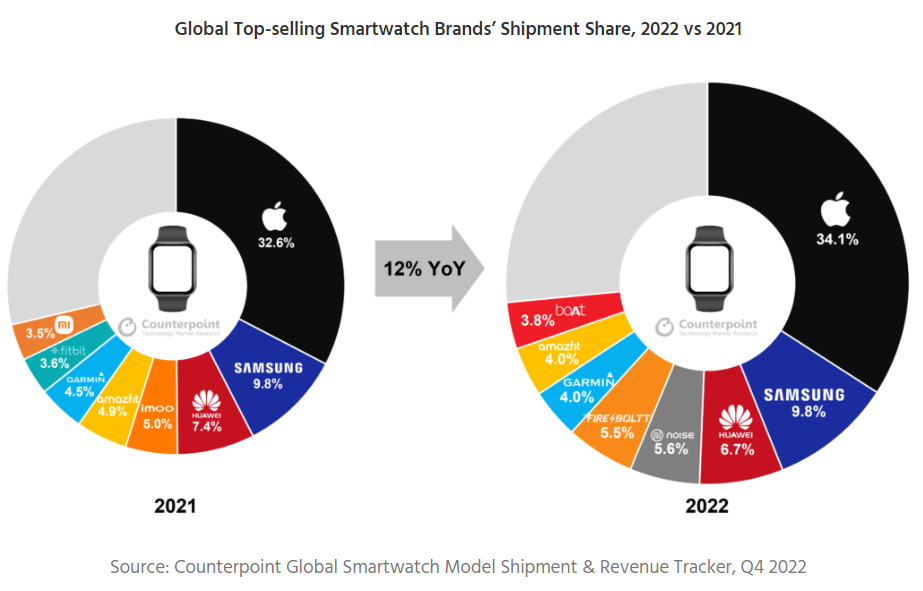

According to Counterpoint Research’s Global Smartwatch Model Tracker, the global smartwatch market shipments grew 12% year-over-year (YoY) in 2022, due to strong YoY growth in the first three quarters of the year.

However, shipments fell 2% YoY in the fourth quarter of 2022, due to inflationary pressures and slow growth in India. This was the market’s first negative growth since the pandemic began in 2020, after eight quarters of growth.

Overview of Smartwatch Market in 2022

- Apple shipments increased 17% YoY and annual shipments increased by 50 million for the first time, accounting for about 60% of the global smartwatch market revenue.

- Samsung’s shipments increased by about 12% but revenue only increased by 0.5%.

- Huawei market share fell 1%p YoY, but revenue increased by 20%.

- Noise and Fire-Boltt surpassed 5% of the global market share to rank fourth and fifth, respectively.

- Fitbit and Xiaomi rankings fell to 10th and 11th in 2022 from 7th and 8th in the previous year, respectively.

Anshika Jain, a Senior Analyst, stated that a huge surge in the third quarter of 2022 was evident due to a majority of firms stocking up on inventories for the upcoming festive season, which in turn led to a fall in deliveries in the fourth quarter.

Global Smartwatch Market in 2022

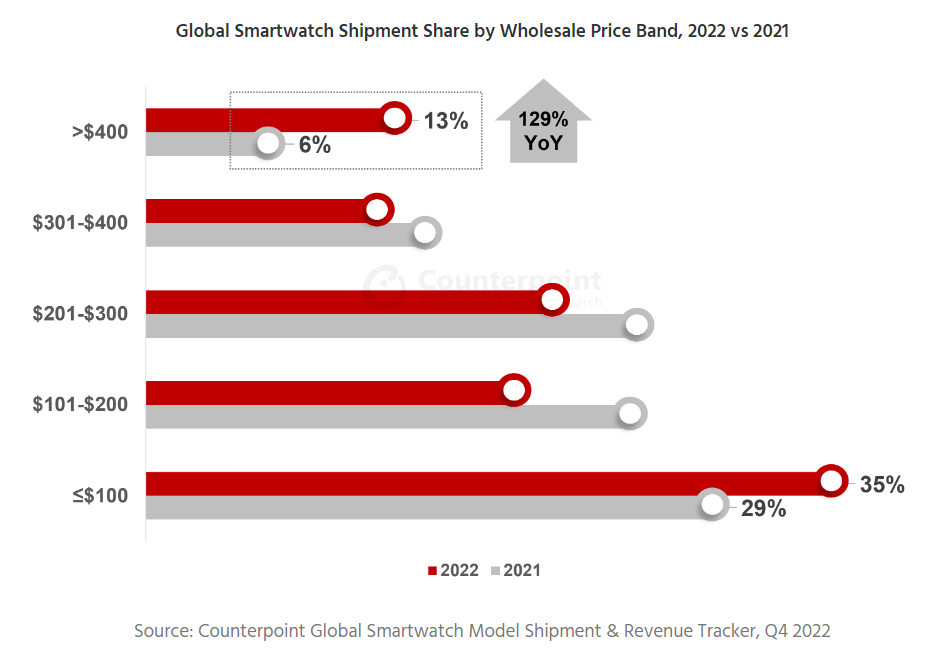

In Q1, 2022, global smartwatch market experienced a 13% year-on-year (YoY) growth. Demand was characterized by price polarization, with shipments in the mid-price range declining while those in the >$400 and ≤$100 segments increased by 129% and 34%, respectively.

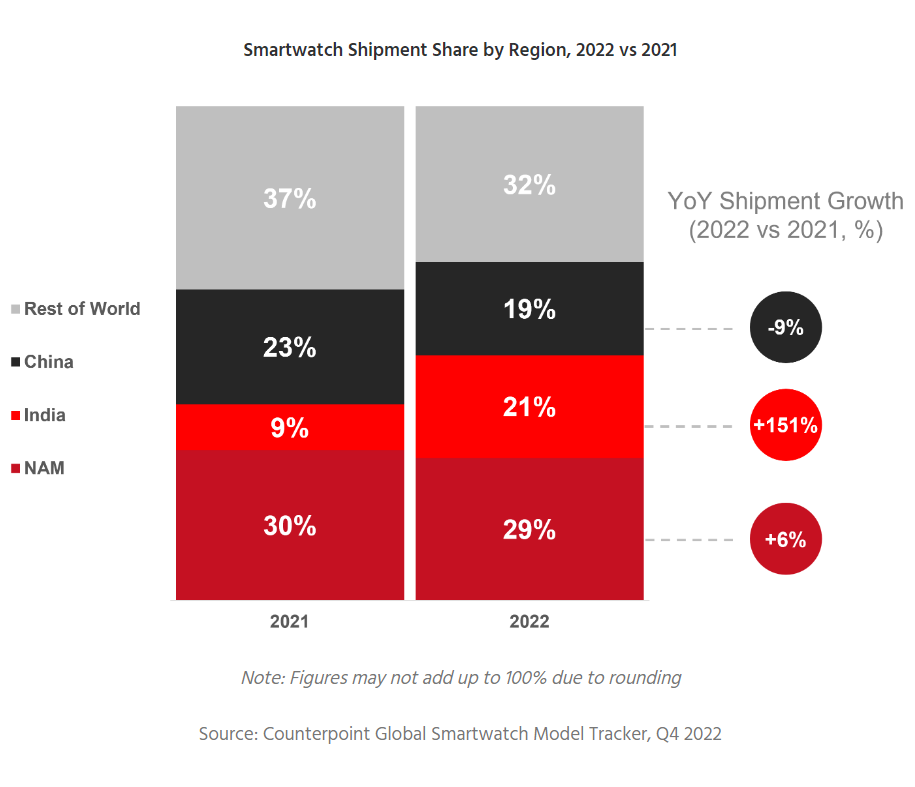

Regional Performance

- North America: Despite a slight decrease in its share, North America remained the largest smartwatch market in 2022 due to a strong performance by Apple in Q4.

- India: India’s market more than doubled in 2022 and grew steadily until Q3, but fell 36% QoQ in Q4.

- China: China’s shipments rebounded in Q4 due to easing of COVID-zero policy and Apple’s more diverse line-up.

Speaking on the report, Research Analyst Woojin Son said,

Apple strongly drove the average selling price (ASP) rise in the global smartwatch market in 2022, especially in the >$400 price band. There are two main reasons for this ASP rise – a diversified Apple smartwatch line-up and a rise in the exchange rate.

This year, Apple released its first premium model, Ultra, at a release price of $799 in the US. In addition, as the exchange rate rose, the local price of Apple Watch in various countries changed. The demand for the premium segment remained relatively strong despite the decline in consumer sentiment at the end of 2022.

On the other hand, we must be cautious about the low-price band of sub-$100. While this segment expanded in 2022 along with the remarkable growth of India’s market, it showed a large withdrawal in Q4 when compared to Q3.