two vendor.

Even in growing markets like India, Samsung seems to be losing its position, thanks to the rapid growth of Chinese brands like Xiaomi, OPPO, and vivo. Meanwhile, China’s domestic market, which represents roughly one-third of all smartphones, has been in decline since the second quarter of 2017, and Q32018 is the sixth consecutive quarter where the market sees contraction. China was down 11% in the first half of 2018, and the challenges continued into Q3 2018.

Huawei once again managed to move past Apple into the second position, but thanks to the upcoming holiday season, Apple will be the market leader who just launched three brand-new iPhones. Huawei’s market share is down slightly from last quarter’s 15.9%; overall the company shipped 52 million units with 14.6% of the overall market.

As for Apple, it shipped a total of 46.9 million units, up 0.5% from the 46.7 million units last year, thanks to the three new iPhones launched recently. Xiaomi once again continued to grow as it captured a market share of 9.7% in Q3 2018. OPPO shipped a total of 29.9 million shipments in Q3 2018, down 2.1% from a year ago. IDC, however, expects the decline to be slim in 2019 with the flat graph.

Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers, said:

China’s domestic market continues to be challenged as overall consumer spending around smartphones has been down. High penetration levels, mixed with some challenging economic times, has slowed the world’s largest smartphone market. Despite this, we believe this market will begin to recover in 2019 and beyond, driven in the short term by a large, built up refresh cycle across all segments, and in the outer years of the forecast supported by 5G migration.