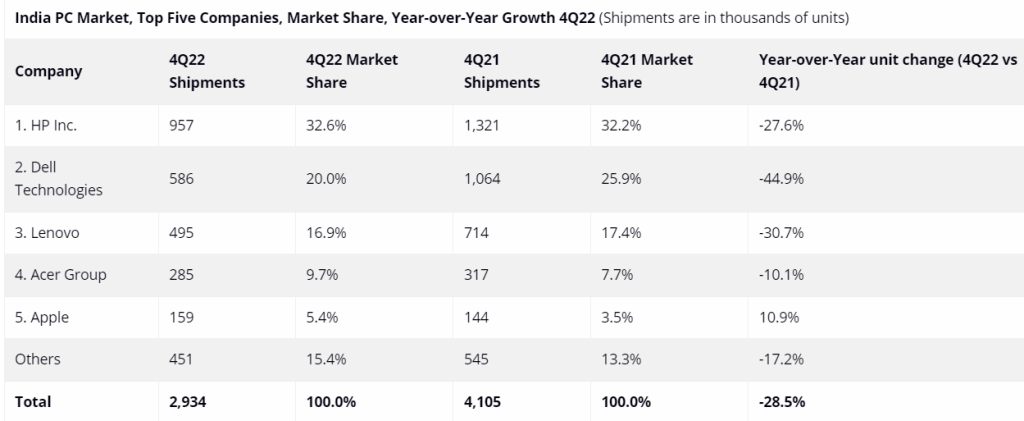

The India traditional PC market, which includes desktops, notebooks, and workstations, grew 0.3% YoY in 2022 to 14.9 million units, as per the latest IDC report, despite a significant 28.5% YoY decline in 4Q22. Earlier, IDC had revealed that smartphone shipments in India declined by 10% YoY in 2022.

India’s PC Market Q4 2022

In 4Q22, the notebook category saw a YoY decline of 37.8%, while desktops continued to trend upward. The consumer segment experienced a 27.4% decline due to inflation and low sentiment, and the enterprise segment fell by 42.6% YoY due to delayed orders and inventory challenges. However, the government and education segments experienced YoY growth of 117.6% and 28.3% respectively, while enterprises declined by 5.9% YoY.

Workstations and desktops saw YoY growth of 24.7% and 32.3% respectively, but the notebook category declined by 8.4% YoY. Premium notebooks grew by 14.6% YoY in the consumer segment, but declined by 7.9% YoY in the commercial segment. The online channel also saw a YoY decline of 9.4% in 2022, with a steeper YoY decline of 37.5% in 4Q22.

India’s PC Market Q4 2022: Key Highlights

- HP led the market with a 30.2% share in 2022, while its notebooks declined by 10.7% year-over-year (YoY), its desktops and workstations witnessed significant YoY gains.

- Dell Technologies ranked second with a 19.2% share, down 18.5% YoY. Its share in the commercial segment was 25.2%, but it dropped to 12.5% in the consumer segment.

- Lenovo held third place in 2022 with a market share of 18.9%. Despite undergoing an inventory correction in 4Q22, the vendor saw positive momentum in both the consumer and commercial segments, resulting in a 3.1% year-over-year (YoY) growth. In the small and medium-sized business (SMB) segment, Lenovo saw a 14.1% YoY growth.

- Acer Group ranked fourth with a 9.9% share, growing 21% YoY in 2022 due to strong demand for commercial desktops. The vendor held a 26.7% share in commercial desktops, ranking second after HP, and grew YoY by 45.7%.

- ASUS ranked fifth with a 6.8% share, experiencing significant YoY growth of 20% in consumer notebooks and holding the third position with a 15.6% share, behind HP and Lenovo.

- Apple surpassed ASUS to claim the fifth spot in 4Q22, growing by 10.9% YoY. While other major vendors reduced shipments due to inventory correction, Apple saw positive traction during the quarter.

Commenting on the report, Bharath Shenoy, Senior Market Analyst, IDC India, said,

In the consumer segment, the year started on a positive note with strong double-digit growth in the first half of the year. Demand started to taper off in the second half of the year and eventually plunged in 4Q22 despite positive online sales in 3Q22, as channel inventory piled up.

Commenting on the outlook, Navkendar Singh, Associate Vice President, Devices Research, IDC India, South Asia & ANZ said,

PC demand has been slowing in the last few months across segments. With channel inventory being as high as 8-9 weeks, vendors are expected to remain cautious in 1H23 by focusing on bringing inventory levels down to normal levels.