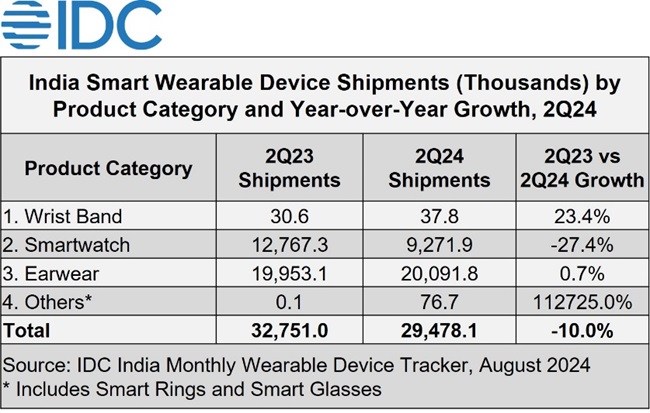

India’s wearable device market experienced its first-ever decline, dropping 10.0% year-over-year (YoY) to 29.5 million units, as reported by the International Data Corporation (IDC) India Monthly Wearable Device Tracker.

Market Performance in H1 2024

In the first half of 2024, the market dropped by 4.7%, with 55.1 million units shipped. The average selling price (ASP) for wearables fell to a record low of US$18.8 in Q2 2024, down from US$21.0, marking a 10.3% decline.

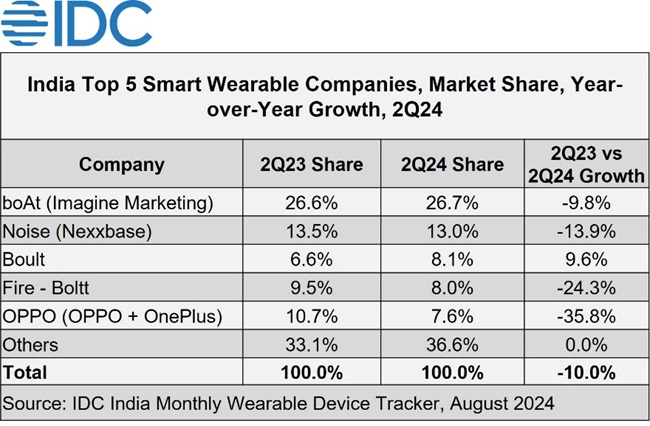

The decline was driven by cautious inventory management by vendors, focusing on clearing old stock before the festive season, and fewer new product launches.

Key Highlights of Q2 2024

Smartwatch Segment

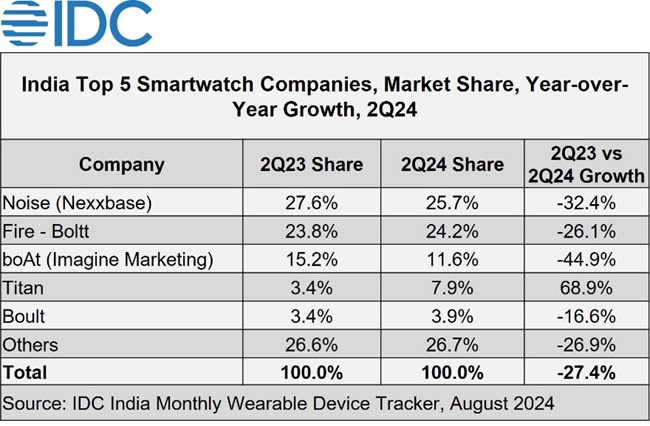

The smartwatch category struggled, declining 27.4% YoY to 9.3 million units. Smartwatches’ share within the wearables market decreased to 31.5% from 39.0% in Q2 2023.

- Issues like excess inventory of previous-generation models and a slowdown in innovation contributed to this decline.

- The ASP for smartwatches dropped to US$20.6 from US$25.6 a year ago, influenced by price cuts and discounts.

- Advanced smartwatches saw a 21.9% growth, increasing their market share from 1.5% to 2.5%.

Earwear Segment

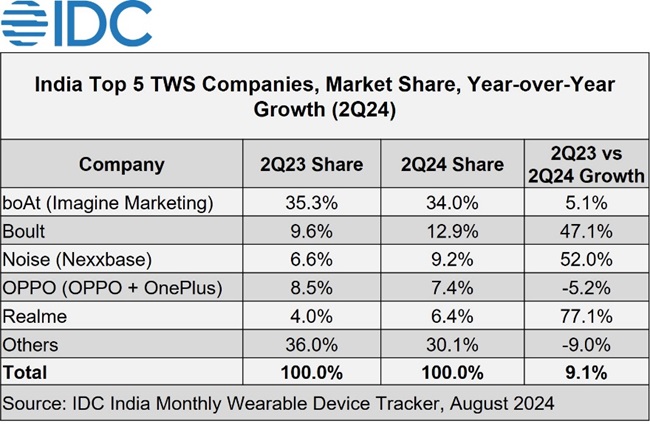

The earwear category grew slightly by 0.7% YoY to 20.1 million units. The Truly Wireless Stereo (TWS) segment reached a record share of 71.0%, up from 65.5% a year ago, with a 9.1% YoY growth.

Shipments of other earwear types (including Tethered and Over-Ear) declined by 16.1% to 5.8 million units. The ASP for earwear decreased by 4.2% to US$17.2.

New Subcategory

A new subcategory within earwear, Open Wireless Solution (OWS) or Open Ear Solution (OES), emerged.

This niche segment includes models from brands like PTron (Palred), Truke (Eccentric Enterprises), and Noise (Nexxbase) in the affordable range, with Bose offering premium models.

Smart Ring Segment

The smart ring category grew, with over 72 thousand units shipped in Q2 2024, at an ASP of US$204.6. Ultrahuman led with a 48.4% share, followed by Pi Ring at 27.5%, and Aabo with 10.5%.

IDC anticipates more affordable smart rings will be launched during the upcoming festive season.

Channel Dynamics

The offline channel remains underutilized, often used to clear excess inventory. Cost pressures are driving many brands to focus on e-tailer channels, particularly during festive periods.

While smaller brands rely on offline channels, major players are heavily dependent on online sales. The online channel’s share increased to 63.4% from 62.0% in Q1 2024, growing by 17.6% quarter-over-quarter (QoQ). Offline channel shipments grew by 11.1% QoQ.

Market Outlook

Anand Priya Singh, Market Analyst at IDC India, noted that major players are focusing more on online channels, while smaller brands still depend on offline channels.

Vikas Sharma, Senior Market Analyst at IDC India, expects new smartwatch models to be launched during the festive season, potentially mitigating the decline.

However, annual smartwatch shipments are projected to decline by 10% in 2024, with possible refreshed portfolios from smartphone vendors in the low to mid-price segments, he added.

Regarding this Noise, said:

This milestone highlights that 1 in every 4 smartwatches sold in India is a Noise smartwatch, reinforcing our commitment to innovation and excellence. Noise’s continued focus on delivering high-quality, user-centric wearable solutions has enabled it to maintain a strong market presence and drive the expansion of the smartwatch category in India. As the industry continues to evolve, the brand remains determined to push the boundaries of technology to provide more innovative wearable solutions that will impact lives for the good. With this achievement, Noise is poised to make a more powered effort to spotlight India in the wearables category globally.