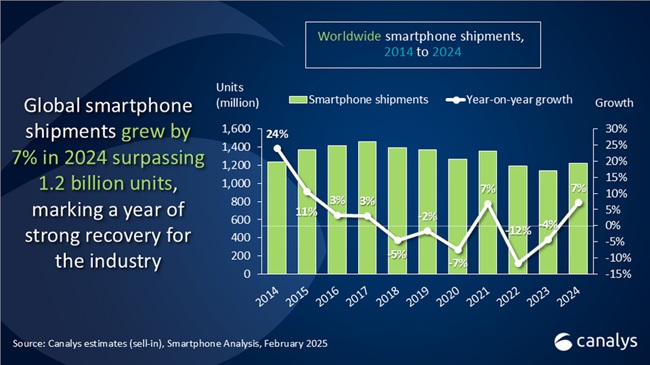

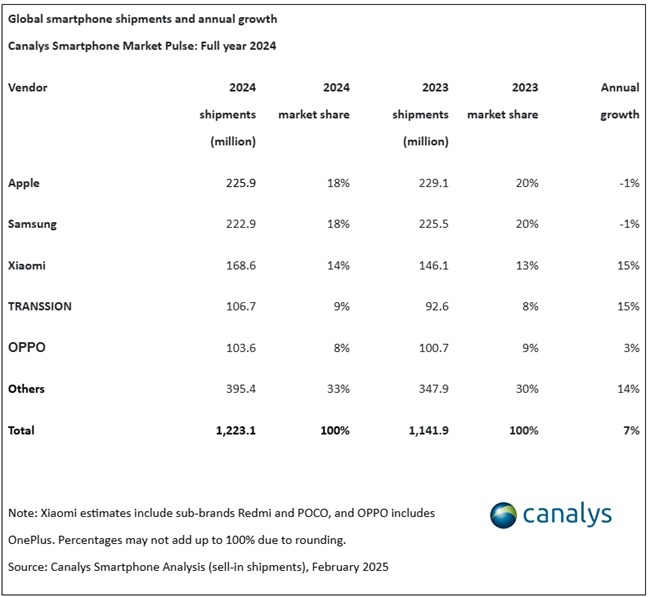

The global smartphone market rebounded in 2024, growing by 7% and reaching 1.22 billion units, according to the latest Canalys research. This marks a recovery after two consecutive years of decline.

Apple maintained its top position, benefiting from growth in emerging markets and steady sales in North America and Europe, which helped counterbalance challenges in Mainland China.

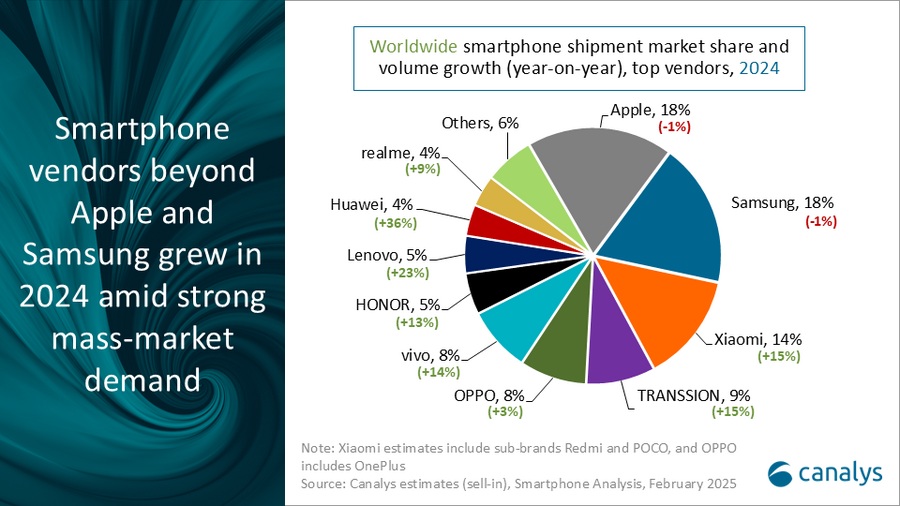

Market Performance of Leading Brands

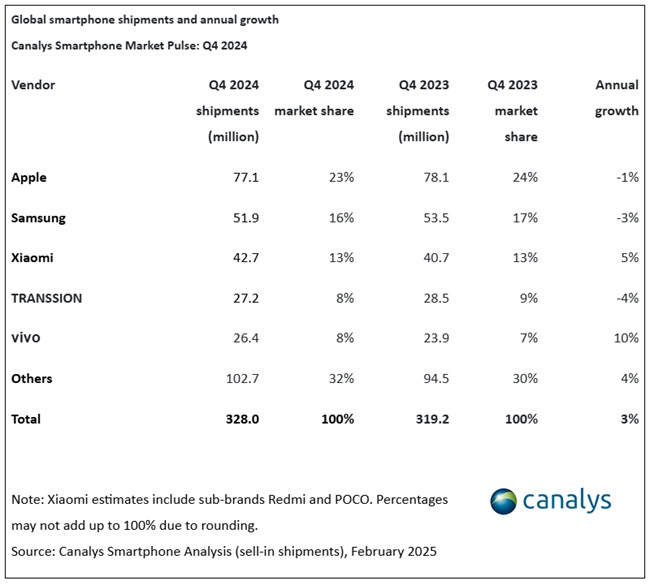

- Apple: iPhone shipments declined by 1% to 225.9 million units in 2024.

- Samsung: Ranked second, with a 1% drop in shipments to 222.9 million units while focusing on profitability.

- Xiaomi: Grew by 15% to 168.6 million units, leading volume growth with strong demand in China and expansion in emerging markets.

- TRANSSION: Entered the fourth position for the first time.

- OPPO (including OnePlus): Ranked fifth, increasing shipments by 3% to 103.6 million units.

Industry Trends and Insights

According to Runar Bjørhovde, an analyst at Canalys, 2024 marked the highest global shipment volume since the pandemic. Increased demand in the mass-market segment was driven by a refresh cycle of older smartphones and vendor restocking.

Many brands leveraged this trend by offering value-for-money products, though this strategy resulted in tighter profit margins. Mature markets also showed signs of recovery:

- Mainland China grew by 4%.

- North America increased by 1%.

- Europe saw a 3% rise.

Promotions such as discounts, trade-ins, and bundled deals played a key role in driving demand in these regions.

Premium Smartphone Segment Growth

Senior Analyst Sanyam Chaurasia noted a rising trend in premium smartphone purchases, with consumers opting for high-end models.

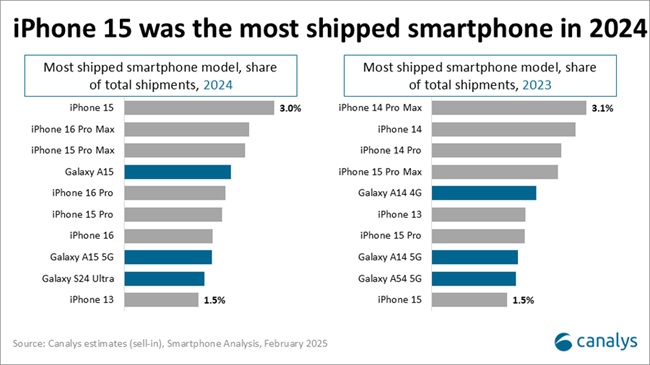

In 2024, shipments of Apple’s iPhone 16 Pro and Pro Max rose by 11% compared to the iPhone 15 Pro and Pro Max in 2023, surpassing 55 million units.

Samsung also reported its best S-series performance since 2019, with increased demand for the Ultra model. The recently launched Galaxy S25 is expected to focus on AI-powered features, including a Gemini Advanced subscription.

Outlook for 2025

Bjørhovde cautioned that 2025 may present new challenges, including slowing growth in emerging markets, economic fluctuations, potential U.S. tariffs, and evolving compliance requirements.

However, opportunities such as the shift toward premium devices, China’s subsidy programs, and innovative financing models could drive growth. Vendors are expected to focus on increasing Average Selling Price (ASP) and profitability while expanding product portfolios and strengthening marketing strategies.

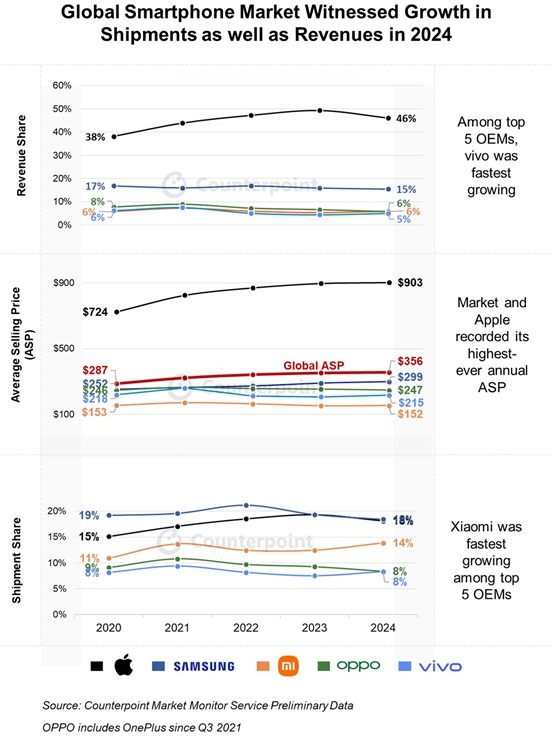

Revenue Growth and ASP Trends

According to Counterpoint Research, global smartphone revenues grew by 5% year-over-year (YoY) in 2024, ending a two-year decline. The global Average Selling Price (ASP) reached a record $356, driven by increased 5G adoption and demand for better cameras and faster processors.

Counterpoint Senior Analyst Shilpi Jain highlighted that both shipments and ASPs rose in 2024. In 2025, shipments are expected to see single-digit growth, while ASP and revenue growth will likely continue at a higher rate. The rise of affordable 5G devices and the integration of generative AI into lower price segments will be key trends to watch.

Brand-Specific Performance

- Apple: Despite a 3% decline in shipments, revenue remained stable due to ASP growth, exceeding $900 for the first time. The Pro series continues to gain traction, and Apple saw a 44% YoY shipment increase in Latin America.

- Samsung: Faced a slight decline in shipments but experienced ASP growth, helping its revenue increase by 2% YoY. The S24 series performed better than its predecessor, and Samsung remains a leader in AI-driven premium smartphones.

- vivo: Achieved the fastest revenue growth among the top five brands at 20% YoY, driven by strong performance in China and India.

- Xiaomi: Recorded 16% YoY shipment growth, expanding in Latin America, the Middle East, and Africa. Its premium segment in China also saw success, and its entry into the automotive industry boosted brand recognition.

Future Growth Prospects

Despite signs of market maturity, growth potential remains in emerging regions such as the Middle East, Africa, Latin America, India, and Southeast Asia. These markets are expected to be key drivers for the industry moving forward.